This blog is written from the point of view of Dyna Boen, with analysis and charting supported by Swati Gupta and Kim LeConey.

Considering Buying an EV

At Escalent, I am a managing director of Consumer Goods & Retail and Telecom but in the real word, I’m a consumer just like you. In fact, when it comes to buying a car, I’m what you would call an EV Intender—someone who doesn’t own an electric vehicle but intends to buy one in the next three to five years, according to our EVForward® study on the next generation of EV buyers.

For me, going on a road trip means looking at what EVs are on the road and thinking about which ones most appeal to me. It’s exciting to think about which EV I would purchase. When I first saw the upcoming plug-in hybrid Ford Bronco Sport, it was an absolute head turner! It’s retro cool and seductive enough to get me to make the switch from a regular gas vehicle. It’s also chic enough to be a lady’s car but rugged enough to carry my kids, dog, skis or mountain bike around South Lake Tahoe, where I live. Of course, the color of the car is a priority for me, and my color is red!

How Life Would Be Different With an EV

Once I got past envisioning the type of EV I wanted, the next biggest thing I had to consider was getting into the habit of charging my EV instead of going to the gas station. As I got more serious about what it meant to switch from a gas guzzler to a car that needs charging, I turned my attention to the realities of owning an EV and the behavioral shifts I’d need to make to accommodate this. Questions emerged as to where I’d charge during my road trips between Lake Tahoe and San Francisco and how long it’d take to juice up, even if my starter EV were a plug-in hybrid. I tried to recall whether the place I stop for my favorite latte already had EV charging stations. Contemplating this change led me to want more information about what EV owners were already doing. Clearly, it was market research time!

Fast-forward, we conducted research in the US to find out more about where EV owners are charging and what retail EV charging locations have the biggest draw. Interestingly, this study sheds light on which retail brands are winning at EV charging and why.

Who’s Winning at Retail EV Charging and Why

I learned that quick-service restaurants (QSRs) are winning at EV charging because it takes 10–15 minutes longer to charge an EV than a typical stop and people want to eat. Now, my most frequented trip is to San Francisco, which is about 200 miles from Lake Tahoe and a 3.5-hour trek on a good day (meaning no snow and minimal traffic). I could go for an average of 230 miles without recharging, but that’s cutting it close and I would likely charge up halfway into the trip. It turns out that 200–400 miles is the most common road trip distance traveled among the EV owners and EV Intenders who responded to our study, so it’s likely that they’d also stop halfway to charge.

