From heat waves and wildfires to hurricanes and winter storms, utilities across the country are facing an increasing number of natural disasters that regularly threaten their ability to provide reliable service to customers. In February 2021, Texas power grid failures caused by a deadly winter storm shut down utility service for millions of people over several days. Two years later, an ice storm in Michigan left more than 700,000 customers without power, with only a fraction of service restored two days later.

In addition to adverse weather, attacks on electrical facilities across the country are on the rise, prompting renewed calls for better protection of the nation’s power grid. Between 2019 and 2022, the number of grid disturbances attributed to physical attacks, vandalism, cyberattacks or other suspicious activity doubled, according to data from the Department of Energy’s Office of Cybersecurity, Energy Security, & Emergency Response.

In the first five months of 2023, the office had recorded 167 such events, indicating that the upward trend is continuing. Increasing in number and frequency, these major events are shaking consumers’ confidence in utilities, driving the need for these companies to clearly demonstrate the value they provide, especially as rates increase. This is particularly challenging as consumers experience rising prices in all household bills—including energy—and where globally more than two in five people have cut back on essentials due to financial challenges, according to a new global study conducted by our sister brands, C Space and Hall & Partners, Value—Relationships Under Duress.

Against this backdrop, utility brands can stay relevant by becoming a trusted voice through authentic, relatable communication, and going beyond simply acting as energy providers. With insights from our Cogent Syndicated Utility Trusted Brand & Customer Experience (UTBCE): Residential study, we dig deeper into these critical issues to help utility companies better understand the challenges they face and how to address them.

Reliability Issues and Outages Are the Primary Adversaries Threatening Consumer Perceptions of Their Electric Utility Service Experience

When we asked consumers to identify the characteristics of their ideal utility, reliability was consistently named as the top brand trait—chosen by half of all respondents—followed by savings and value.

After an outage, 77% of consumers expect their utility service to be restored in fewer than 2 days.

However, while reliability is consistently the strongest driver of customer satisfaction, very few consumers support a rate increase to strengthen that reliability. This demonstrates the importance of educating consumers about the connection between reliability and resilience, and how they ultimately benefit.

If utilities could effectively communicate that investing in grid resilience would improve service reliability—ensuring faster restoration in the wake of increasingly frequent and severe weather events—then consumers would more clearly see the value of a price increase. Utilities also need to ensure they’re consistently communicating how investing in resilience increases reliability, especially after a major weather event or grid attack.

Florida Power & Light (FPL) is effective with this type of communication. The utility, which has seen intensifying hurricane seasons in the past few years, has been making significant grid improvements since 2006. It regularly communicates details and stats about these reliability improvements on its website and through frequent social media posts, building trust with its customers.

Our crews began undergrounding neighborhood power lines in Jupiter Farms, one of our many projects across Florida designed to improve grid resiliency. While no system is stormproof, underground lines like these perform better than overhead lines – including 50% better day-to-day… pic.twitter.com/V4vgTEfnav

— Florida Power & Light (@insideFPL) February 27, 2024

Historically, FPL’s reliability and outage communication scores have improved based on how well it manages extreme weather events, and we have measured improvements for other utilities that performed well during weather events.

Reliability Concerns Are Leading Consumers to More Strongly Consider Home and Backup Power Generation

Growing concerns about power disruption, along with lower tolerance for these events, are prompting a surge in demand for backup generators and battery storage technology. To help reassure apprehensive consumers, utilities should communicate that they are, indeed, building and maintaining a resilient grid. In addition, there’s an opportunity for utilities to move beyond the service provider role and deliver added value as a trusted energy consultant, advising customers and becoming a player in the power generation and storage consumer market.

For example, Ameren Illinois, which is among the top-performing utilities on several key reliability-oriented metrics in our UTBCE Residential study, partnered with Generac to offer its customers standby generator installation. The utility reminds customers that its grid is safe and reliable but also acknowledges the threat of weather-related outages and other “unexpected interruptions.”

