Success of Comcast’s Xfinity Mobile has potentially big repercussions in telecom, new research shows

Editor’s Note: This is the second installment of a three-part blog series based on a new, independent research study called “The Xfinity Mobile Effect.” As Comcast marks the one-year anniversary of its Xfinity Mobile launch, this series explores the success and competitive threat of cable companies offering wireless service. This research was featured on Fierce Wireless.

Quad Play is becoming a real competitive advantage in the telecom market. With consumers wanting a more seamless experience and a better deal from their TV, wireless, broadband and phone providers, more people are choosing to do business with just one provider. There is a big incentive for telecoms to offer Quad Play options: it increases “stickiness” as customers who subscribe to various services are less likely to churn.

But a viable Quad Play strategy is not easy to pull off. It requires major investments in technology, partnerships and marketing. In fact, very few telecoms have become real Quad Play competitors so far. For a few years now, AT&T and Verizon have been unchallenged in the Quad Play space.

That is, until now.

New, independent research from the technology and telecom market research division of Escalent shows that Comcast is now a viable Quad Play business. The report, which we published this week, shows that with the launch of Xfinity Mobile, Comcast is successfully gaining ground in the Quad Play space.

As we revealed in an earlier blog post, “Xfinity’s X-Factor,” the study shows that Xfinity Mobile is doing really well. Consumers are ranking the new service higher than other wireless providers. More importantly, Xfinity Mobile is achieving a higher NPS® compared to its competitors.

The early success of Xfinity Mobile will have a big impact in the wireless industry. For carriers, Xfinity Mobile’s momentum is a wake-up call to accelerate their efforts in Quad Play or to consider services that will improve customer stickiness.

Quad Play is no longer optional

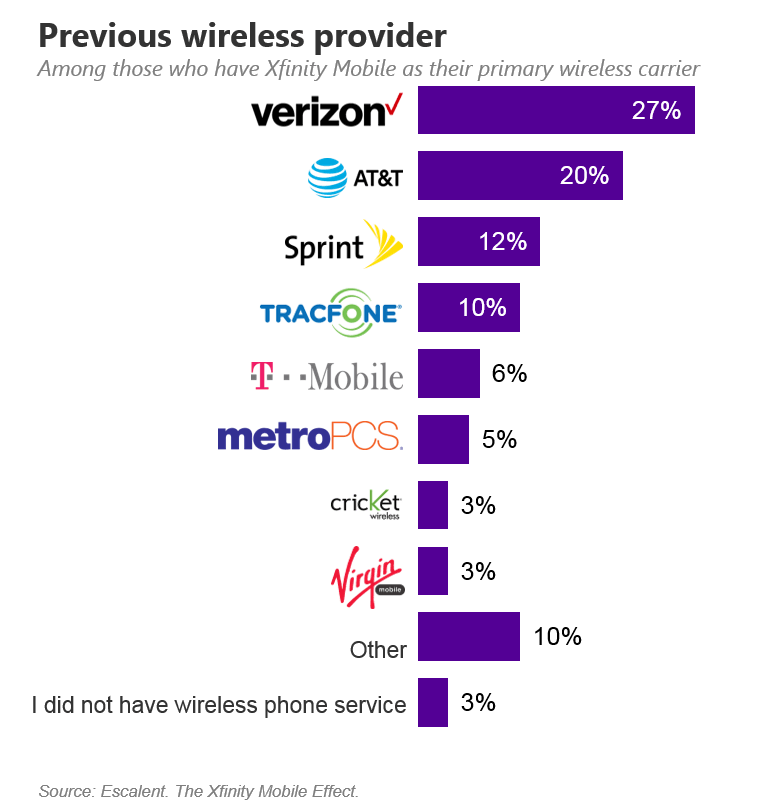

Our study shows that Xfinity Mobile is pulling away customers from major carriers. Verizon and AT&T, in particular, are taking the biggest hit—almost 50% of current Xfinity Mobile customers have come from these two carriers alone.

These numbers are particularly interesting for Verizon. Xfinity Mobile is on the Verizon cell network, but our report shows that Xfinity Mobile is ranking higher than Verizon when it comes to network coverage. We found that only 29% of current customers are aware that Xfinity Mobile is on the Verizon network. These findings suggest that the deal with Xfinity Mobile may not be resulting in Verizon losing customers outright, but they are likely losing average revenue per user due to reseller customers supplanting their base.

