New research from Escalent shows Xfinity Mobile’s impressive traction

Editor’s Note: This is the first installment of a three-part blog series based on a new, independent research study called “The Xfinity Mobile Effect.” As Comcast marks the one-year anniversary of its Xfinity Mobile launch, this series explores the success and competitive threat of cable companies offering wireless service. This research was featured on Fierce Wireless.

When Comcast first introduced the Xfinity brand in 2010, many experts and industry observers questioned the move. Blogs like Gizmodo and the Consumerist and even Time Magazine made fun of the rebrand. One branding expert went as far as calling the initiative “a complete and total waste of time and resources.”

Fast forward to 2018, and these experts couldn’t be any more off. The Xfinity brand is alive and well, with Comcast launching a wireless service under this brand in May 2017. Called Xfinity Mobile, the service uses Comcast’s extensive network of Wi-Fi hotspots and Verizon’s cell network.

In a recent independent study, the technology and telecom market research divisions of Escalent sought to understand how Xfinity Mobile is performing both as a wireless service within a highly competitive market, but also as a tool that enhances Comcast’s core Xfinity Internet and TV businesses. The comprehensive research, which we released this week, reveals the impact Xfinity Mobile is making and provides compelling insight on what’s ahead for wireless providers and multi-system operators (MSOs).

