The European automotive landscape is undergoing a shift, leading the global transition to BEVs. In 2023, 14.6% of new-car sales in the European Union (EU) were BEVs, according to ACEA. This figure represents the highest percentage of BEV sales among all continents, showcasing Europe’s lead in sustainable mobility despite a recent stagnation in BEV sales due, in part, to the ongoing war in Ukraine and its economic impact along with slower than anticipated BEV charging infrastructure development, which is likely to be temporary. This growth is driven by several factors, including government regulations mandating the transition to BEVs, continual improvement in battery technology offering greater BEV range and lower costs, and growing awareness and acceptance of BEVs among consumers.

While the impact of BEV adoption on traditional sectors such as automotive, energy, oil and gas, and manufacturing is evident, retail is another crucial aspect of life that will be affected. Modern retailers heavily reliant on the sale of fuel, such as Tesco, Carrefour and E.Leclerc, risk facing increased challenges in drawing shoppers to their stores. However, while the decline in fuel sales will be inevitable with the rise of BEVs, this presents a unique opportunity for these retailers to compensate for the decline in fuel sales and create new revenue streams by strategically investing in BEV charging stations. Better still, retailers can provide solutions to one of the top pain points BEV drivers have: charging time.

Addressing the Consumer Pain Point of BEV Charging

For drivers, charging their BEV requires them to spend more time at or around a location. This presents an attractive opening for forward-thinking retailers to offer a broader range of services. Brands such as Ikea and Tesco are already leading the way, recognizing the value of incorporating BEV charging into their retail sites.

However, key questions remain:

- Will customers prioritize retailers with BEV charging stations?

- What will be the deciding factors for consumers when choosing where to stop?

- Which retailers, quick-service restaurants (QSRs) and convenience stores do BEV drivers frequent? And what would cause them to frequent one location over others?

The answers are crucial for retailers as they consider substantial investments required to build BEV charging infrastructure at their locations. This is why Escalent recently partnered with PureSpectrum to survey BEV drivers and intenders in Germany, France and the UK to understand how the e-mobility transition is shifting and will continue to shift consumer spending and how retail brands can win during this shift.

Understanding the Diverse Charging Needs of BEV Drivers

The charging needs of BEV drivers are not one-size-fits-all. They vary based on the length and the type of journey, familiarity with the terrain, and even the passengers involved. We determined three distinct scenarios that illustrate how BEV charging needs and behaviors differ and how retailers can align with each to benefit.

1. The Unfamiliar Adventure for BEV Drivers

This mode is triggered when travelers take road trips outside their local areas, typically requiring travelers to be on the road for at least two hours. Close to seven in ten people surveyed report taking such journeys in the past six months, making an average of more than three stops, with two-thirds lasting up to 30 minutes on a trip of around 650 km, lasting approximately 7.5 hours. Long journeys to unfamiliar places in BEVs often require more planning on where to charge than on where to get gas in petrol or diesel vehicles and this presents a significant opportunity to capture a share of consumer spending.

