In the past few months, two banks have collapsed, sending shock waves throughout the financial services industry. In the wake of these events, Cogent Syndicated conducted an exclusive survey of affluent investors from March 24 to April 7. Using our own Investor Insights On Demand* product, we revealed that more than eight in ten (81%) affluent investors are aware of these recent bank failures, with more being aware of SVB’s (79%) than Signature Bank’s (39%) collapse. Positively for the industry, among affluent investors who are aware, nearly twice as many see these as isolated events (44%) versus an indication of something more systemic (26%). But while it’s one thing to be aware of these events (you couldn’t turn on your TV or browse the internet without hearing about them), how did these affluent investors react? What do banks, and the greater financial services industry, need to do now to win investors’ confidence?

Affluent Investors Express Concern, Signal Likely Withdrawals

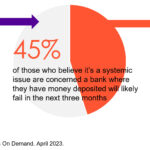

Of those 26% of affluent investors who think these bank failures are systemic events, nearly half (45%) are concerned that one of their banks will fail in the next three months, substantially more than the 28% who are not concerned. And that worry may trigger action, with 36% of concerned investors expressing they are likely to withdraw money out of the bank(s) they are using and split their funds into smaller amounts across multiple banks in an effort to ensure that all of their deposits are fully insured.

Digging Into Worries and Root Causes

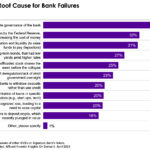

Even more alarming, but perhaps not surprising, is that nearly half (46%) of the affluent investors Cogent surveyed are worried about the impact the recent bank failures could have on their investments and/or the companies they invest with. While the top perceived root cause of these bank failures is ineffective corporate governance of the bank, the second-leading perceived root cause is outside individual banks’ control—interest rate hikes by the Federal Reserve, increasing the cost of money (32%). Rounding out the top three root causes, more than three in ten affluent investors cite inadequate capitalization and liquidity to raise funds to pay depositors.

When we look at the responses based on those who are aware of each bank’s failure, there are some notable differences. Affluent investors aware of the SVB failure are more likely than those aware of Signature Bank’s failure to perceive the root cause to be senior manager(s) offloading stock shares the week before the collapse (29% and 17%, respectively) or a concentration of loans in specific industries such as start-ups or tech (23% and 12%). Interestingly, despite the reporting on SVB’s failure being largely depicted as the result of having too much invested in long-term bonds and Signature Bank’s failure being reported as the result of being too tied to cryptocurrency, affluent investors’ perceptions are about the same for those two root causes for each failure.

Opinions Are Divided on New Bank Regulations

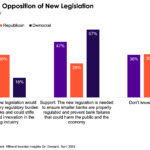

Since these failures, there has been newly proposed legislation to lower the asset floor from $250 billion back to $50 billion when deeming banks to be “too big to fail” and making them subject to enhanced federal supervision. This is built on the belief that increased federal supervision is necessary to ensure smaller banks are properly regulated and to prevent future bank failures that could harm the public and the economy. We found that more than four in ten (43%) affluent investors support this proposed legislation.

In contrast, just 24% oppose this proposed legislation because they believe it would place unnecessary regulatory burden on smaller banks and could stifle competition and innovation in the banking industry. Given partisan history of this debate, Democrats are more likely than Republicans to support this proposal (57% vs. 28%), while Republicans are more likely than Democrats to oppose (36% vs. 16%). Independents appear to be siding with Democrats, as they are more likely to support than oppose the proposed legislation (47% supporting vs. 18% opposing).

Affluent Investors Urge Caution and Transparency

When we asked affluent investors, “If you could give the company or companies where you have investments one piece of advice in the aftermath of recent bank failures, what would it be?” the most common response is to be careful/cautious (33%). This includes keeping more in reserves, managing risk, greater diversification, stricter due diligence, investing in real assets (rather than speculating), better lending practices, maintaining adequate liquidity, and not overreaching and being realistic instead. Second in line is the request for investment firms to be honest, transparent and ethical (10%).

But we can let investors speak for themselves:

Be Careful/Cautious

- “Be careful how you manage my investments.”

- “Balance your portfolio and actively manage risk.”

- “Be cautious and think of your customers above all.”

- “Be aware of too many risky investments and tighten controls on lending. Know what is going on with management. Are they acting in the best interest of depositors and customers?”

- “Ensure sufficient liquidity on hand to satisfy depositors’ needs at any time.”

- “Don’t overreach; invest conservatively.”

Be Honest, Transparent and Ethical

- “Be honest and transparent about money you have available. Do the right thing.”

- “Always act as a fiduciary. Don’t be too risky as in tech stocks and crypto; don’t get too greedy. Sure, everyone deserves to make a profit, but don’t do it to the point that you forget your customers. Be honest.”

- “Be honest and don’t give yourselves big bonuses or sell off stock right before you know something bad will happen. That’s why we don’t trust you.”

- “Don’t make unethical choices with my money.”

What Next? Communicate Trust.

These findings reinforce the urgent need for wealth management companies to demonstrate trustworthiness to their clients (to reinforce stability and minimize withdrawals) as well as to prospects (to capture new assets from those who may split the funds across multiple companies). For help in bolstering knowledge of your company’s strengths and vulnerabilities and in determining your next course of action, read CCO and managing director Chris Barnes’ blog titled “It’s Not Time for Banks to Be Silent.”

* Cogent Syndicated’s Investor Insights On Demand provides cost-effective and sophisticated real-time market feedback from A nationally representative sample of affluent investors. Use our proven platform to gain rapid insights that answer your firm’s specific business questions. We are in the field every month, giving us the flexibility to be ready when you are.