Battery electric vehicles (BEVs) have disrupted the marketplace, changing how consumers think and feel about vehicle purchases. Price, brand, size and capability continue to inform decisions. However, new factors, such as range and charge time, now also come into play.

BEVs have spurred a new approach to design, too. Manufacturers are increasingly opting for futuristic-looking exteriors, while interior design choices are moving toward open driver cockpits and high-tech touchscreens.

Market research methodologies can assess the logical elements of vehicle buying—for instance, what functionality consumers value. Although designers and marketers intuitively know that design and emotional appeal drive consumer purchasing behavior, it has been difficult to quantitatively gauge how emotion informs the vehicle shopping process. This, in turn, has made it hard to know how consumers emotionally react to and rate design choices. Until now.

The EVForward™ 2022 Product DeepDive aims to solve that problem. Using Escalent’s proprietary, data-driven Evoke™ approach, this novel study taps into respondents’ subconscious reactions to automotive design to understand what shoppers feel when they see a vehicle.

BEV Designs That Amaze

Emotion is challenging to measure. People are complicated and often struggle to verbalize how something makes them feel. To address this, Evoke™ uses quantitatively tested images linked to specific emotions, allowing brands to measure intuitive emotional reactions to a product.

When combined with consumer feedback on more logical differentiators, our data provide unprecedented insight into why drivers would or would not select a vehicle.

Emotion significantly influences consumers—particularly at the early stages of the purchase funnel. Escalent has found that exterior designs that elicit positive emotions generate stronger appeal and consideration. Designs that induce a sense of amazement leave the most powerful impression.

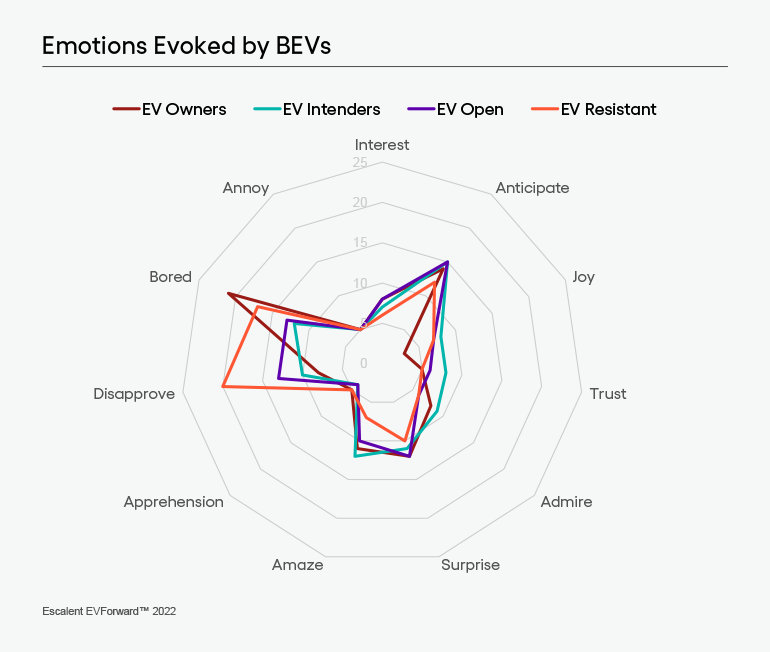

The next generation of EV buyers—EV Intenders—are receptive to BEV exterior designs and react most positively. This group reacts more strongly with emotions of amazement, admiration, trust, anticipation and joy. It also has lower reactions of boredom and apprehension.

Automakers have long asked whether BEVs should have a different look from internal combustion engine (ICE) vehicles. Interestingly, participants were less concerned with whether a model looked like a BEV or ICE vehicle and instead valued exterior designs they considered exciting, strong, responsive and luxurious. Respondents also demonstrated less concern for whether a vehicle appeared futuristic. In fact, the lowest-ranked product in the study was the Tesla Cybertruck, which features a highly futuristic body design.

The Price Dichotomy

Drivers love the look of luxury. Despite this, price is a leading factor in BEV consideration alongside body type and exterior design. As a result, while consumers appreciate a luxury feel and design, they are not necessarily willing to pay more to attain them. This leaves automakers with a fine line to walk between aesthetics and affordability.

For automakers, homing in on what drivers care most about could help them telegraph luxury without the corresponding price tag. Consumers want attractive vehicles, but most are less invested in futuristic, BEV-specific designs. Knowing how drivers rank design elements can help manufacturers produce aesthetically pleasing vehicles without driving up costs.

