Editor’s Note: Cogent Syndicated’s annual Retirement Planscape® report has just published – read on for a sneak peek at the introduction to the report.

With industry leaders growing more dominant and opportunities to compete for new 401(k) business becoming more limited, brand management is fundamental for firms both big and small. DC plan providers and DC investment managers need to fully understand which elements are unique to their brand identities and how to showcase them in a way that resonates with retirement plan sponsors.

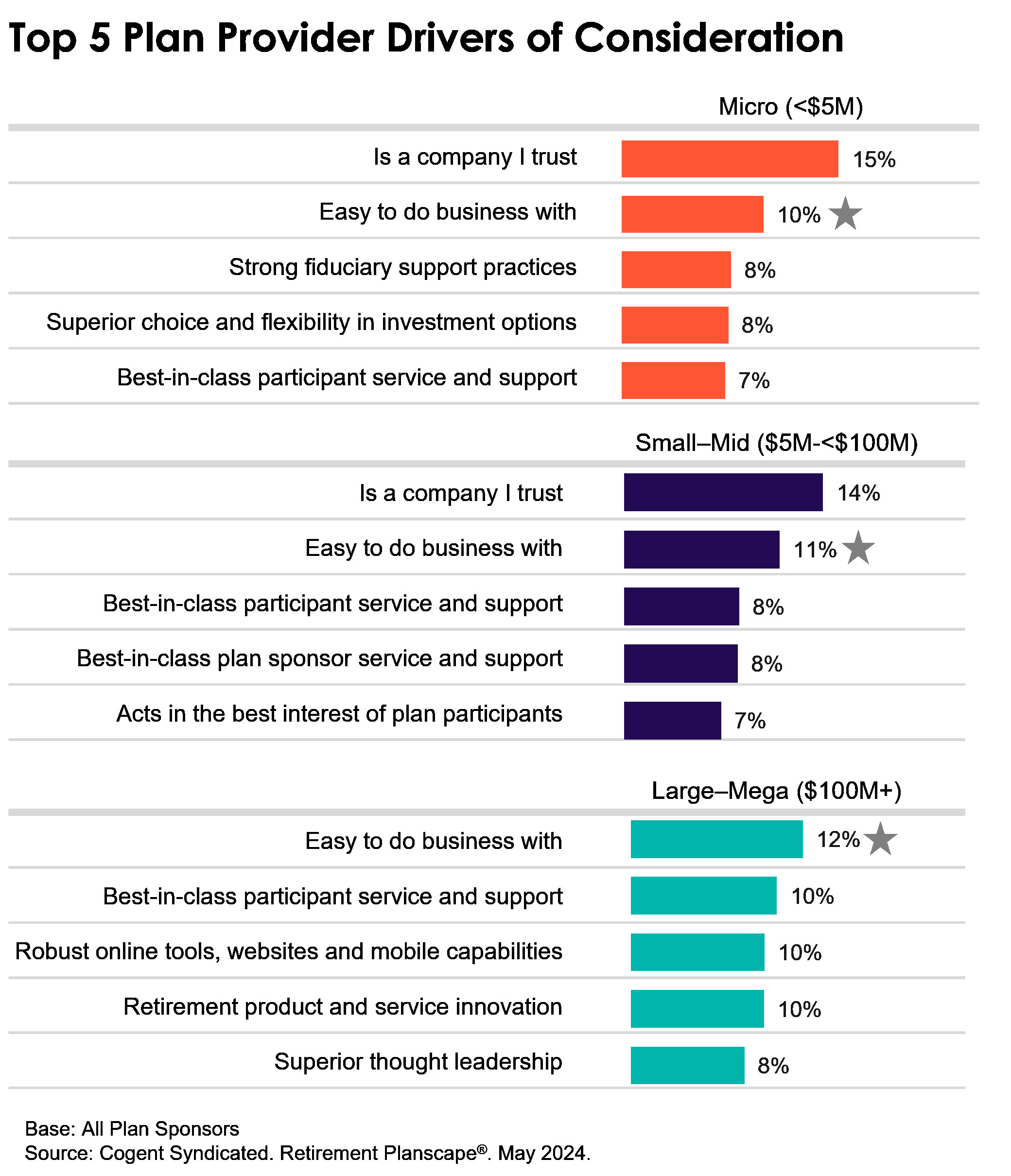

There are a multitude of statistical techniques that can be leveraged for this endeavor. For over a decade, our data scientists at Cogent Syndicated have conducted driver analyses to determine which aspects are most vital to enhancing plan sponsor consideration, satisfaction and loyalty levels. For example, for DC plan providers, being easy to do business with remains a key consideration driver across all plan-size segments, highlighting the merits of seamless service capabilities for plan sponsors.

