Consumers now see Comcast as a major Quad Play provider, new data shows

Editor’s Note: This is the final installment of a three-part blog series based on a new, independent research study called “The Xfinity Mobile Effect.” As Comcast marks the one-year anniversary of its Xfinity Mobile launch, this series explores the success and competitive threat of cable companies offering wireless service. This research was featured on Fierce Wireless.

Since the arrival of the so-called “cord cutters,” many experts have been predicting the decline of the cable industry. But rather than back down, many cable MSOs have fought back not just through technological innovation, but also by expanding their businesses. Today, the cable companies experiencing the biggest growth are those that have some sort of bundling offerings, providing a slew of complementary services to customers.

Indeed, cable companies are in a race to establish themselves in the Quad Play business. The ability to provide TV, wireless, broadband and phone services has become a competitive advantage in a world where consumers are increasingly seeking out better deals and the convenience of doing business with just one company.

The latest company to enter Quad Play is Comcast, and the plan appears to be working so far. A new study conducted by the technology and telecom market research division of Escalent shows compelling evidence that with the launch of Xfinity Mobile, Comcast has set itself as a viable Quad Play competitor.

Elevating Comcast’s position as a multi-service provider

Our study examines the performance of Xfinity Mobile both as a carrier within the highly competitive wireless market and as a tool that augments Comcast’s core Xfinity Internet and TV businesses. In a previous blog post , we revealed data that shows Xfinity Mobile has early momentum, stealing customers from major wireless providers and scoring high on several customer satisfaction measures, including NPS®.

