The latest Fleet Technology Index report shows sustained levels of market readiness for data analytics, telematics and AI, while interest in BEVs softens

With a healthy staff and drivers back behind the wheel, fleet company sales are returning to or exceeding pre-pandemic levels. More than half (52%) of fleet decision-makers indicate business has returned to normal, according to Escalent, a top data analytics and advisory firm. Additionally, the overall Fleet Technology Index (FTI) score—an industry metric that indicates market readiness and expectation for adoption of forward-looking fleet technologies—has increased by 39% from an index score of 21.4 in 2020 to 29.7 in 2024. Despite the chaos caused by the pandemic and supply chain disruptions, this increase reflects the continued progress toward a technology-driven future for fleet businesses.

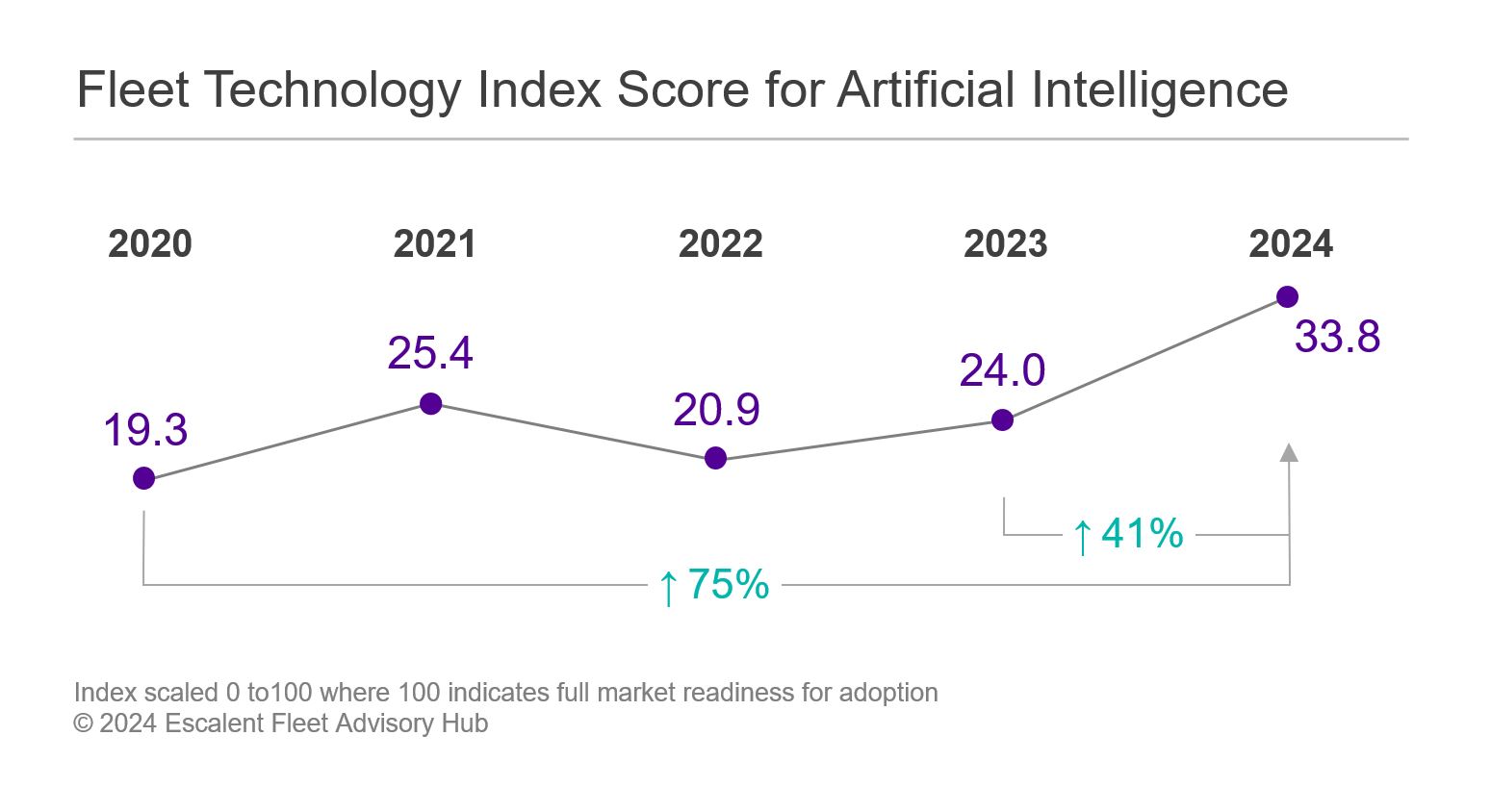

The FTI for emerging technologies—artificial intelligence (AI), drones, mobility services and blockchain—has increased by 43% from an index score of 16.6 in 2020 to 23.7 in 2024. This increase is driven by a surge in momentum for AI, which sees a 75% increase in the index score from 2020, of which the last year alone sees a 41% increase.

The FTI score for core technology—data analytics, telematics, battery electric vehicles (BEVs) and autonomous vehicles (AVs)—also has increased by 35% from an index score of 26.3 in 2020 to 35.6 in 2024. This increase indicates fleet decision-makers are cautiously optimistic about business conditions and continue to see value in investing in data analytics and telematics.

These are among the latest findings from Fleet Advisory Hub™, a leading insights tool designed to explore the needs, expectations and emotions of commercial vehicle and fleet decision-makers. The program, developed in 2019 by Escalent, offers an annual snapshot of the state of various forward-looking technologies among commercial vehicle and fleet businesses through its flagship Fleet Technology Index report. For each technology, the FTI provides an analytically based sense of market readiness and expectation for technology adoption that reflects a point in time, taking into consideration the perceptions of the current business environment and several predictive factors.

“The intersection of data analytics, telematics and AI is truly revolutionary, and fleets are showing optimism and early adoption for these technologies as they operate in a state of continuous improvement to remain competitive,” said Dania Rich-Spencer, vice president and strategic advisor for Fleet Advisory Hub at Escalent. “The adoption curve of these data-driven technologies has been defined by larger fleets of over 50 vehicles and those operating heavier-class vehicles. To continue driving adoption, service providers need to demonstrate how these technologies can feasibly be integrated into small- and medium-sized fleets and drive business value.”