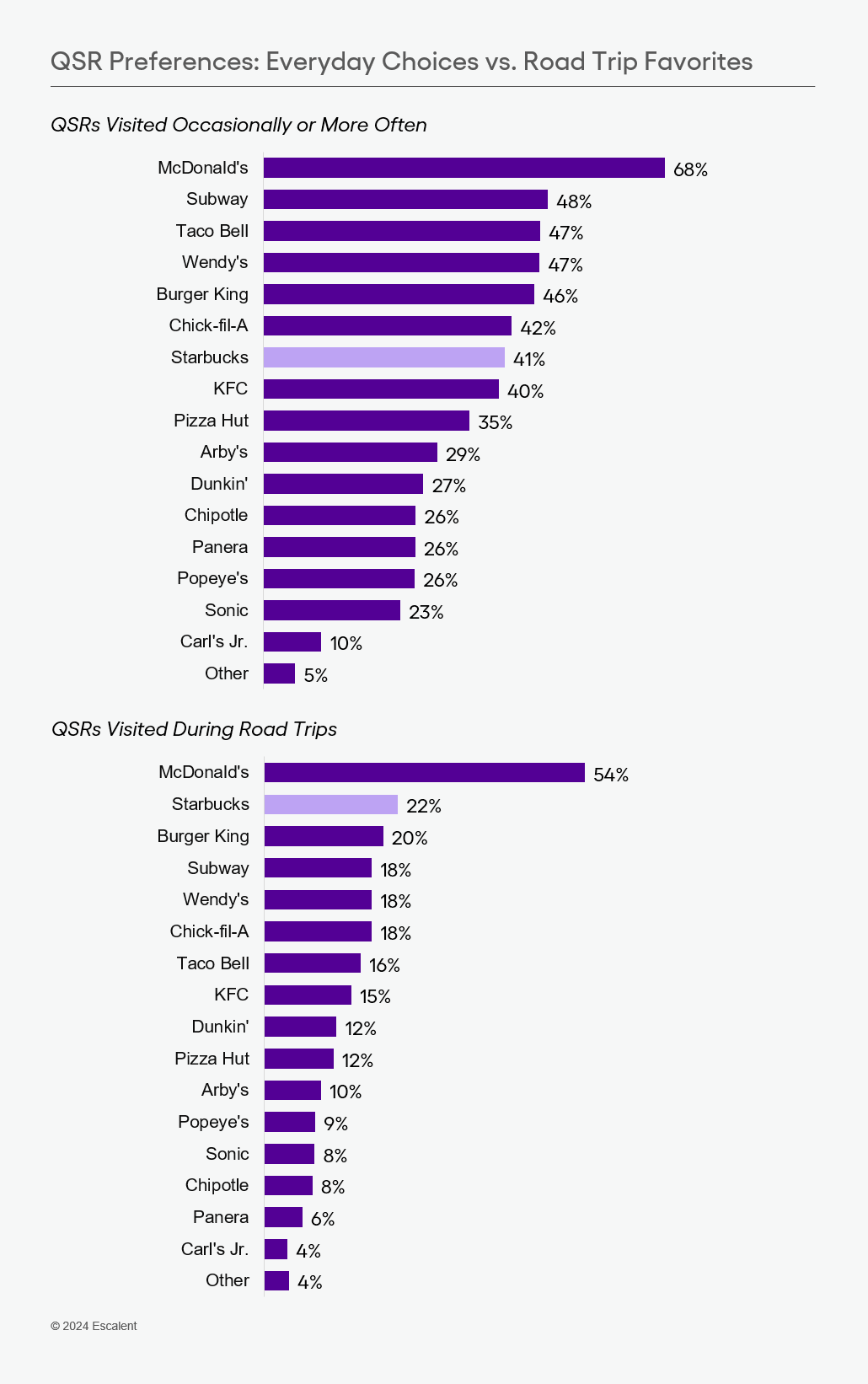

For me, stopping for a charge means where is the closest Starbucks? For others, it means McDonald’s. Twenty-two percent of EV owners and EV Intenders also pick Starbucks but most prefer McDonald’s (54%), followed by Burger King (20%), with Subway, Chick-fil-A and Wendy’s being other top alternatives. However, across distances of 1,000 miles or more, McDonald’s, Starbucks and Wendy’s are the top three QSR stops.

Perhaps even more interesting is that Starbucks ranks seventh among these respondents when they are simply selecting a QSR on any given day but then jumps to second when it comes to road trips. The more hours people spend in the car, the more significant McDonald’s and Starbucks become. Is it the coffee?

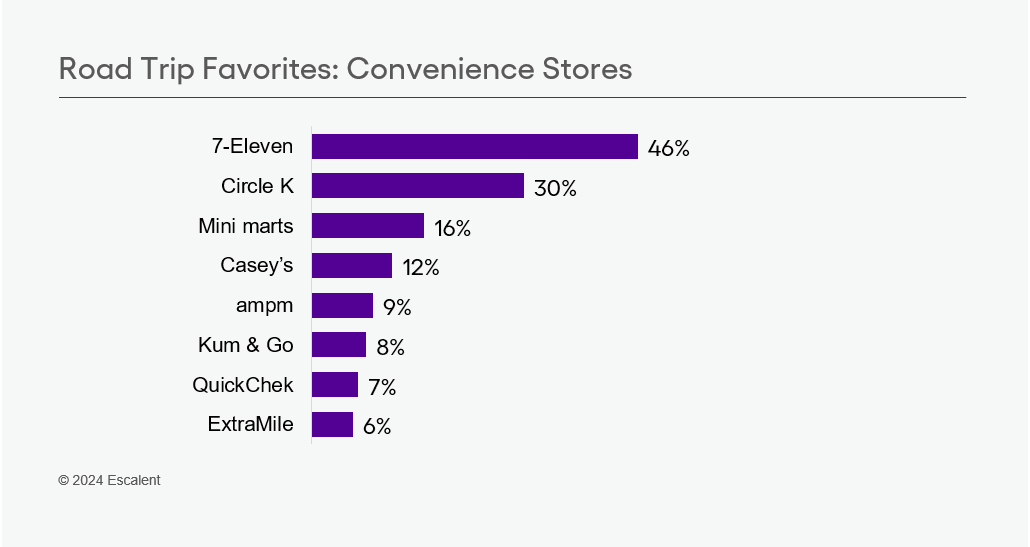

Equally popular, 7-Eleven (46%) is consistently winning stops among convenience stores. I mention this because I, too, have stopped there when craving a Slurpee and a pepperoni stick during a seemingly endless road trip. The good news here is that I won’t have to change my behavior when charging on road trips; I can still hit up Starbucks and the occasional 7-Eleven when I need to satisfy a craving because both brands are investing in EV charging stations.

I was surprised to learn that 42% of EV owners plan where they are going to stop and eat, most using Google Maps, Waze or Apple Maps (42%), an app like TripTik (29%), or an automaker-app such as FordPass (21%). These stops are likely planned because EV owners know it takes longer than a typical gas car stop to charge up. It’s interesting to learn that in everyday situations (not road trips), EV owners still select QSRs as their first choice (44%) for charging versus other venues such as big box retailers or convenience stores, and they are making the most of these visits. EV owners are 72% more likely to go to a venue to dine or shop while they charge.

