The e-mobility transition is scrambling consumer buying behaviors. Consumers are considering automotive brands and vehicle segments they haven’t before. Consumers who own battery electric vehicles (BEVs) are learning about new brands that offer charging networks for their BEVs and they are changing their shopping behaviors in favor of retailers, convenience stores (also known as C-stores) and quick-serve restaurants (QSRs) that fit into their new life as a BEV owner.

Nearly 8% of new-car sales in 2023 were electric vehicles in the United States, and Escalent’s EVForward® study on the next generation of EV buyers found that a full one-quarter of new-car buyers are “EV Intenders,” meaning, consumers who are most likely to purchase a BEV as their next car. The accelerating e-mobility transition doesn’t just impact automakers; it also has ripple effects on how people “fuel” their transportation and where they spend their time and money while charging their BEV. Forward-thinking brands such as 7-Eleven, Walmart, Circle K and Starbucks, recognizing these effects, have begun building out BEV charging infrastructure to capture a more significant share of this shifting retail spending.

But are these strategies likely to succeed? Over 70% of BEV charging happens at home, and installing BEV charging infrastructure is expensive, with a single DC fast charging (DCFC) unit running into the six figures for equipment and installation. Escalent recently partnered with PureSpectrum to survey BEV owners and purchase intenders to understand how the e-mobility transition will shift consumer spending and how retail brands can win.

Various BEV Use Cases Play Out Differently for Retail, Convenience Store and Quick-Serve Restaurant Locations

With the vast majority of BEV charging happening at home, we examined three different “journeys” and their impact on retail, QSR and C-store brands:

- Road trips. Nearly three-quarters (72%) of drivers say they take a road trip outside their local area at least once a year. BEV drivers typically seek out DCFCs during road trips, which can replenish the battery in as little as 15 minutes, but may seek out slower (e.g., Level 2 or 240-volt) charging at and around their destination.

- Local BEV charging. This is charging done on a day-to-day basis that is necessary for the driver’s commute, errands or other mobility needs. This charging can happen either through a DCFC or Level 2 depending on the driver’s needs and may serve as a draw to an establishment with these chargers.

- BEV opportunity charging. This charging is done simply because a charger is where the BEV driver is, not because it’s necessary for mobility.