We’ve also created models that uncover the underlying relationships between attributes and how they function together to strengthen plan sponsor consideration potential. This year, we found the most efficient way for DC plan providers to build consideration is by leveraging perceptions of partnership, comprised of being easy to do business with and offering best-in-class plan sponsor and participant service and support; or leadership via DC industry leadership, retirement product and service innovation, and superior thought leadership.

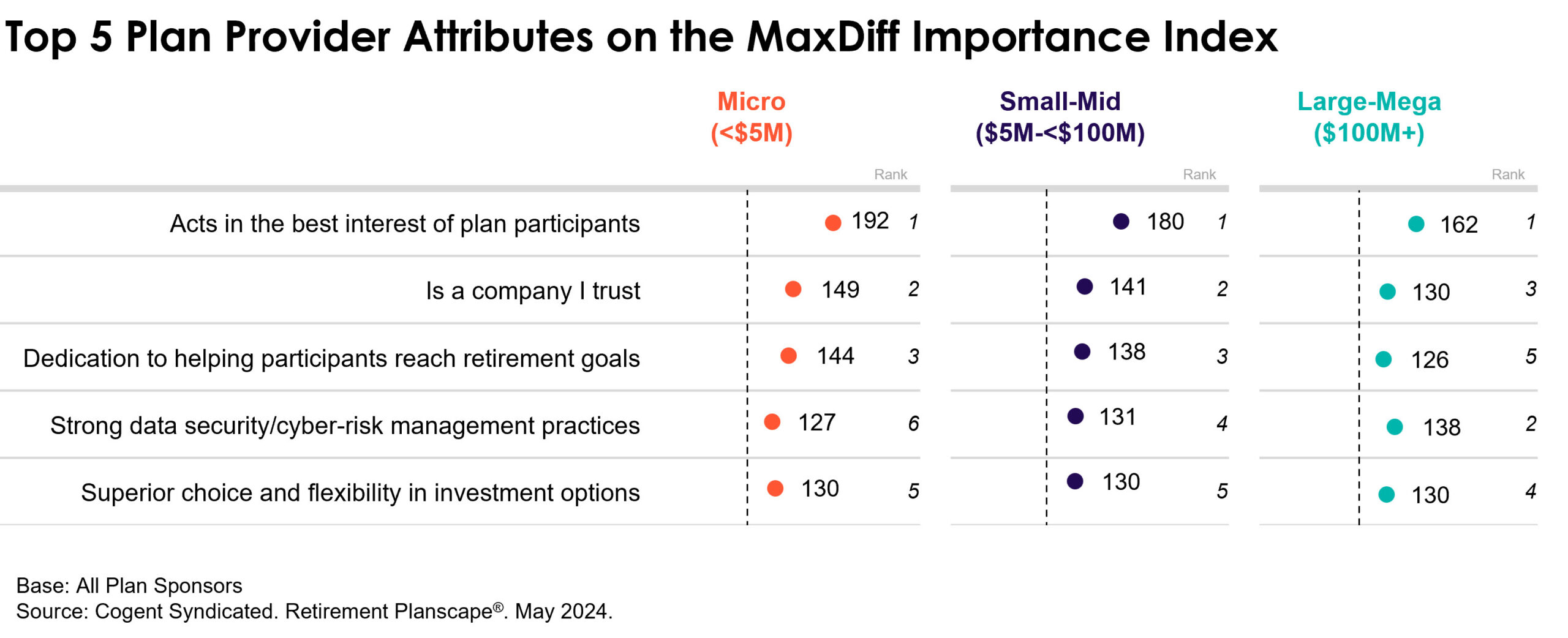

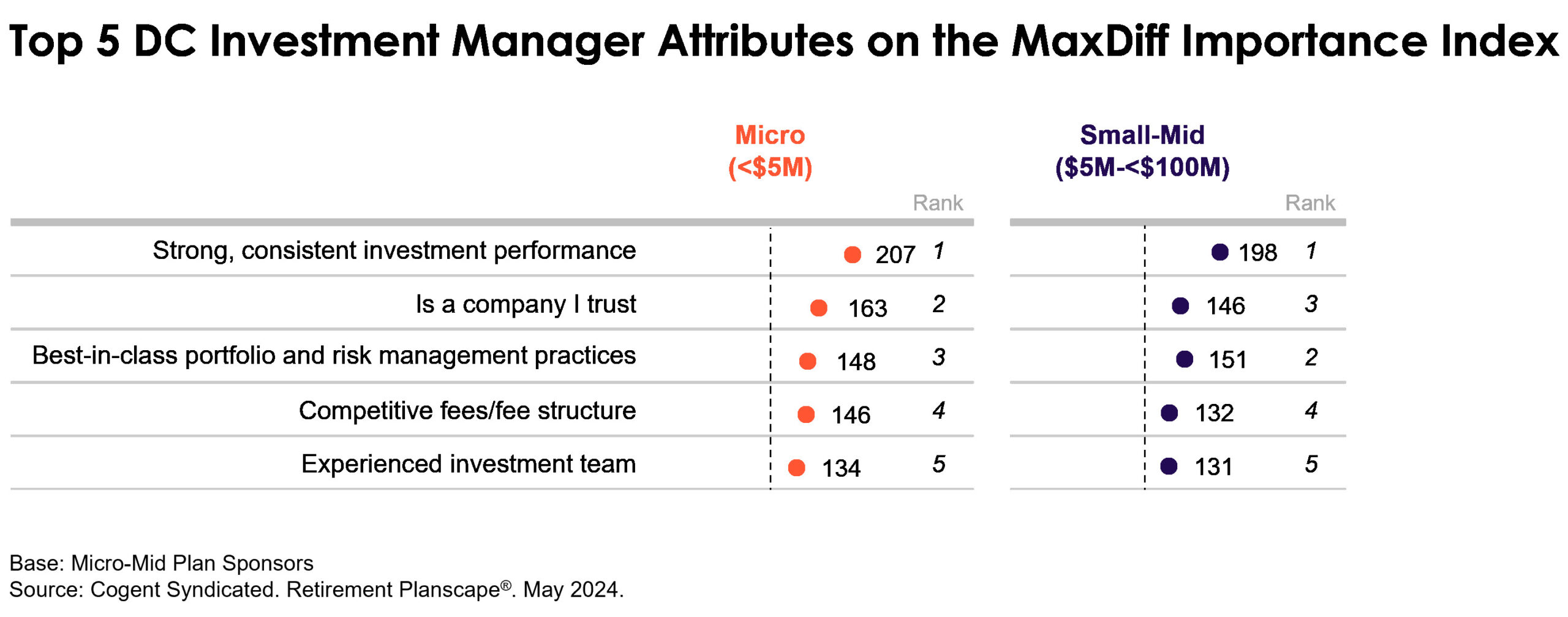

New in this year’s report, we’re introducing an anchored MaxDiff analysis, which enables us to pinpoint what’s most influential to brand consideration on a stated basis by asking plan sponsors to choose which characteristics are most and least important. The results complement our derived regression/driver analysis and provide deeper insight into the factors that influence plan provider and investment manager selection.

Our MaxDiff results reveal that acting in the best interest of plan participants is most vital to plan provider consideration across all segments of the marketplace. Brand trustworthiness is the runner-up among Micro and Small-Mid plans, while strong data security/cyber-risk management practices is the second most important attribute in the minds of Large-Mega plans.

For DC investment managers, strong, consistent investment performance is fundamental to consideration, yet brand trustworthiness along with best-in-class portfolio and risk management practices plays an influential role.

To effectively integrate these findings into firm-specific strategies, we examined detailed brand imagery associations and rankings for each provider as well as industry-average benchmarks for comparison. The results and our customized analysis help firms ascertain how differentiated their brands are in the areas that matter most to plan sponsors and chart the best paths moving forward.

Retirement Planscape provides insight into the latest industry trends, benchmarks the competitive strengths and weaknesses of the leading 28 DC plan providers and 43 DC investment managers, and tracks the emerging appeal of nine digital recordkeepers. As always, our goal is to help firms understand their unique brand identity and claim their distinct place within this ever-evolving market.

For more information on the full report, click below.