This is the final blog in a three-part series being released as we head into 2021, covering telematics adoption, service retention, and data overload concerns. This installment delves into the importance of data analytics, including the challenges and opportunities for telematics adopters—and how service providers and adopters alike can navigate potential obstacles to efficiently implement effective solutions. The first entry covered telematics adoption rates and patterns while the second article discussed the critical issue of retention.

Data analytics and the promise of leveraging insights generated by Big Data have the potential to radically redefine fleet management and significantly improve business performance like never before. Today, connected vehicles are increasingly smarter through advanced driver assistance systems (ADAS) and highly automated features designed to improve safety and mitigate risks for the fleet company.

Key Insights and Takeaways

However, as the 2020 Commercial Fleet Telematics and Data Analytics report reveals—the newest release in an ongoing series of forward-looking fleet technology publications from Escalent’s Fleet Advisory Hub—capitalizing on growth opportunities for the providers in this space is a complex proposition, demanding both a nuanced understanding of the pressures, preferences and priorities of commercial and fleet vehicle decision-makers, and the ability to deploy products and services that solve real-world problems. Making that happen will require a commitment to educate on the value of leveraging more of a company’s data assets as well as the ability to demonstrate financial outcomes with relevant use cases.

Providers will need to tailor product and service-related communication around pertinent challenges and missed opportunities to gain the attention of key fleet decision–makers:

Goals and Growth

For adopters, motivations for integrating data analytics into the business management process are rooted in cost reduction and improved fleet performance. However, the decision to invest in integrating data analytics and the associated process goes beyond the standard quest to save money. It’s also part of a longer-term strategic shift that involves thinking about the business differently and pursuing opportunities to identify areas of innovation. Providers that can demonstrate compelling, successful real-world use cases can help drive that shift.

Uncertainties and Concerns

There are, however, a proportion of potential adopters who remain uncertain about their ability to manage and fully leverage various streams of data. To ensure fleets integrate and do not abandon data-driven solutions, it is vital for providers to understand the nuances and changing perceptions of data overload—and the specific actions they can take to address data management and utilization challenges.

Data Overload: Overblown?

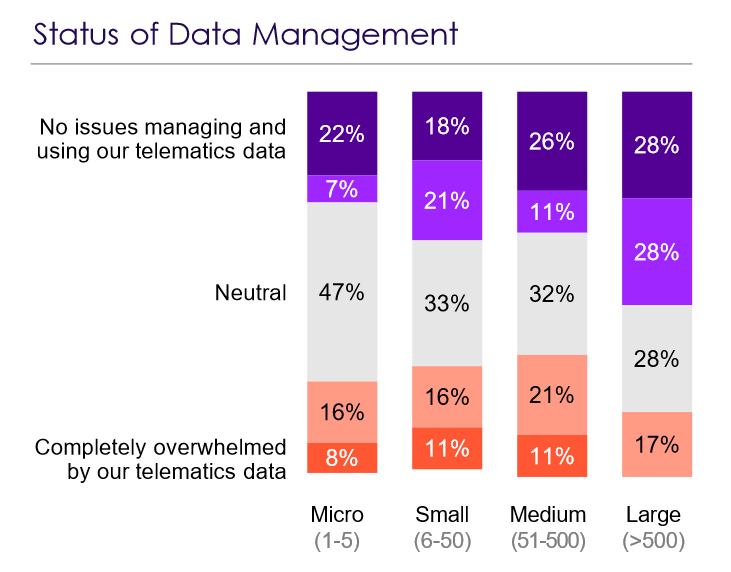

While concerns about data overload (the inability to use or optimize large volumes of captured data) are often discussed in the industry, fewer than one-third of adopters report experiencing the phenomenon. In fact, slightly more report no issues than those who say they can be overwhelmed. Addressing the concerns of those in the latter group remains a priority, however, as the risk for underuse or abandonment of data-centric solutions is higher. Data overload has been mitigated by using providers’ core dashboards, and further, by implementing custom solutions for individual companies that consistently provide information that can be used to affect business outcomes and demonstrate ROI.

Priorities and Partnerships

Consequently, providers need to be highly engaged and proactive in educating fleets on the management and application of their various data streams. This consultative relationship will be increasingly important with even more data produced in the future. Providers also need to understand adopters’ data analytics priorities and overall fleet objectives, and adapt pursuit and positioning strategies accordingly. For example, while fleet size is not a determinant of proficiency or competency for managing and using data, there are differing priorities. Large fleets, for instance, tend to be more concerned about data security.

Meaningful Solutions

Providers would be wise to identify and capitalize on opportunities to partner with companies to improve their data management. Such partnerships present an opportunity for providers to elevate their status and deliver problem-solving consultative service in the pursuit of securing brand loyalty and becoming a trusted advisor. These types of efforts will increase data program implementation and generate a significant number of revenue opportunities for service providers that can guide commercial and fleet businesses in a proactive, turnkey manner that clearly demonstrates value.

Achieving Success with a Data-Driven, Decision-Making Framework

In closing, we’d like you leave you with three steps, tailored from Escalent’s DataDialogue™ data-driven, decision-making framework to consider, that can be leveraged by both fleet businesses and service providers to overcome data overload and collaborate toward mutually beneficial engagements.

- Prioritize business challenges to focus on solving priority business objectives and problems; if everything is important at once, nothing is.

- Identify pertinent, problem-specific data and business rules as well as any required additional contextual understanding that will be leveraged to support the analytical framework for solving the business problem.

- Conduct the analysis to identify factors contributing to the business issue, determine and take actions to solve the business problem—monitoring the framework regularly to prevent reoccurrence (automate as able), while moving on to solving the next-level priority business issues.

If you would like to know more about Fleet Advisory Hub or DataDialogue™, or talk about how Escalent can help your business embrace and promote a data-driven mindset, please send us a note.

About Fleet Advisory Hub™

The results reported come from our 2020 third quarter report on telematics and data analytics, comprising a subset of commercial and fleet vehicle decision-makers drawn from the Fleet Advisory Hub audience. Participants were recruited from an opt-in online panel of business decision-makers and interviewed online. Escalent will supply the exact wording of any survey question upon request.