The Great American (BEV) Road Trip

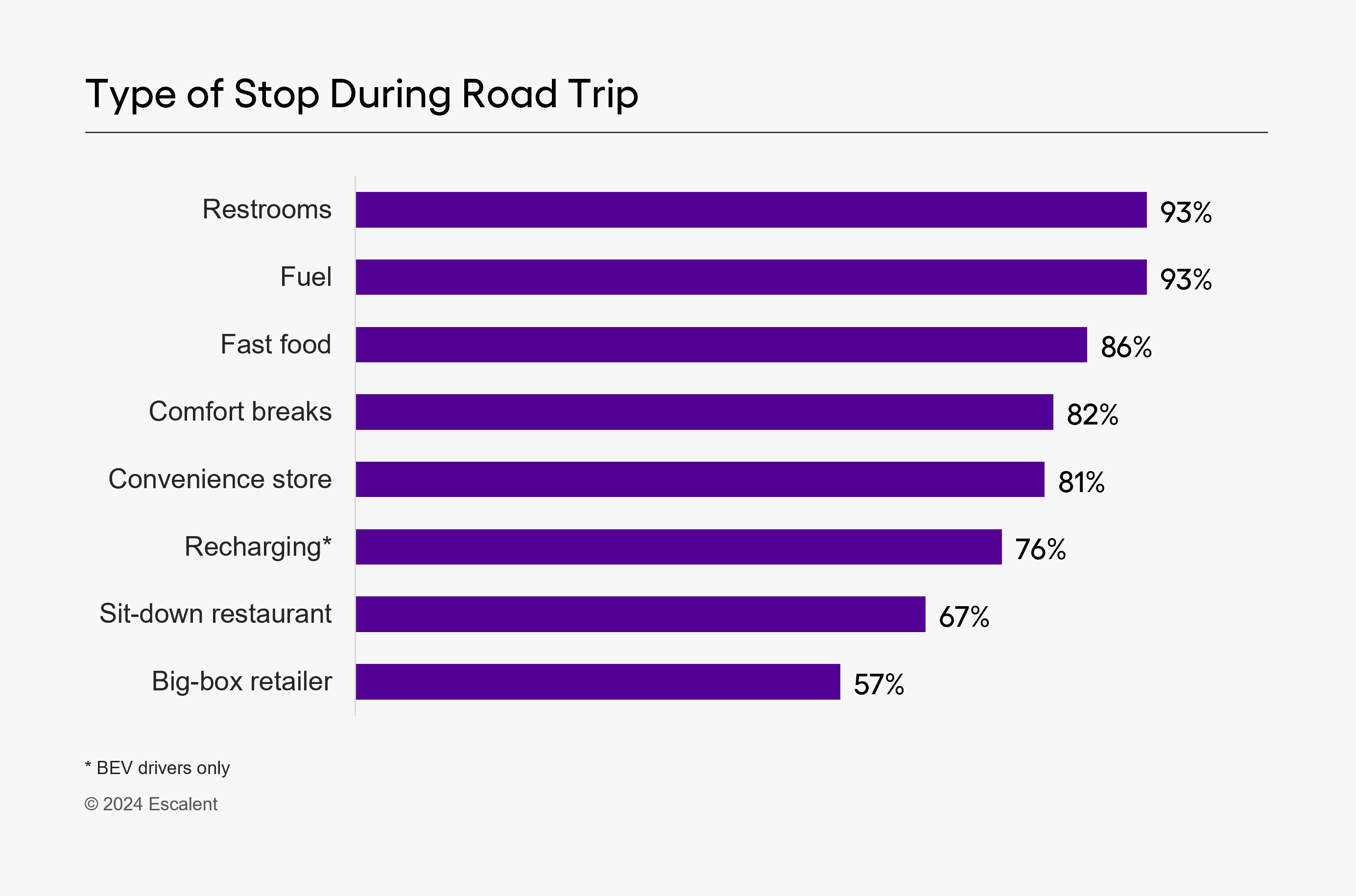

Few drivers (4%, to be precise) approach a road trip by driving straight from their origin to their destination; the majority report making one to four stops during their trip. For most drivers, these stops last 10 to 20 minutes and most frequently consist of stops for fuel, fast food, fresh air, bathroom breaks, and getting up to stretch and walk around. While stops for fresh air are typically spontaneous, consumers are roughly split between preplanning for fuel and stopping spontaneously for fast food.

BEV drivers display different behavior, with nearly four in ten (38%) preplanning their recharging stops and a further one-quarter searching while en route for the best stop. As a result, retailers looking to attract traffic from BEV drivers need to adjust their strategy to ensure visibility in route planning software (e.g., Chargeway, A Better Routeplanner, PlugShare, Google Maps) and in-vehicle navigation. Furthermore, while decisions to stop for fast food are generally shared between the driver and passenger(s), 57% of BEV drivers say it was their decision alone about where to stop to charge.