A new competitor stealing from established players

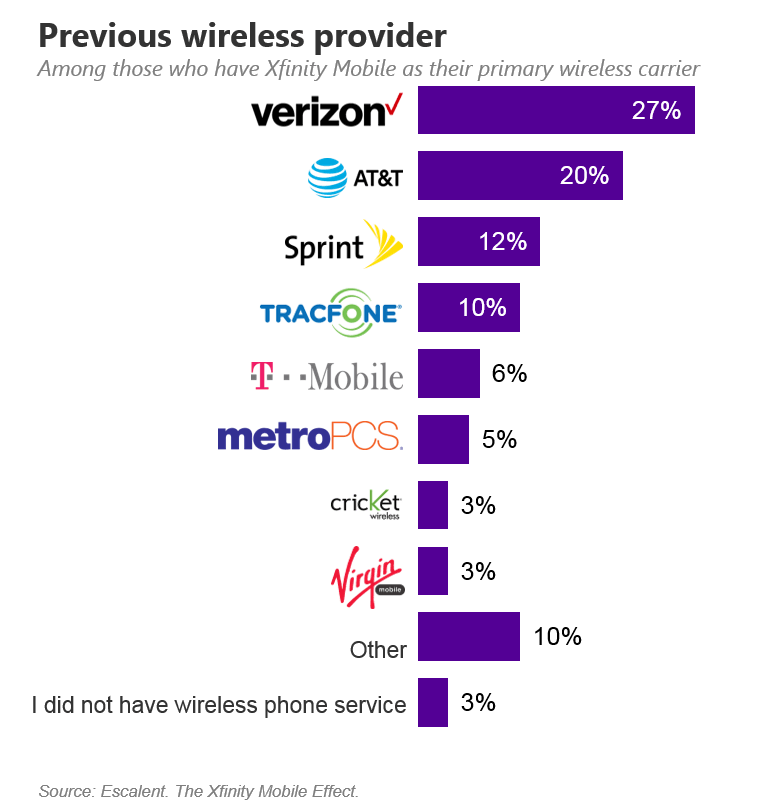

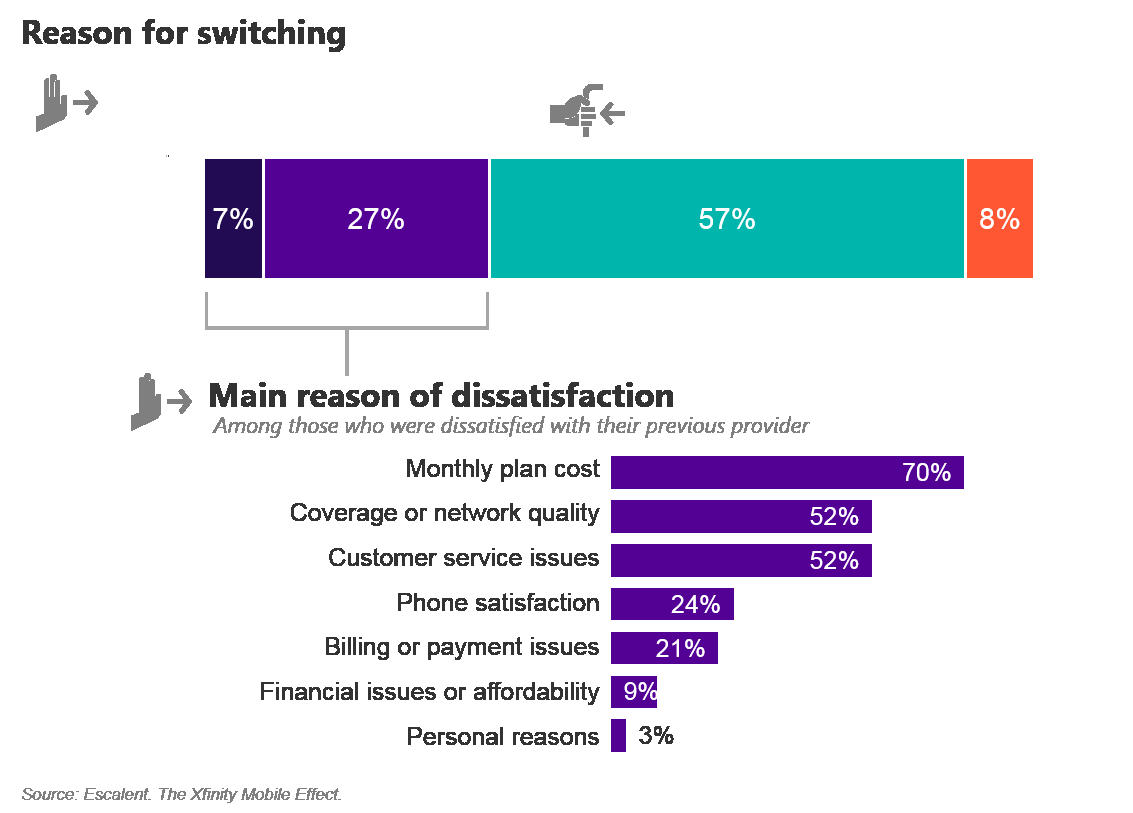

Our data show that Comcast’s foray into the competitive wireless market is going very well so far. Thanks to its pricing strategy, Xfinity Mobile is stealing customers from all major carriers. Almost 60% of current Xfinity Mobile customers said they switched because of the better deal, while an additional 27% mentioned both the better deal and dissatisfaction with previous provider as reasons they’ve switched.

The migration towards Xfinity Mobile isn’t done yet. More people are likely to switch to Xfinity Mobile in the near future, according to our study. Consumers exposed to Xfinity Mobile’s plan indicated that they are somewhat more willing to make the switch. This is particularly true for consumers who have been with their current provider for a shorter period of time.

Happy—and potentially loyal—customers

What makes Xfinity Mobile’s success compelling is that current customers are very happy about the service they’re getting. In fact, 79% of Xfinity Mobile customers do not believe they will switch anytime soon, although some indicated that lower prices elsewhere may lure them away.

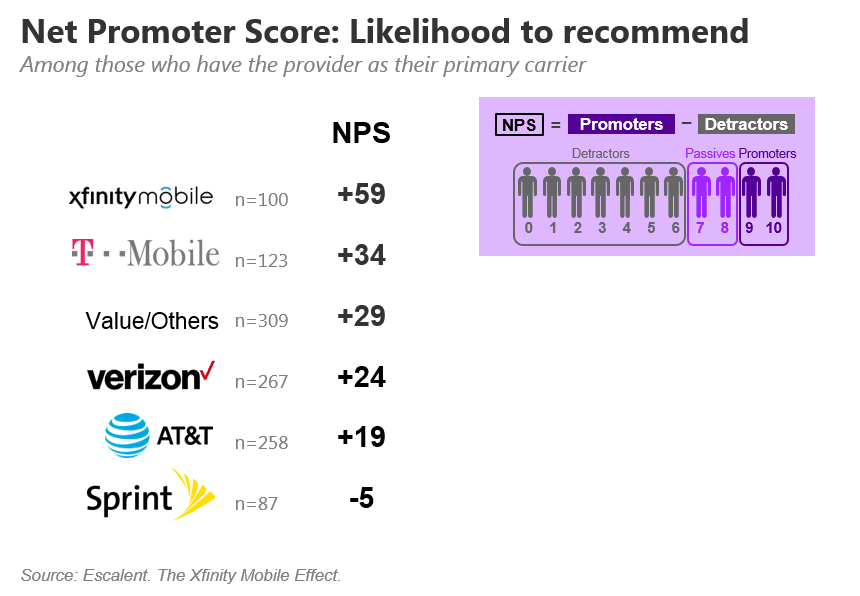

This high percentage of people who plan on staying with Xfinity Mobile is not surprising if you look more granularly. We asked consumers to rate their current wireless provider on various aspects of their experience, including overall service, network coverage and price. Xfinity Mobile came out on top in all but one of these measures. (The only measure where Xfinity didn’t end up at number one is customer service, where T-Mobile and Verizon ranked highest.)

In fact, Xfinity Mobile customers are so satisfied with the service they’re getting that they are willing to recommend it to other consumers. Xfinity’s Net Promoter® Score (NPS) easily beat other competitors, with a tremendous score of +59. This score is practically unheard of in the wireless industry and showcases the impact Xfinity Mobile is having. This higher likelihood to recommend is true even when compared to other customers who have recently switched to competitors, which rules out the “honeymoon effect” of switching service.

A promise of a successful Quad Play bundle

In the telecom industry, the importance of a Quad Play strategy (internet, television, telephone and wireless services) cannot be understated from a customer experience standpoint. Consumers that sign up for multiple services are stickier and more valuable for the company. Our customer experience research shows that Comcast is now firmly rooted in Quad Play—a space that only AT&T and Verizon have successfully dominated in the past.

While some people may dismiss Xfinity Mobile’s early success as beginner’s luck, our research suggests that this isn’t the case. Lower price compels consumers to switch, but many things contribute to Xfinity Mobile’s x-factor. There is sustained satisfaction among customers—and this satisfaction is translating to word of mouth.