Xfinity Mobile’s entry means AT&T is also losing consumers. The company could fight back with Fiber and DirecTV offerings, but it might need to re-examine its own brand positioning to succeed.

The bigger takeaway here is that Comcast is a new viable competitor in Quad Play—the first in years. Now is the time for both AT&T and Verizon to rethink their strategy in light of Xfinity Mobile’s success.

Non-Quad Play companies can’t afford to sit on the sidelines

Arguably, Xfinity Mobile’s early momentum has bigger repercussions for non-Quad Play wireless companies. In an increasingly competitive space, these brands risk losing momentum or becoming less relevant.

To compete more strategically in Quad Play, some telecoms have already embraced mergers, acquisitions or partnerships. Wireless companies might need to accelerate such efforts now that Comcast is firmly in Quad Play. For example, T-Mobile and Sprint cannot compete head-to-head in Quad Play as they have no internet or video product, but with the pending entrance of other cable companies like Charter and Altice and the likely entrance of Cox, there is a major opportunity to be a reseller for these and other providers.

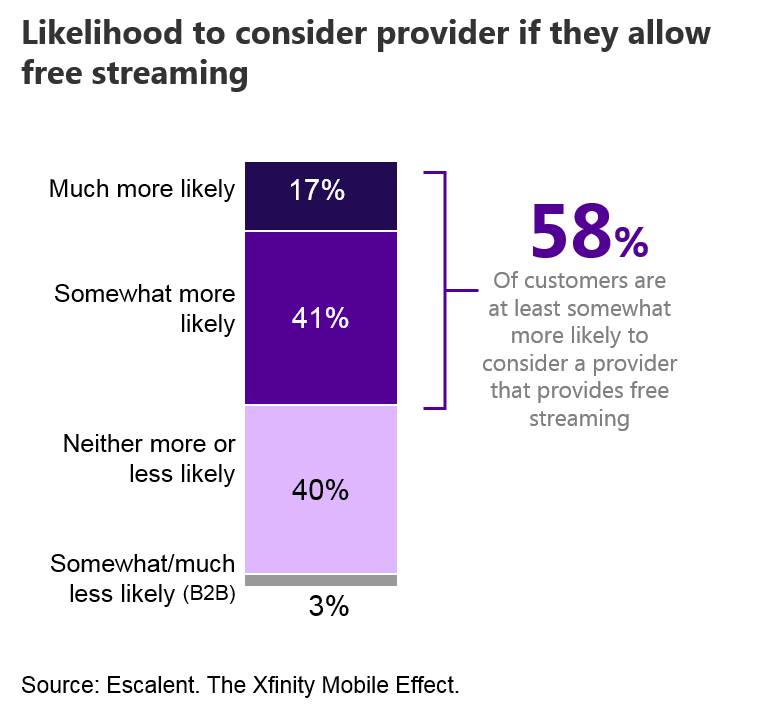

Some non-Quad Play wireless providers are using add-on services to entice consumers to switch, with video offerings a popular option. Our study suggests that this tactic is having mixed results. For T-Mobile, its Netflix promotion influenced 4 in 10 customers to sign up and increased loyalty for nearly 1 in 5. But Sprint’s Hulu offer is slightly less successful: although it also positively impacted loyalty for nearly 1 in 5, it influenced carrier decisions for only over a third.

Most consumers, we found, are somewhat likely to consider a carrier that provides free streaming. Companies should invest in more customer experience market research to explore other types of add-ons that will compel customers to act.

Lower-priced competitors are affected, too

For companies competing on price, Xfinity Mobile’s momentum means loss of potential new customers. Five percent of current Xfinity Mobile customers that we engaged, for instance, indicated that they used to be with MetroPCS, while 3% said they came from Cricket.

For these smaller players, an effective brand positioning strategy will become increasingly important. While some Xfinity Mobile customers indicated that they are likely to switch if given a better deal, carriers need to differentiate themselves in the market more effectively or risk getting stuck in a race to the bottom.

As you can see, Xfinity Mobile’s momentum has substantial implications for wireless carriers. But Xfinity Mobile’s entry also has repercussions for adjacent services. In our next blog post, we will dissect the impact for multi-service operators and video providers.