Despite the growth of low-touch, online and remote services spearheaded by electric vehicle (EV) specialist automakers such as Tesla and Rivian, consumers still favor dealerships.

In our new EVForward Dealer DeepDive report, Escalent surveyed new-vehicle buyers to understand the role they want dealers to play during the shopping process and throughout the lifetime of EV ownership.

To keep pace with the next generation of electric vehicle buyers, dealers should lean into existing consumer trust—and position themselves as a reliable source of information on EV ownership and maintenance. But to remain competitive with alternative sales and service models, gaps in the consumer experience need to be addressed.

An Important Touch Point for Selling EVs

When it comes to purchasing and maintaining an EV, consumers consider the dealership a key touch point.

While almost one-quarter of respondents said they would consider purchasing an EV directly from the manufacturer, nearly all new-vehicle buyers rely on dealers during their shopping process: 94% of respondents reported contacting a dealership the last time they shopped for a vehicle.

In particular, consumers indicated that dealers are top of mind for questions regarding warranties, rebates and incentives. With the changes to the federal EV tax credit contained in the Inflation Reduction Act, it is all the more important for dealers to provide guidance around rebates and incentives.

However, only 48% of EV owners said they received a rebate or incentive when they purchased their vehicle. Many expressed that they did not feel their dealer supported them in identifying available rebates and incentives. On a five-point scale, 65% rated the helpfulness of their dealer at a three or below. This gap between customer expectations and experience is critical for OEMs and dealerships to address.

While 88% of buyers said they were satisfied with their dealership experience, consumers gave lower marks to staff knowledge of EV charging. Although EV owners generally have a greater degree of comfort with new technology, future buyers aren’t quite as comfortable. As a trusted source of information, dealers can improve the customer experience—and potentially boost sales significantly—by providing more robust support around the “fueling” experience for customers.

Consumers demonstrated an appetite for in-person experiences during both vehicle shopping and ownership. 69% of respondents said they rely on dealers to provide repairs and service. Meanwhile, 66% thought test drives should happen through the dealer, and more than half said purchasing or leasing the vehicle—including pricing, negotiation and discounts—should take place at the dealership.

Centering Consumer Preference

EV specialist automakers have instigated a shift toward leaner, online-oriented retail approaches, including remote services and branded stores with minimal inventory. Traditional OEMs are starting to follow the trend—but consumers have mixed feelings.

Fewer than half of all survey respondents would be comfortable if their vehicle shopping, purchasing or leasing, and maintenance phases were shifted entirely online or to the customer’s home. On the other hand, the post-COVID-19 consumer is more comfortable—and in some cases, expects—the convenience of virtual engagement and mobile services. EV specialist approaches that enhance consumer control and convenience, such as mobile service and scheduling appointments online, scored higher marks.

The takeaway? OEMs and dealers should make decisions based on consumer preference rather than just mirroring the tactics employed by EV specialists. An omnichannel approach, where buyers can seamlessly and effortlessly complete any phase of their transaction via their preferred channel, can help to balance convenience with the peace of mind that an in-person visit can offer.

Inventory Limitations: Acceptable, But Not Ideal

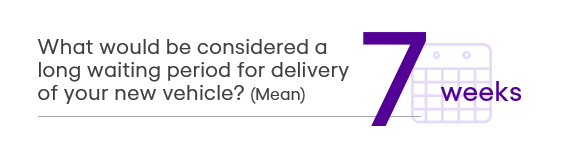

As inventory limitations due to supply chain constraints continue to plague dealers, buyers are extending understanding—up to a point. Consumers are willing to order their vehicle and wait, but most consider seven weeks to be too long. 70% of survey respondents said they would be willing to wait less than a month before they pivot to purchase or lease a different vehicle. 46% would be willing to wait a few weeks, and 24% would wait only a few days.

While consumers would prefer dealerships to have enough inventory to see and experience their vehicle in person, most do not blame the dealer or the manufacturer for the current shortages. 91% of respondents said a long wait time would have somewhat, or no, negative impact on their perception of the dealership, while 94% said the same for the vehicle brand.

Building Trust; Instilling Confidence in EV Shoppers

For consumers, the dealer is still the preferred source of information when buying a new vehicle. But buyer pain points, such as dissatisfaction with the level of staff expertise on EV-specific issues, represent vulnerabilities in the current model.

To increase buyer confidence, dealerships must continue to deliver superior in-person service—and be ready to educate consumers on the ins and outs of EV ownership. Dealers should be prepared to go beyond the capabilities and features of the vehicle and speak to all aspects of the EV ecosystem, including incentives, rebates and charging.

By shaping their model around consumer preferences and behavior, and enhancing their capacity to paint a complete picture of owning an EV, dealers can continue to be a trusted touch point for the next generation of electric vehicle buyers.

To learn more about EVForward and how we can help you tailor your strategy to better reach future EV buyers, send us a note by clicking the button below.

Note: This blog was updated on March 26, 2025.