However, an 8% year-over-year decline in the BEV index score also indicates that some fleets are pulling back from battery electric technology. A consistent pattern of shifting attitudes and intentions coupled with a softening in positive orientation toward BEVs contributes to a year-over-year 16% reduction in companies both shopping for and intending to invest in BEVs in the next six months. The proportion of companies not considering adding a BEV into the fleet has increased by 21% compared with 2023.

Readiness for AVs also recedes as receptivity for integrating autonomous vehicles into the fleet softened in 2022 and remains flat today. Concerns around safety are prevalent and the FTI for AVs is the lowest among the core technologies, indicating it is more aligned with the emerging technologies of drones, mobility services and blockchain.

“Connected fleet is the future and those who successfully leverage their data assets will be leaders, but the learning curve is steep. This presents an ideal opportunity for service providers to become heroes and to direct attention to the highest priority areas that deliver the greatest impact for the individual fleet’s use case and business objectives,” explained Lucas Lowden, insights consultant and program lead of Fleet Advisory Hub at Escalent. “This is especially relevant to help drive adoption of BEVs, for example, as many decision-makers may believe, incorrectly, that they have the knowledge, skills and talent to integrate zero-emission vehicles into the fleet by simply doing what they have always done with gas and diesel vehicles.”

Fleet Advisory Hub is one of the largest collections of commercial vehicle and fleet decision-maker insights available on the market today. Currently, nearly 12,000 fleets collectively numbering more than one million vehicles are represented.

Click below for more information about the study.

About Fleet Advisory Hub™

The results reported come from Escalent’s 2024 FTI report about the current state of market readiness for adoption of core and emerging technologies by commercial vehicle and fleet businesses, and comprise a subset of commercial vehicle and fleet decision-makers drawn from the Fleet Advisory Hub audience. Participants were recruited from an opt-in online panel of business decision-makers and interviewed online. Escalent will supply the exact wording of any survey question upon request.

For fleet decision-makers in businesses operating vehicles who want to have their voices heard, you can join here to participate in our research program.