To create the conditions for more battery electric vehicle (BEV) “wins” in shopping journeys, automakers need to increase consumer exposure to the realities of BEV ownership—long before consumers reach the point of purchase.

In a recent study, 85% of BEV owners state that they became aware of the vehicle they chose at least a few months before purchasing one, affording them ample time to explore the reality of owning a BEV and overcome common concerns, such as where and how the BEV can be charged.

In contrast, 46% of non-BEV shoppers report first becoming aware of the vehicle they chose immediately before purchase or in the days or weeks prior—making them more often “spur of the moment” purchasers.

These are just some of the findings from our new EVForwardTM Path to Purchase DeepDive report, which examines the differences in shopping journeys among BEV owners, BEV shoppers (those who shopped for but ultimately didn’t buy a BEV) and non-BEV shoppers (those who neither shopped for nor owned a BEV) to identify how to increase BEV consideration throughout the consumer journey and, ultimately, spur greater BEV purchases.

Automakers and utility companies have a much greater opportunity to more effectively drive BEV adoption by boosting BEV consideration and winning over future buyers before they are even triggered to shop for a new car.

Paving the Way Ahead of Purchase

Because non-BEV shoppers don’t typically plan their vehicle purchases well in advance, automakers have limited opportunity to increase BEV adoption if focused on influencing consumers during the shopping and decision-making process. Without the time to address BEV concerns (such as misconceptions around day-to-day ownership costs, rebates/incentives and charging), shoppers without prior BEV exposure tend to default to what they know—internal combustion engine (ICE) vehicles. As a result, BEV consideration appears restricted to those who have done their research ahead of time, drastically reducing the chances that a BEV will make the short list for a spontaneous shopper.

To tap into new consumer bases, automakers need to reach and influence consumers long before their new-vehicle shopping journey begins. This includes marketing BEVs well in advance of production and reinforcing how BEVs are a reliable, cost-effective and convenient choice.

Closing the Gap Between Expectations and Reality

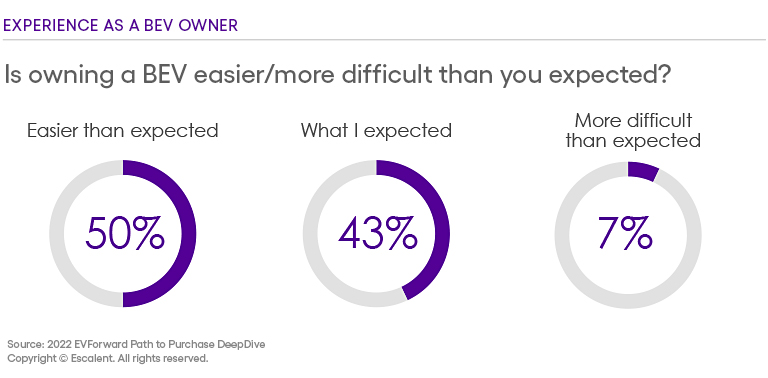

Owning a BEV is easier than many expect, but that lesson is slow to permeate the broader market. While 54% of non-BEV shoppers expect owning a BEV to be more complicated than owning an ICE vehicle, half of current BEV owners report that owning a BEV is actually easier than their initial expectations, and only 7% say it is more difficult. This perception that owning a BEV will be more complicated and challenging than an ICE vehicle is a big emotional barrier for consumers that automakers need to resolve—ideally, before the shopping process even begins so consumers will include a BEV in their initial consideration set when they do start shopping for a new vehicle.

The ease of home charging, the convenience of not having to visit a gas station, and a reduced need for regular maintenance are all compelling points in favor of BEVs around the ease of day-to-day ownership. Automakers should also focus on assuaging fears around vehicle longevity—such as emphasizing that BEV powertrain warranties protect against severe battery degradation for 10 years or 100,000 miles.

Utility companies equally have a unique opportunity to connect with consumers before and throughout the BEV shopping journey. Only 16% of BEV owners report speaking to their utility company about their electricity rates ahead of purchase—highlighting a missed opportunity to illustrate the realities of BEV ownership to potential future buyers.

To bring more shoppers into the fold, utility companies should be proactive in helping potential owners understand how to “fuel” their vehicle at home, in public, and on road trips, as well as in demonstrating that the charging infrastructure is already widespread.

Leveraging Consumer Loyalty

While BEV-specific education paints a part of the picture, automakers can also capitalize on existing brand exposure and loyalty. Many car buyers learned about their current vehicle because they previously owned the same make or model. Reusing name plates or offering vehicles with various powertrains—ICE, hybrid and BEV—can create a sense of familiarity and help consumers overcome BEV hesitation.

Word of mouth presents a huge opportunity, too—88% of BEV owners report knowing at least a few other BEV owners prior to purchase, which is in stark contrast to the 62% of non-BEV shoppers who said nobody they know owned a BEV. Between not knowing anyone with a BEV and having little-to-no other form of exposure to BEVs, it is easy to understand why non-BEV shoppers don’t include BEVs in their initial consideration set. Instead, these shoppers are on auto-pilot for the drivetrain they’ve always bought: ICE.

As such, tapping into personal relationships through “ambassador programs” can boost visibility and enthusiasm while helping to counter and shift misconceptions around the cost and hassle of owning BEVs. Non-BEV shoppers need to be shown that owning a BEV can be an easier proposition than many expect, and who better to show them than BEV owners themselves?

Creating More BEV “Wins”

Consumers with little to no exposure to BEVs typically go into the car buying process thinking that BEVs are not a convenient or cost-effective option to consider. Because of the speed at which non-BEV shoppers commit to a vehicle, opportunities to address concerns before the point of sale are limited.

Advertising, public relations and exposure to BEV owners all have a role to play in paving the way for widespread BEV consideration and adoption. Automakers must use multiple avenues to educate their audience on the benefits of BEV ownership so that by the time consumers begin actively shopping, they’re already sold on the advantages of a BEV.

To learn more about EVForward and how we can help you tailor your strategy to better reach future BEV buyers, send us a note by clicking the button below.

About EVForward™

The EVForward Path to Purchase DeepDive was conducted among a national sample of 1,374 respondents, including 118 BEV owners, 248 BEV shoppers (shopped for but have never owned a BEV) and 1,008 non-BEV shoppers (haven’t shopped for and haven’t owned a BEV) from February 16 to March 6, 2022. All respondents in this study have shopped for a new vehicle within the last two years.

These respondents are a subset of the EVForward database, a global sample of more than 40,000 new-vehicle buyers age 18 to 80, weighted by age, gender and location to match the demographics of the new-vehicle buyer population and by vehicle segment to match current vehicle sales. The sample for this research comes from an opt-in, online panel. As such, any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.