This is the second blog in a three-part series being released as we head into 2021, covering telematics adoption, service retention, and data overload concerns. This installment explores the critical issue of retention: delivering essential insights into post-adoption strategies for retention and value optimization. The first entry covered telematics adoption rates and patterns—and implications for the industry going forward.

With the release of the 2020 Commercial Fleet Telematics and Data Analytics report, the latest in a series of forward-looking fleet technology publications from Escalent’s Fleet Advisory Hub, product manufacturers and service providers in this fast-growing space have received critical information about the current state of the marketplace—and the attitudes, aspirations and actions of commercial and fleet vehicle decision-makers.

Key Insights and Takeaways

The good news is that commercial vehicle telematics adopters currently have a defection rate of less than one in ten. Taking a closer look at adoption patterns and retention rates reveals some fascinating and potentially important patterns that providers should be aware of. Perhaps most notably, large fleets lead the adoption curve (more than half have pilot tested or integrated a telematics solution into their fleet) and, due to less experience, smaller fleets are substantially less likely to view telematics as an important fleet management asset—and, consequently, have lower adoption rates (around 25% of small and medium fleets and just 6% of micro fleets). While satisfaction with implemented telematics solutions is generally high, defectors are more likely to be micro and small fleets (almost half of defectors represent micro fleets).

Our report has uncovered some of the reasons for these technology abandonment patterns and what might be done to mitigate them:

Accurately Identifying and Addressing Priorities and Areas of Concern

Understanding and addressing the needs of commercial and fleet vehicle decision-makers begins by considering the factors that play into defection decisions. Acknowledging the unique challenges of fleets and connecting with decision-makers on a more personal level are important, and that empathy needs to be front and center in the sales, marketing and after-sales support process.

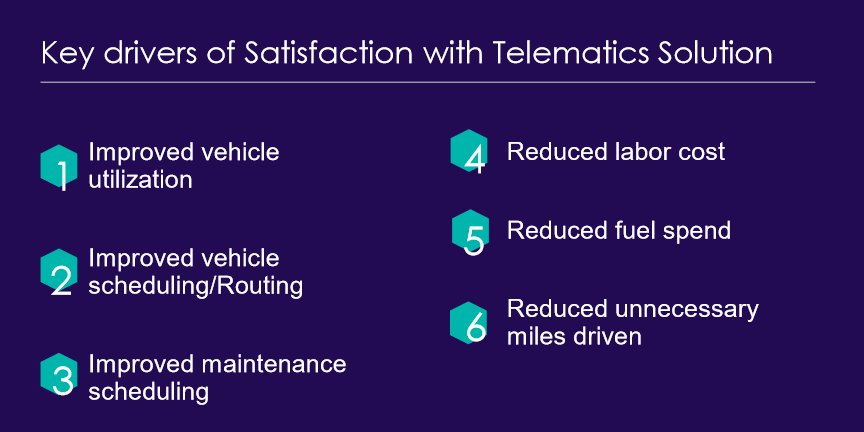

Cost is a significant factor in the decision to defect, particularly among micro fleets, which tend to be more sensitive to economic fluctuations. With that in mind, establishing a longer-view ROI metric (favored over a more absolute investment expense) can and should be viewed as critical to limiting defection of telematics and data analytics programs. ROI metrics should be more than just a sales tool, but rather a key element of a robust and sustained retention program. Appropriate objective-based metrics allow decision-makers to fully understand both the savings and incremental revenue that are being generated. While specific objectives of telematics and data analytics programs vary, increasing fleet productivity and vehicle use is a universal priority of all fleets, as is improving maintenance scheduling. Micro fleets, however, place higher value on reducing fuel spend and unnecessary miles driven, while larger fleets prioritize labor cost management. Medium fleets value increasing uptime and improving vehicle tracking. Additionally, it is important for small fleets to have a solution that helps improve vehicle scheduling and routing.

Customized/Concierge Solutions

A one-size-fits-all approach will be ineffective given the diversity of the fleet business use cases in the industry today. Providers looking to increase retention should tailor their approaches to ensure customers are engaged, thus maximizing service benefits. That customized service might include catered support to help users sift through and act on critical data—a process that can be facilitated by moving away from raw/manual data to introducing dashboards and integrated or complementary provider insights.

Showing and Ensuring Value

Achieving scale among providers to reduce costs is also critical to limiting the integration investment for cost-conscious smaller fleets, as they tend to abandon telematics platforms after seeing insufficient return on investment rather than due to user experience or data overload. For the near term, it will continue to be critical for providers to demonstrate and reinforce how these technologies and solutions can be leveraged to deliver value for adopters’ specific businesses and applications. For the longer term, it will be important to exhibit how telematics applications differ and continue to add value, as the industry moves toward advancements in transportation such as electrification, shared services and autonomy. Providers that can continue to directly and specifically articulate and address the needs of adopters will effectively build the kind of strong brand loyalty and advocacy that will enable them to stand out in this highly competitive space.

If you would like to know more about Fleet Advisory Hub or discuss how we can help you maintain engagement with telematics and data analytics solutions, please send us a note.

To read the final article in this series that covers the growing role of data analytics and data management in the fleet industry, click here.

About Fleet Advisory Hub™

The results reported come from our 2020 third quarter report on telematics and data analytics, comprising a subset of commercial and fleet vehicle decision-makers drawn from the Fleet Advisory Hub audience. Participants were recruited from an opt-in online panel of business decision-makers and interviewed online. Escalent will supply the exact wording of any survey question upon request.