Following one of the worst years in the market, the collapse of FTX and several banks, and the persistent fear of an economic downturn, advisors and their clients continue to feel uneasy, with many worrying that economic conditions will worsen. Fee-conscious advisors are increasingly turning to ETFs and decreasing their allocations to mutual funds. As value for the money becomes one of the most important consideration drivers for advisors this year, momentum is building for Vanguard as a provider known for its low fees. That said, a rapidly changing investment environment creates opportunities for both active and passive managers, as advisors seek to smooth market volatility, diversify investments and capture opportunistic returns.

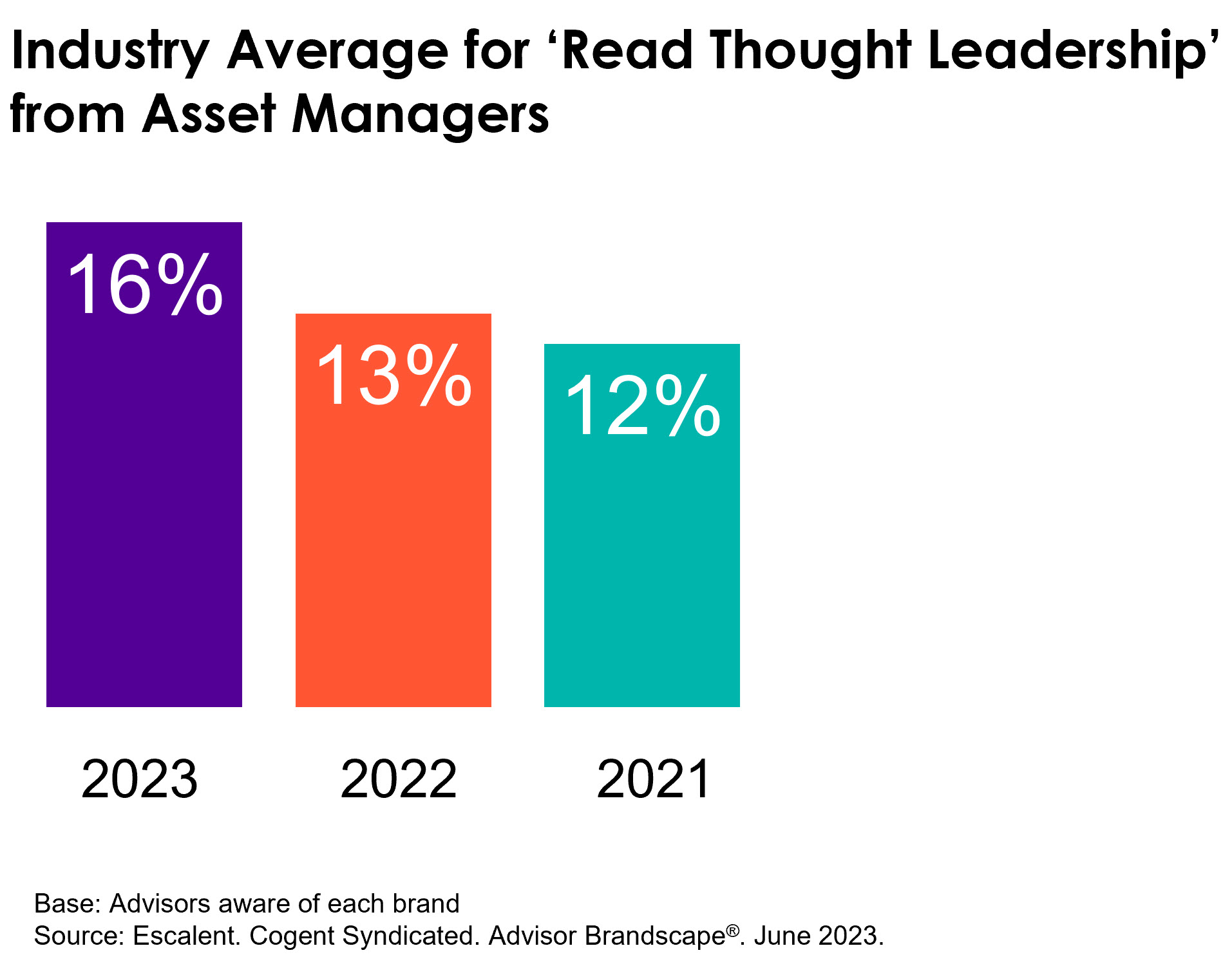

This year’s Advisor Brandscape report finds that advisors are increasingly turning to asset managers and other external sources to help them navigate an uncertain economic environment and inform their investment decisions. This year, we observed a significant increase in advisor engagement with thought leadership materials from asset managers, pointing not only to advisors’ appetite for these insights, but also to managers’ stepped-up efforts to deliver relevant and timely content. Advisors cite economic and market insights/commentary as one of the most important reasons for visiting provider websites.

Another area over which asset managers have direct influence is in delivering exceptional service so that advisors have more time to focus on cultivating client relationships. As advisors continue to migrate up-market and serve more-affluent clients with unique needs, asset managers can play a pivotal role by providing tools and consulting services that support advisors in the portfolio construction process. Wholesaler interactions also remain critical, with half of advisors indicating they prefer to meet with an external or internal wholesaler at least quarterly.

As asset managers face continued disruption and fee compression, it’s more important than ever for firms to articulate a vision for how they deliver value to their clients. The value proposition and pathways to execution will vary by firm, with some seeking to deliver value through scale and M&A activity while others choose to distinguish themselves in certain asset classes or partnership-related areas. As always, Cogent is here to help firms understand their place in the market and identify optimal opportunities to grow.

Click below to learn more about the full Advisor Brandscape report.