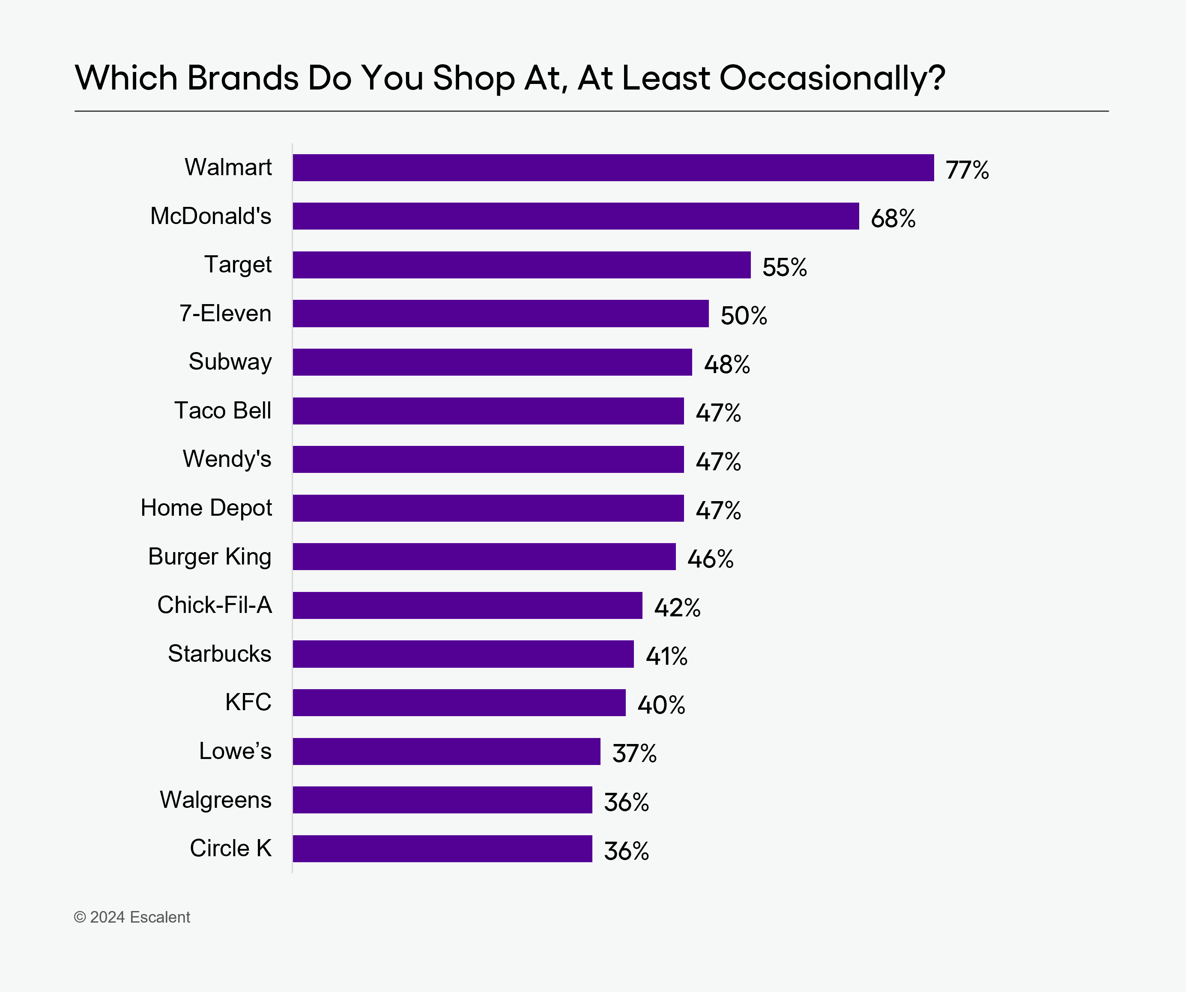

McDonald’s captures most (54%) fast-food stops, followed by Starbucks at 22%. Although Starbucks is a distant second, it punches above its weight since it’s tied for the fifth most-preferred fast-food restaurant overall. As a result, Starbucks may be well-positioned to capture increasing traffic from BEV drivers if it expands its current BEV charging pilot program nationally.

On the fueling front, 7-Eleven, Shell and Circle K captures most drivers’ stops. All three brands are actively building out BEV charging networks nationally and, thus, are well-positioned to defend their market share. One-fifth of BEV drivers say they have stopped to charge at a Shell Recharge station. Other fuel brands such as Chevron, Exxon Mobil and Speedway must act quickly on building out BEV charging networks to remain relevant in an increasingly BEV world.