A BEV-Specific Response

In terms of broad appeal, no one brand dominates the market. Instead, consumers gravitate to specific models. Among vehicles that received above-average scores for appeal and consideration, a range of recognized automakers are represented, including Ford, Chevrolet, Hyundai and Audi.

That said, brand is still an important factor in purchase consideration. For each vehicle, participants first saw a de-badged photograph of the vehicle. After we evaluated their emotional reaction to the design and gauged how appealing they found it, participants were shown specifications, such as brand, model, range, charge time, battery warranty and cost. Only then did they rate their level of consideration.

Echoing previous EVForward findings, electric vehicle (EV) start-ups such as Rivian, VinFast and Polestar fall behind legacy brands that have already earned customer trust. In addition, when asked what would prompt them to not consider a vehicle, 28% cited brand.

New BEV Design Flexibility

BEVs offer more flexibility in interior design than ICE vehicles—although that doesn’t mean that consumers are on board with what designers are doing with that flexibility. BEVs do not need a central tunnel, creating the opportunity for an open driver compartment with a diminished center console and no floor division. This provides additional space for infotainment screens, allowing automakers to put more emphasis on and functionality in touchscreens.

BEVs offer more flexibility in interior design than ICE vehicles—although that doesn’t mean that consumers are on board with what designers are doing with that flexibility. BEVs do not need a central tunnel, creating the opportunity for an open driver compartment with a diminished center console and no floor division. This provides additional space for infotainment screens, allowing automakers to put more emphasis on and functionality in touchscreens.

However, our data revealed differences in consumer attitudes toward interior design across demographics, signaling a need for caution among automakers experimenting with interior possibilities. When asked to choose between three cockpit layouts—closed, semi-enclosed and open—respondents more often selected the semi-enclosed design. Preferences varied across ages and genders. Those younger than 35 and females favored the closed compartment. Meanwhile, older age groups and males were drawn to the open compartment design.

Our findings indicate that whether the vehicle looks more like a BEV or ICE vehicle is much less important than other design attributes.

Capturing Broad BEV Appeal

Newer BEVs typically feature open interiors with a subdued center console and no floor division, but this doesn’t fully align with shopper preferences.

When asked about specific interior design elements, many participants indicated comfort with characteristics correlating to a traditional cockpit layout. 55% of respondents favored a prominent center console and 45% preferred a floor division. And although close to half of those surveyed wanted a touchscreen and a high-tech design, 28% opted for buttons.

This reflects sentiments around vehicle exteriors. Consumers like sleek, cohesive designs. However, they are not necessarily seeking something cutting-edge. Rather than pursue a futuristic look, automakers may need to inch back their aesthetic to capture appeal from a wider group.

The first generation of BEV buyers were trailblazers who craved the latest technology and a futuristic design that screamed “BEV.” As more drivers go electric, automakers should revisit assumptions about their target audience. Tomorrow’s BEV buyers have different preferences. Designing future BEVs that appeal to current owners may miss the mark for the tidal wave of BEV buyers on the horizon. While design innovation can allow brands to differentiate themselves in the market, they won’t be successful if they are not aligned with consumer preferences.

To learn more about these findings, EVForward in general, or how we can help you tailor your strategy to reach future EV buyers, click the button below.

About the 2022 EVForward™ Product DeepDive

This EVForward DeepDive was conducted among a national sample of 1,494 respondents—with 43 EV Owner, 269 EV Intender, 590 EV Open and 592 EV Resistant respondents as identified by Escalent’s algorithm—from October 27 to November 15, 2022. These respondents are a subset of the EVForward database, a global sample of more than 50,000 new-vehicle buyers age 18 to 80, weighted by age, gender, race and location to match the demographics of the new-vehicle buyer population and by vehicle segment to match current vehicle sales. The sample for this research comes from an opt-in online panel. As such, any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.

About Evoke™

Evoke™ is Escalent’s proprietary, data-driven approach to revealing emotion. It leverages a large, diverse collection of images that are quantitatively linked to the specific emotions they trigger—eight primary emotions (joy, trust, fear, surprise, sadness, disgust, anger and anticipation) along with their various intensities and combinations. Rooted in Robert Plutchik’s academically acknowledged Wheel of Emotions, Evoke is a stronger, more robust approach that instills an unprecedented degree of objectivity into the exploration of emotions through a quantitatively validated process, peels back the layers of rational thinking to reveal the underlying emotions of decision-making, and enables participants to be more forthcoming, introspective, and honest in a highly informed, consistent way. Evoke is one of the tools created by Escalent’s Human Experience Center of Excellence, which helps clients build human-centric relationships that create meaningful connection, inspire loyalty and drive growth.