As the go-to destination for vehicle sales and servicing, dealerships have long played a central role in the ownership journey. However, this relationship is evolving as buyers shift their attention toward battery electric vehicles (BEVs).

Drawing insights from Escalent’s most comprehensive study of the next generation of electric vehicle (EV) buyers, EVForward®, the 2024 Aftersales DeepDive report seeks to understand the nuances of the aftersales experience for BEV owners and how dealerships can evolve their services to build stronger customer relationships as the e-mobility transition accelerates.

Since new-car buyers typically buy or lease a new vehicle every five years, getting customers back to the lot regularly for maintenance and servicing is a top priority for dealers. However, while 84% of vehicle shoppers told Escalent they were very likely to purchase their next vehicle from the same brand, only 67% said the same for their dealer. If dealerships wish to earn and retain the loyalty of future customers, they must adjust to account for the needs of BEV drivers.

Building Affinity With New BEV Owners

A vehicle represents a significant expense and buyers—particularly BEV owners—want to ensure they know how to protect and care for their investment. When asked how important it would be for a dealer to discuss vehicle maintenance when shopping for a BEV, 82% of new-car buyers stated it would be extremely or very important.

Despite this, only 62% told Escalent that their dealer provided an overview of the appropriate care and maintenance for their current vehicle at the point of purchase. Almost two-thirds (65%) of new-car buyers—and 78% of EV Intenders, consumers who are more than 15 times more likely to purchase a BEV, according to Escalent’s research—said that if the dealer went over their vehicle’s upkeep at the point of sale, they would be very likely to return to that dealer for service.

New-vehicle buyers are also interested in steps to streamline service scheduling. In fact, 82% of EV Intenders reported they would consider using an automaker’s mobile app to schedule service and 74% said they would be open to scheduling service directly from the vehicle’s infotainment system. By helping customers understand how to care for their vehicles and by making the servicing process as easy and convenient as possible, dealers can build affinity with car owners, paving the way for increased service visits and future sales.

Opportunities for Car Dealerships to Capitalize on Electrical Expertise

At present, dealerships have an edge in the EV ecosystem. Consumers see dealers as the experts on mechanical, electrical and software work—something dealerships should lean into before independent shops and third-party competitors crowd the space. Currently, 87% of new-car buyers stated that if they owned a BEV, they would take it to either the dealership where they bought their vehicle or another dealer to address a battery, charging or electric motor issue. Similarly, 92% indicated that the dealership would be their destination of choice for servicing their vehicle’s software.

However, vehicle buyers feel more confident shopping around for smaller jobs. While 57% of study participants told us that they would still go to the dealership for minor maintenance (such as getting their wipers changed) if they owned a BEV, just more than one-quarter (26%) said they would opt for a chain, independent or local service provider.

Foster Long-Term Loyalty Through Vehicle Maintenance Subscriptions

While dealerships are the popular choice for major maintenance, our data indicate dealers will need to compete more aggressively for routine upkeep. This is especially relevant since oil changes—a common source of recurring revenue from internal combustion engine (ICE) vehicles—are not part of the BEV ownership experience, putting pressure on dealers to prioritize alternative touchpoints.

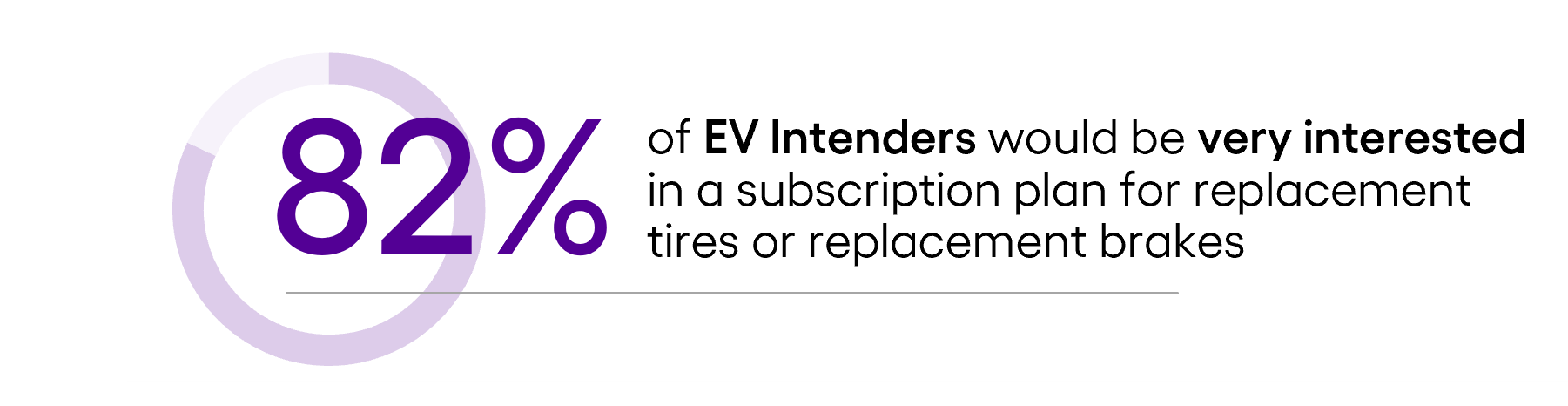

One promising route is through vehicle maintenance subscription services. Many BEV drivers are keen to take a proactive role in caring for their vehicles, and dealers are ideally positioned to support them by setting up a clear service schedule at the point of sale. EV Intenders also expressed enthusiasm for subscription services that could help them adhere to this plan, with a strong majority saying they would be very interested in a subscription for replacement tires (84%) and replacement brakes (82%).

Furthermore, 74% considered the dealership the natural place to purchase these services, making a strong case for a subscription-based strategy. Dealers could market these as add-ons at the point of sale to generate additional revenue, all but guaranteeing that customers return.

Center the Aftercare Experience Around BEVs

As BEV adoption increases, many dealers have voiced trepidation about the long-term viability of their model. While our data highlight multiple ways dealers can maintain consumer loyalty, these worries are not altogether unfounded. Under the right circumstances, new-car buyers said they might consider a competitor for their vehicle upkeep. For instance, 70% indicated they might go elsewhere for minor maintenance if another dealer offered cost savings.

Dealers have several advantages in the BEV space. Customers trust their expertise and are in the habit of relying on dealers for maintenance. That said, dealerships cannot afford to become complacent. While competition from third-party providers is limited, dealers should use this time to reimagine their approach through the lens of BEV owners. By capitalizing on their strengths, dealerships can create an aftercare experience centered around BEVs, cementing their position in the marketplace for the next generation of vehicle buyers.

If you’d like to learn more about our study or how our Automotive & Mobility experts can help you strategically plan for a future dominated by BEV owners, send us a note by using the form below.

Want to learn more? Let’s connect.