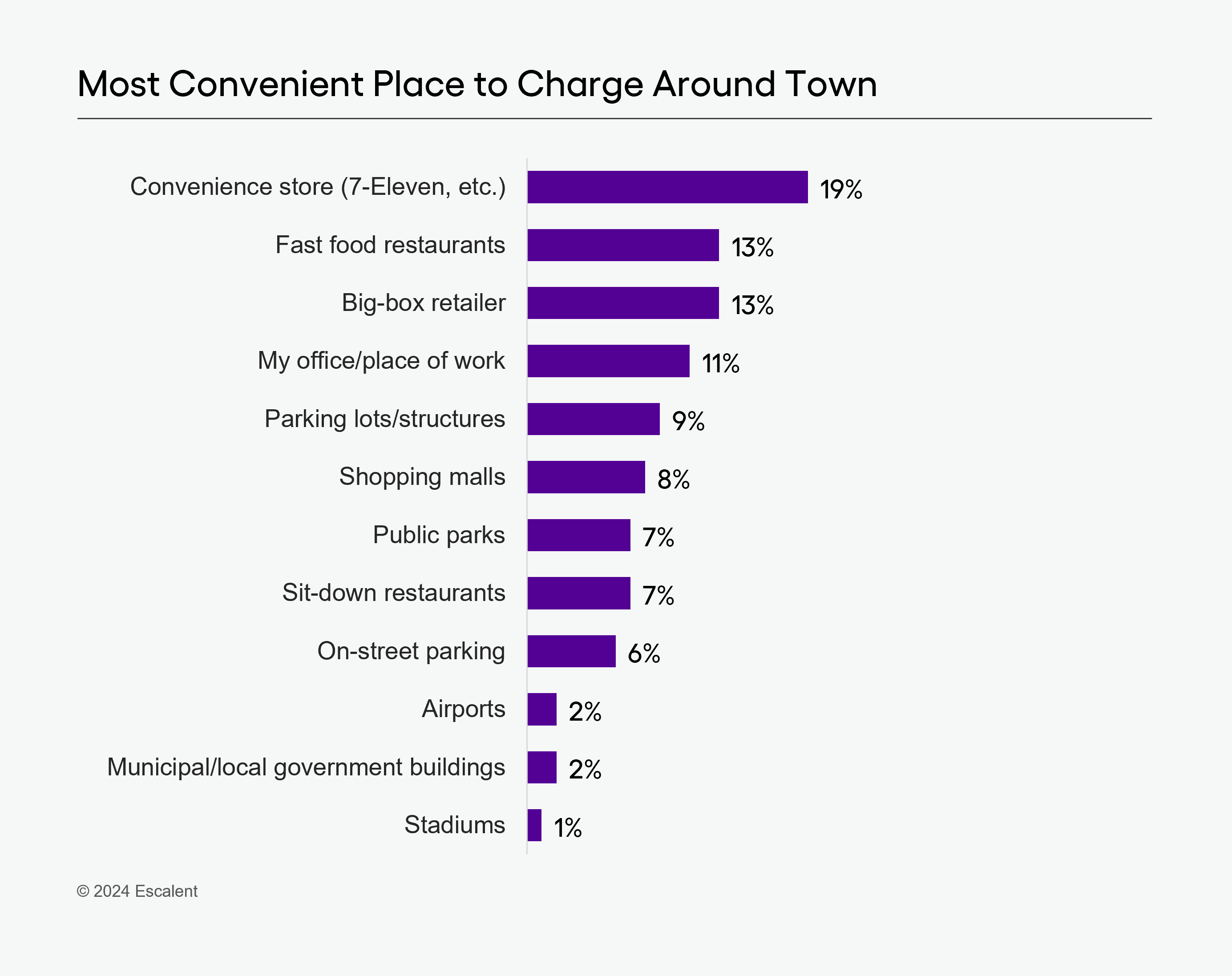

BEV Charging Around Town

Retail and QSR brands are featured heavily in BEV drivers’ most convenient places to charge around town and, therefore, have an opportunity to attract additional traffic as increasing numbers of drivers purchase BEVs. In fact, two-thirds (66%) of drivers say they’d be more likely to shop or dine at a business that has installed Level 2 electric vehicle charging; that number rises to 77% for businesses that have installed DCFC.

One way retailers can make BEV charging more “sticky” is to incorporate charging into their loyalty programs. Nearly half (47%) of drivers say they would be more likely to charge their BEV at a business that offered discounts on purchases while they charge, and a further 44% say they’d be more likely to choose a business that allows them to use their reward points to pay for charging.

BEV Opportunity Charging Likely to Increase Average In-Store Retail and QSR Purchase Amount

Nearly half (45%) of drivers say that, even if they didn’t need to charge their vehicle, if BEV charging was available at a business they visited, then they would spend more time in the store to allow their vehicle to charge more.

Customers spending more time in the establishment would likely result in a higher average purchase ticket, and the business impact of this kind of opportunity charging would be likely to accrue to those brands if, like Walmart, 7-Eleven, Starbucks and Circle K, they invest in BEV charging for their customers.

A New BEV World, New Opportunities for Retail, C-Stores and QSRs

Forward-thinking retail brands recognize the growing number of BEV drivers as an opportunity to grow their business through a combination of higher traffic (more BEV drivers patronizing the business) and higher average purchase ticket (BEV drivers spending more time in the establishment).

Join us on May 21, 2024, at 1 pm EDT for a webinar with further findings from this study and insights on how best to position your business for success in this new world. Click the button below to learn more and register for the webinar.

About the study

Escalent interviewed a national sample of 1,000 EV owners, EV Intenders, and used EV considerers ages 18 to 80 between August 22 and September 6, 2023. Respondents were recruited from the PureSpectrum opt-in online panel of US adults and interviewed online. As such, any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.