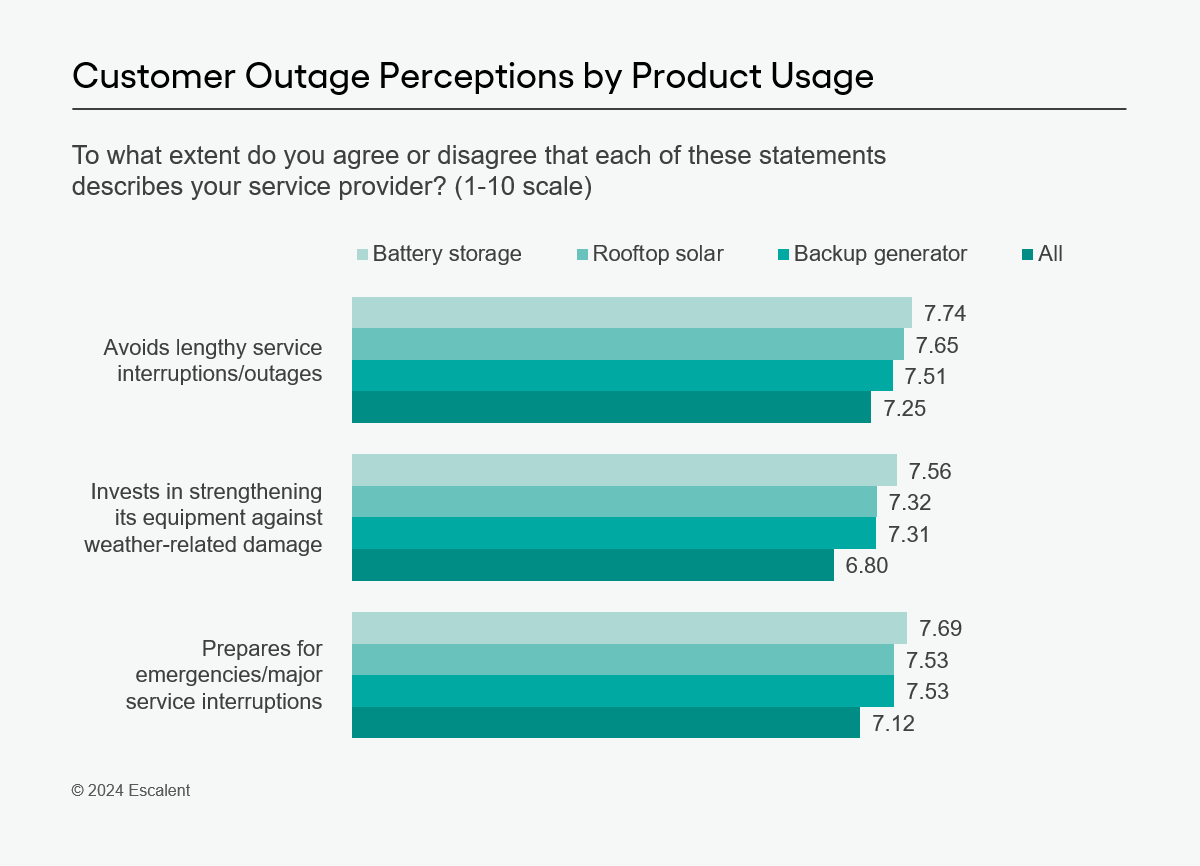

Paradoxically, customers who report using generators, rooftop solar and/or battery storage report higher perceptions on outage-related attributes as well as higher reliability-oriented scores. Knowing that they can fall back on these technologies may leave customers more inclined to report confidence in their utility to be prepared for emergencies.

Consumers Have Little Confidence in Their Utility’s Ability to Keep Its System Safe From Increasing Physical Attacks and Cyberattacks

In December 2022, about 45,000 Duke Energy customers lost power for five days due to a coordinated shooting attack that crippled two electrical substations in Moore County, North Carolina. A few weeks later, three substations near Tacoma, Washington, were deliberately damaged, causing power outages for more than 14,000 Tacoma Power and Puget Sound Energy customers. With attacks like these on the rise, consumer confidence in utilities is at a low point.

Only 11% of US customers agree their utility keeps its system safe from physical attacks and cyberattacks.