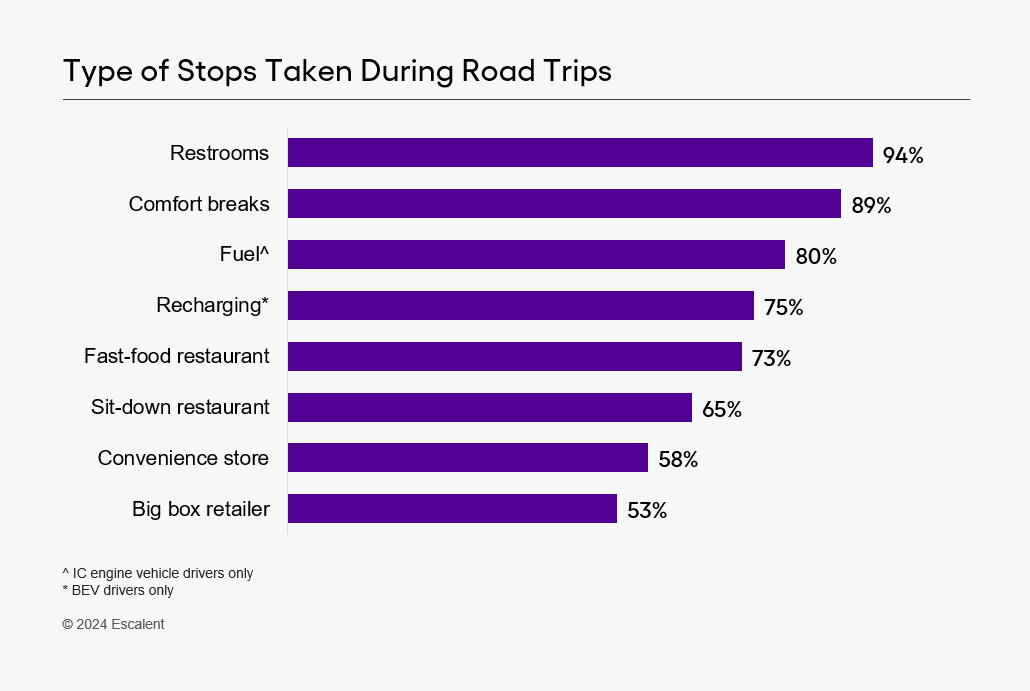

Travelers report making stops for various purposes during their road trips; restroom breaks, comfort stops, refueling, recharging and quick meals at fast-food restaurants are among the most common stops reported. These stops are often spontaneous, except for BEV recharging, which is often planned. Range anxiety for BEV drivers necessitates meticulous planning on where and when to stop for a charge. Factoring in their vehicle’s range, BEV drivers carefully plot their route just as they would map out destinations on a tour.

For traditional stops at QSRs or convenience stores, travelers rely on web searches, general navigation, and automaker-owned, in-car navigation apps. However, BEV charging changes the equation. Charging location apps (such as PlugShare and Chargeway) and charging station brand apps (such as BP Pulse and Ionity) become crucial tools in the search for BEV charging points. Retailers hoping to attract these road-tripping BEV customers should prioritize building visibility in these charging location apps and establishing partnerships with BEV charging networks. Furthermore, marketing, advertising and providing incentives through these apps for charging and shopping at the retailer’s locations as well as offering enhanced convenience by integrating charging point booking through the charging network app can build awareness of the charging stations that the retailer offers and thereby gain entry into BEV drivers’ charging ecosystem consideration set.

Decisions on the choice to stop at QSRs, convenience stores or retailers is generally made jointly between the driver and passenger(s). However, when it comes to BEV charging, we found that 45% of drivers make the decision independently whereas joint decision-making between the driver and passenger(s) takes place in 49% of cases.

On a road trip, McDonald’s is the most frequented fast-food restaurant (60%), with others such as Burger King (25%), KFC (13%) and Starbucks (12%) being far behind. Retailers such as Lidl (15%), Tesco (14%) and E. Leclerc (13%) are most visited during road trips. 7-Eleven (23%) is the most visited convenience store, followed by Carrefour City/Express/Montagne (9%).

Travelers mention charging speed, cost, location close to the journey route, and charging reliability as the top reasons for choosing a charging location on a BEV road trip. Retailers that prioritize and communicate these factors effectively stand to gain a significant advantage in attracting this lucrative segment of customers.

Shell, Total, Esso, Aral and BP capture the majority of refueling stops. With the exception of Esso, these brands are aggressively expanding their BEV charging networks across Europe to maintain their market share and remain relevant in the era of BEVs. Shell, with its charging arm, Shell Recharge (25%), and BP, with its BP Pulse (13%), are among the top brands travelers report having charged at during their road trips. The rest, especially Esso, need to enhance their BEV charging infrastructure to remain competitive.

2. The Familiar Routine for BEV Drivers

This consists of shorter trips within familiar territory that are a regular part of a BEV driver’s routine. Charging behaviors during shorter, routine trips in familiar surroundings differ substantially from long road trip adventures in unfamiliar territory. Home charging is the primary method, accounting for more than half of all charging needs, while workplaces and schools contribute roughly 15%. However, public BEV charging stations still play a vital role, accounting for over one-quarter of all charging needs during these familiar travel routines.