Where’s the Opportunity for QSRs With EV Charging?

In a world where many eat in their cars and order takeout, EV charging represents a unique opportunity to get people back into the restaurant during the time it takes their battery to power up. Tables and chairs set QSRs apart from convenience stores like 7-Eleven when competing for EV charging time. Additionally, it’s a moment for disruption, a time when gas stations are rethinking their identity. It puts QSRs in a unique position to rebuild their post-pandemic in-store relationship with consumers.

As an EV Intender, I’ve identified two compelling opportunities for quick-service restaurants:

- Loyalty Programs and EV Charging Integration: Thirty-two percent of consumers are keen on linking EV charging to rewards. QSRs can seize this opportunity by expanding their loyalty programs. Imagine a scenario where patrons not only earn points for food and beverage purchases but also for EV charging. For instance, could a certain QSR offer a discount on meal purchases when patrons charge their EVs? Or perhaps a delightful combo deal where a Happy Meal purchase comes with discounted EV charging? By intertwining these incentives, QSRs can enhance customer loyalty while encouraging sustainable practices.

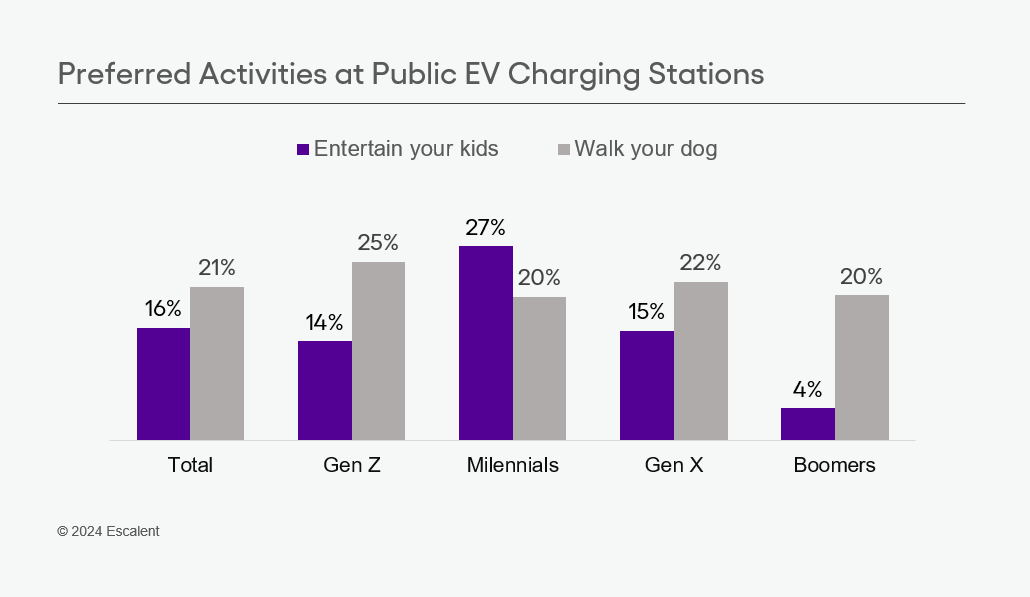

- Family-Friendly Experiences: Remember the joy of road trips as a child when a stop at McDonald’s meant playtime and excitement? Sixteen percent of EV owners and EV Intenders share this sentiment—they want to entertain their kids during travel. Notably, Millennials (27%) are most likely to have young children. Furthermore, 12% of EV owners specifically seek places to walk their dogs. Especially among Gen Z, this desire to accommodate furry companions jumps to 25%, although it represents a substantial market across generations (Gen Z, Millennials, Gen X and Boomers). Therefore, QSRs can create family-friendly environments that cater to both human and canine guests. After all, road trips often involve kids, dogs and the promise of memorable experiences.

In summary, the convergence of EV charging, family outings and tasty treats presents exciting prospects for QSRs. Meantime, I’m still dreaming about my red, plug-in hybrid Ford Bronco Sport. I’m recognizing that I’m going to need to be more mindful about planning my stops and hoping that by the time I become an EV owner, QSRs will have something to offer the entire family.

If you’d like to learn more about our study’s findings and how your brand can grow by seizing the opportunities that come with EV charging, join me and my colleagues K.C. Boyce and Nancy Arter on May 21 at 10 am PT for an insightful webinar on How the EV Revolution Will Upend the Energy, Retail and Tech Landscapes.

About the Study

From August 22 to September 6, 2023, Escalent conducted interviews with a national sample comprising 1,000 individuals. These participants included EV owners, EV Intenders and individuals who were considering purchasing an EV. The age range of respondents spanned 18 to 80 years. The recruitment process involved selecting participants from the PureSpectrum opt-in online panel of US adults, and the interviews were conducted online. Any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.