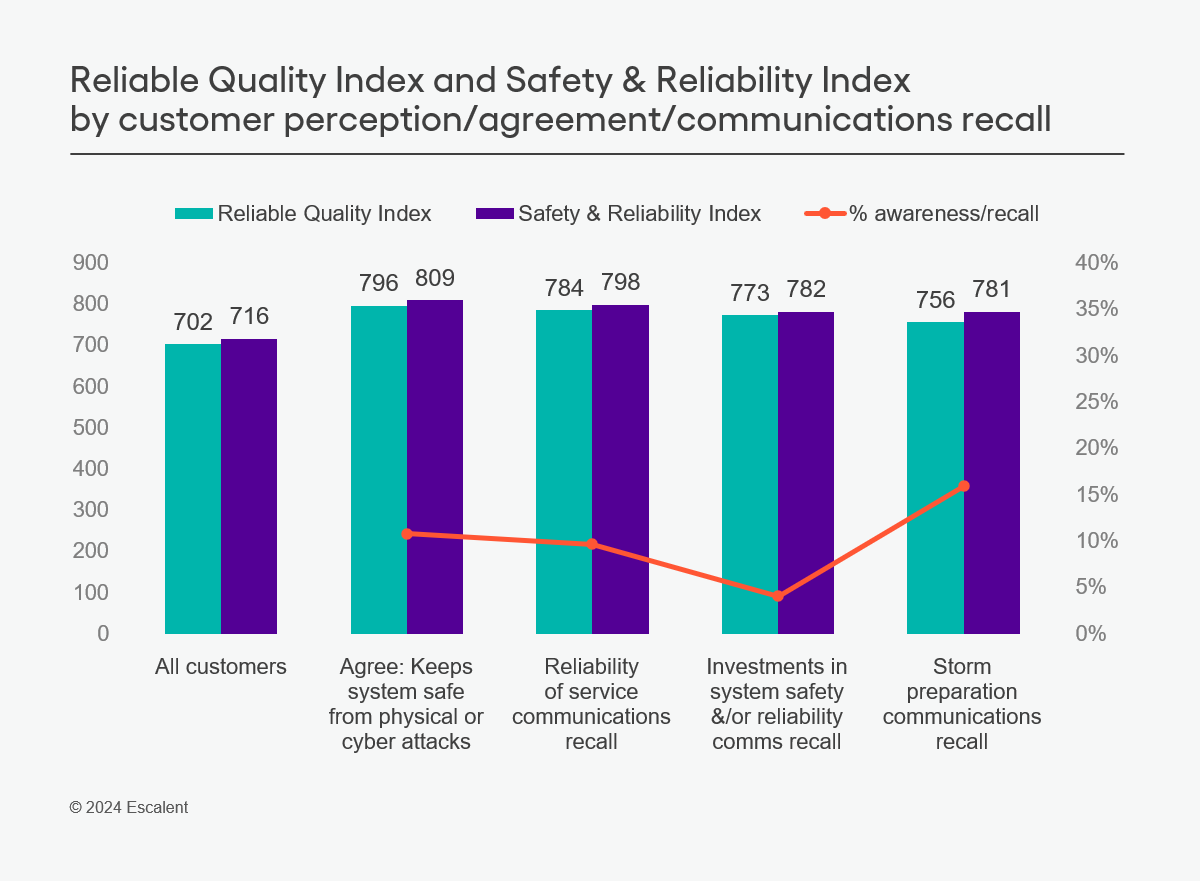

To improve customer perceptions around resiliency and reliability, utilities must consistently communicate their commitment to grid security and the measures they’re taking to safeguard their systems. Our study shows that customers who agree that their utility keeps its system safe and those who recall messaging related to service reliability, storm preparation or system investments give their utilities higher overall reliability-oriented scores.

If a utility faces a grid attack and receives national media attention, then it is crucial that other utilities reassure their customers that they have robust safeguards in place and that they remain vigilant against emerging threats.

Three Actions Utilities Can Take Now to Improve Customer Satisfaction and Brand Trust

Tell your reliability story: As the cost-of-living crisis continues to impact customers, utilities have the opportunity to deliver consistency in a chaotic world—to become a “constant” in the lives of consumers. The reliability story helps customers feel safe, showing them you’ll always be there no matter what state the world is in. At the same time, help customers understand the importance of investing in grid resilience so they can see the benefits they receive from the rates they pay.

Go beyond the service provider role: With adverse weather events and grid attacks driving demand for home and backup power generation, utilities have an opportunity to become consultants and players in this market. By acting as a trusted source of energy expertise to consumers, you can make your company more relevant in their lives and further demonstrate the value you provide.

Consistently communicate system safety: With rising attacks on power grids, consistently communicating the measures you’re taking to secure your services is key to gaining customers’ confidence—whether that attack happened to your utility or another company. Customers who recall hearing about how utilities are securing their grid have improved perceptions around resiliency and reliability.

To find out more about how you can improve service satisfaction, product experience and brand trust to deliver true value and become a utility of the future with our Utility Trusted Brand & Customer Engagement: Residential study click the button below.

About Utility Trusted Brand & Customer Engagement™: Residential

Each year, Escalent conducts surveys among 75,000+ residential electric, natural gas and combination utility customers of the 142 largest US utility companies (based on residential customer counts). The sample design uses a combination of quotas and weighting based on US census data to ensure a demographically balanced sample of each evaluated utility’s customers based on age, gender, income, race and ethnicity. Utilities within the same region and of the same type (e.g., electric-only providers) are given equal weight to balance the influence of each utility’s customers on survey results. Responses are collected continually throughout the full year, providing seasonal perspectives.