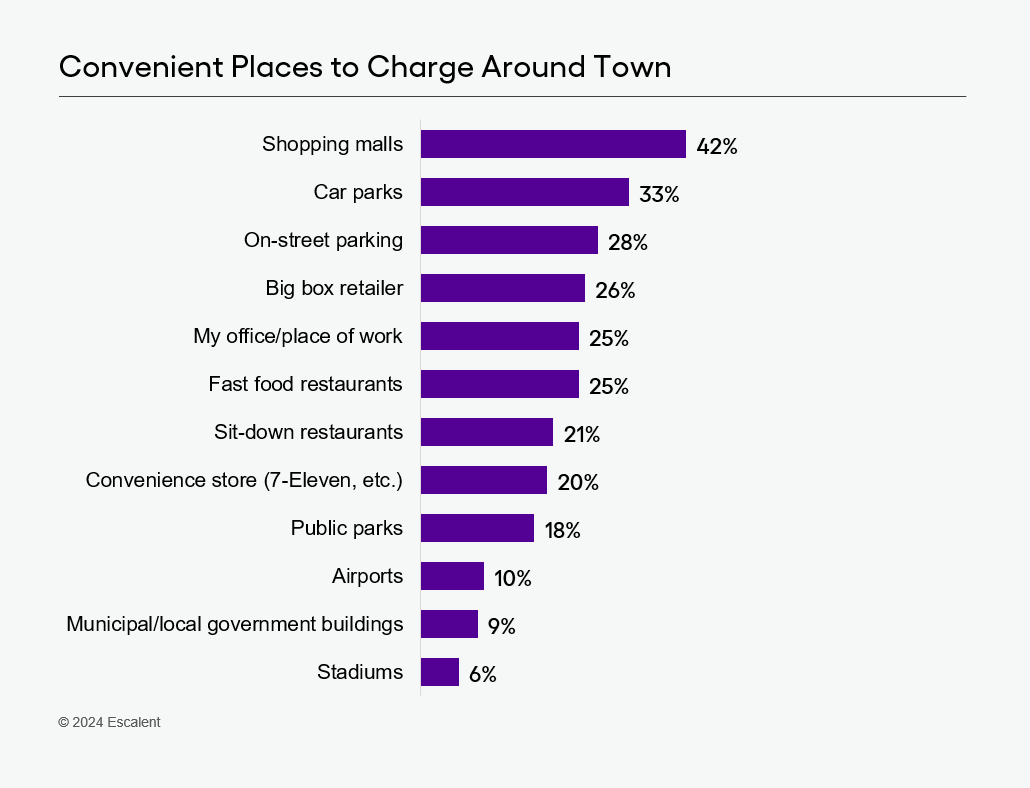

So, where do travelers prefer to plug in during their local travels? Shopping malls (42%) emerge as highly coveted charging destinations. This preference stems from their convenience—easy access, ample parking spaces and a higher chance of finding a free charger due to the sheer number of charging points. Car parks (33%) and on-street parking (28%) are popular for similar reasons.

This trend presents an attractive opportunity for retailers, especially those within shopping malls, to install BEV charging stations and attract customers. Retailers can drive more business by offering discounts or incentives to customers who use their charging stations and shop at their stores. This approach is likely to be effective because BEV drivers indicate that such offers would make them prefer one retailer over others. Furthermore, 75% of BEV drivers are actively seeking ways to occupy most of their time while their vehicle charges. Currently, BEV drivers are using this time to walk around, purchase and eat food, nap, shop, remain in the car, play games or otherwise entertain themselves. This is the prime occasion for retailers to capture additional consumer spending.

Retailers can also use the type of charger as a differentiator, as charging speed is a top priority for customers. A high proportion (58%) of BEV drivers prefer retailers with Level 2 chargers, while an even more impressive 69% report a preference for retailers that offer direct-current fast charging (DCFC).

3. The Unexpected Boost for BEV Drivers

Not every charging session is planned. The unexpected boost mode is akin to seizing an opportunity—using a BEV charger when drivers unexpectedly notice an available charging point. When presented with such an opening, drivers charge their BEV simply because a charging point is available at their current location rather than out of necessity.

Nearly seven in ten (69%) drivers report opportunistically using a free BEV charging spot even when their battery does not need a charge. This behavior presents another opening for retailers to drive incremental business, as more than half of these opportunistic drivers (55%) would be willing to extend their stay in-store while their vehicle charges. This unexpected time allows retailers to engage these consumers for longer.

It is evident that brands with louder footfalls stand to benefit more from this opportunity if they can align their charging offerings effectively. Therefore, the impact of this opportunity is likely to be greater for brands that are currently more frequented by customers, such as fast-food chains like McDonald’s, Burger King, KFC, Subway and Starbucks, as well as retail stores such as Lidl, Tesco, Ikea, REWE and Edeka.

Understand BEV Drivers and Fulfill Their Needs

The rise of BEVs is disrupting consumer behaviors and will continue to as BEV adoption grows. Forward-thinking retail brands, convenience stores and QSRs recognize this shift as a catalyst for growth. The ability to meet consumers’ evolving expectations can contribute to retailers’ future success. The path forward lies in understanding the changing landscape, prioritizing BEV drivers’ evolving needs and investing strategically to deliver solutions that address BEV drivers’ pain points and desires.

On May 21, 2024, we will host a free webinar, How the EV Revolution Will Upend the Energy, Retail, and Tech Landscapes, on the US findings from this study and how best to position your business for success in this new world.

Click the button below to learn more and register if you’d like to join us—and stay tuned for a future webinar focused on our study’s European findings.

Want to learn more? Let’s connect.

About the study

Escalent interviewed a sample of 3,000 EV owners, EV Intenders, and used EV considerers from the UK, France, and Germany, ages 18 to 80, between August 22 and September 6, 2023. Respondents were recruited from the PureSpectrum opt-in online panel of adults and interviewed online. As such, any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.