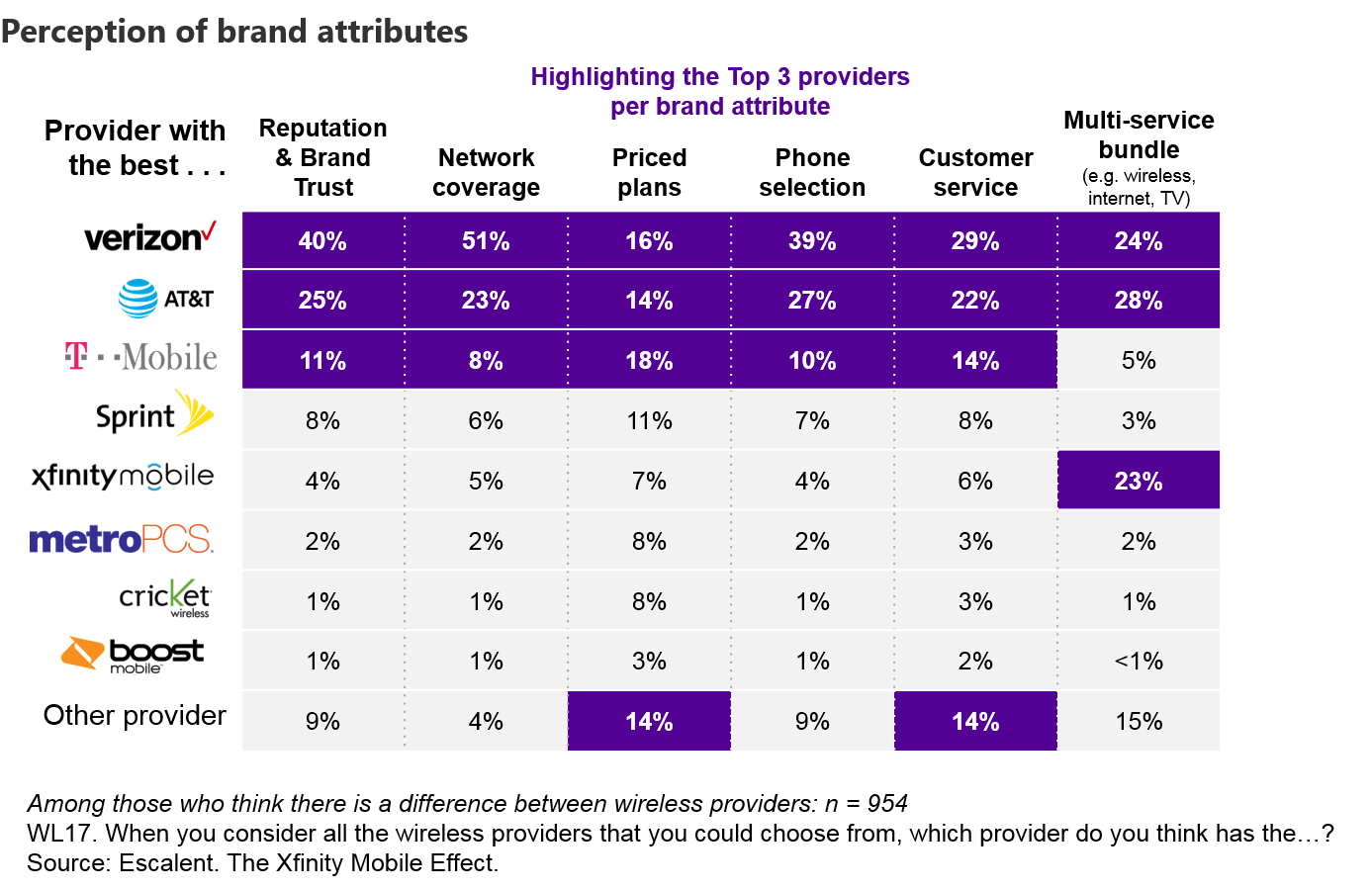

Findings in our study also provide some important insights for cable companies. Perhaps the biggest takeaway is that Xfinity Mobile has solidified Comcast’s brand perception as a Quad Play provider. Of consumers who agree that there is a difference between providers, 23% said they associate Xfinity Mobile as a brand that offers multi-service bundles. The only other companies that scored highly in this brand attribute are existing Quad Play providers, Verizon and AT&T.

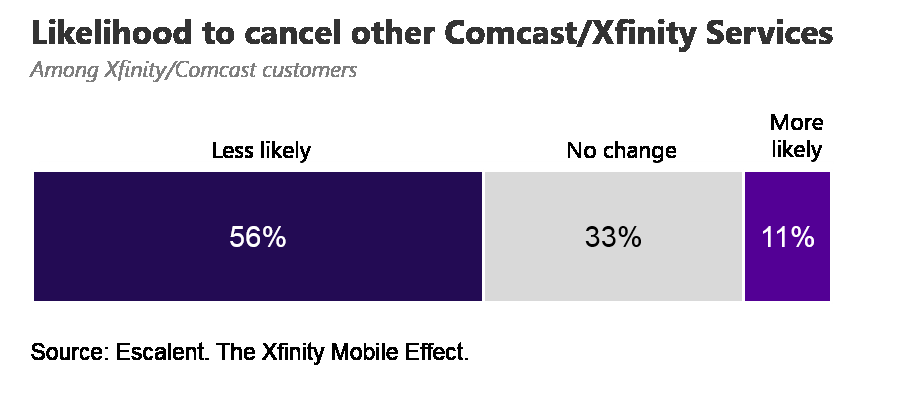

But what’s more stunning is that we already see the potential effect of Comcast’s Quad Play to customer loyalty. A majority (56%) of current Xfinity Mobile customers told us that with the inclusion of Xfinity Mobile to their bundle, they are less likely to cancel their internet and TV services with Comcast.

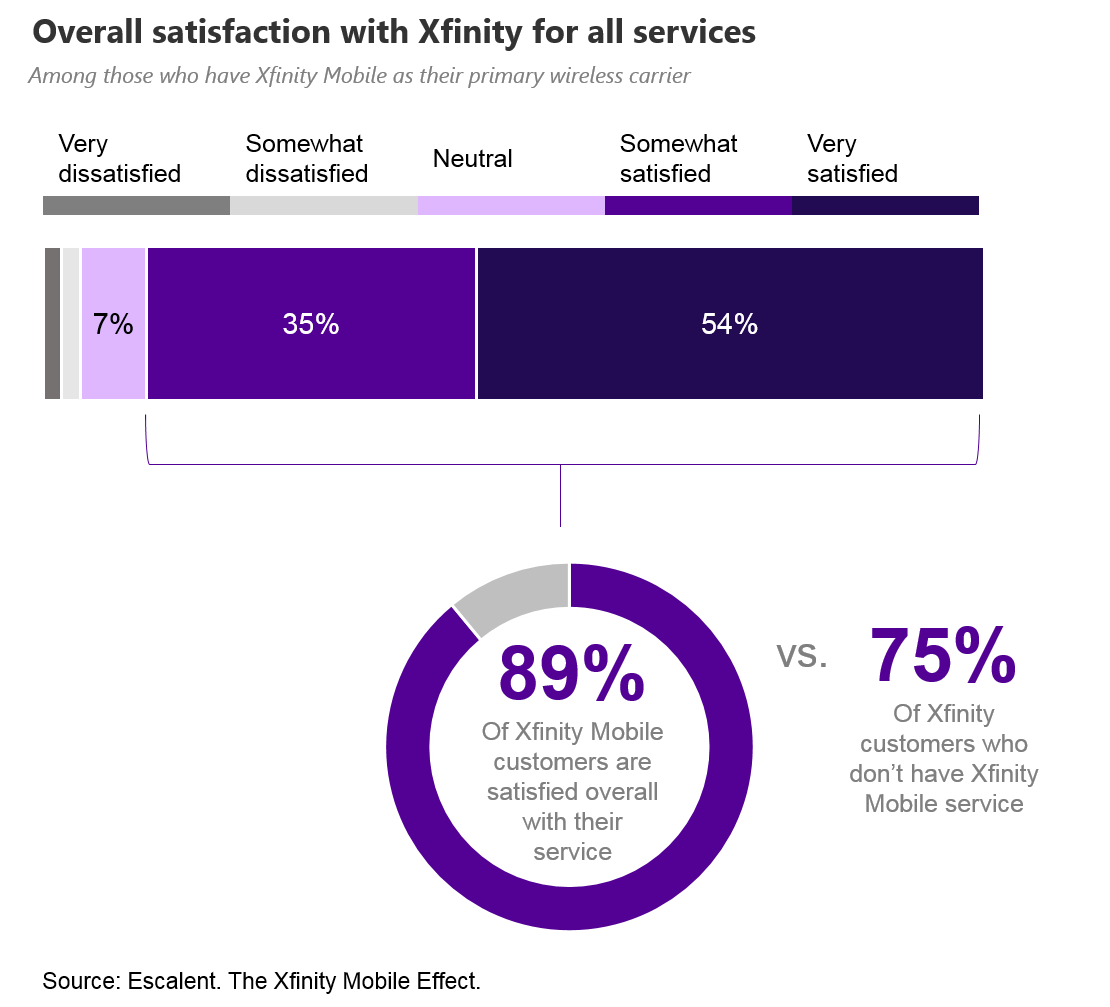

If you dig into the data further, it becomes clear why most Xfinity Mobile customers are less likely to leave Comcast. Almost 9 in 10 Xfinity Mobile customers indicated that they are satisfied with their services from Comcast, according to our study, and most customers are likely to recommend Xfinity Mobile to friends and family.

Competing with Quad Play companies

Comcast’s success in establishing Xfinity Mobile (and, by extension, its place in Quad Play) is an urgent call for other cable companies to follow suit. Cable providers with plans in place to offer mobile services are on the right track, but they will need to execute just as well as Xfinity Mobile has. That said, these cable companies also need to invest in customer experience market research as they enter Quad Play to successfully compete with—and differentiate from—the current giants.

On the other hand, cable companies that do not have a plan in place yet to offer mobile services should rethink their strategy. Our data on Comcast suggests that a wireless service can increase customer stickiness—provided consumers are happy with the service.

If you’d like to learn more about the impact of Xfinity Mobile to the wireless and cable industries, download your copy of our report or reach out to our team here at Escalent.