The cost-of-living crisis is taking a toll on every aspect of consumers’ lives, including utility costs. Consumers are facing higher monthly consumption costs that are outpacing wage growth, leading to 60% of adults living paycheck to paycheck as of January 2023. Rising prices are posing a challenge to the affordability of essential needs such as medical treatment, shelter, food and travel. Furthermore, as of August 2022, US consumers who are unable to pay their utility bills owed utilities more than $16 billion.

As a result, more than one-third of consumers have stopped or cut back on future savings while more than half have cut back on things that bring them joy, according to a new global study conducted by our sister brands, C Space and Hall & Partners, Value—Relationships Under Duress. Price sensitivity is at an all-time high and consumers are demanding more affordable goods and services and more value for each dollar they spend.

Concerns about the cost of living, the local political environment and the ability to work remotely are creating a shifting landscape as people look to move to more attractive states that better align with their economics, beliefs and lifestyles. As new residents mix with your existing customer base, having a deep understanding of the economic conditions and headwinds your customers are facing is more important than ever. This knowledge is critical to ensuring you can meet your residential customers’ evolving needs and expectations, while building trust and driving overall satisfaction.

In this blog, we cover the major points to consider as you seek to better understand your residential utility customers and how Escalent’s Macroeconomic Landscape Insights Assessment can make the process easier.

Populations Are Shifting Due to Macroeconomic Variables

In many states, the population is notably shifting, with Texas, California, Florida and Tennessee being prime examples. Post-COVID-19, many in the workforce can work remotely, making it much easier to move and work in places with lower taxes, lower cost of living and better weather.

A polarized political environment is also pushing consumers out of or into certain regions. Think of the influx of Californians moving to Texas for a “freer” and less regulated environment.

While the economy appears to be bouncing back overall, inflation and higher costs continue to drive migration. For example, some Californians and New Yorkers are moving to Florida for lower cost of living and fewer taxes.

Many utilities may not have a good handle on just how much their residential customer base has shifted, leading to a potentially costly blind spot. Gaining a clear sense of who the current customer base is, and is projected to be, is critical in understanding customer wants, needs and expectations and in ensuring the utility is properly positioning itself to address these needs.

Consumer Perceptions Are Evolving as a Result of the Cost-of-Living Crisis

No matter where consumers live, volatile economic conditions affect the way consumers view utilities. For example, if consumers see all their household bills increasing, then it will feel relatively more difficult to pay utility bills and consumers will become frustrated, even if utility rates don’t change.

When people move to a new state, they bring their prior experiences and perceptions with them, which means the views of your customer base are changing. For instance, we have found in our studies that those who move from states with a higher cost of living to more affordable states are more positive toward utility rates and see greater value in the service provided.

By understanding why people are moving into the state and your service area and why they left their prior state, you can get a better grasp on the economic conditions that are causing your customers stress and take appropriate action to ease their concerns.

How The Macroeconomic Landscape Insights Assessment Can Help

The Macroeconomic Landscape Insights Assessment explores how economic factors and migration patterns are impacting your residential customer base. The report provides detailed analyses of current and projected economic conditions in your state(s) and service area(s) as well as an estimation of migration patterns of consumers in and out of the areas in which utilities operate.

The Assessment provides a framework for utilities to understand their customers more deeply, especially given recent shifts in populations and customer expectations. It provides more context and highlights external factors that impact how customers are perceiving a utility, the value of a utility’s services, changes in rates, and customers’ trust in the utility.

With insights from the Macroeconomic Landscape Insights Assessment, you can:

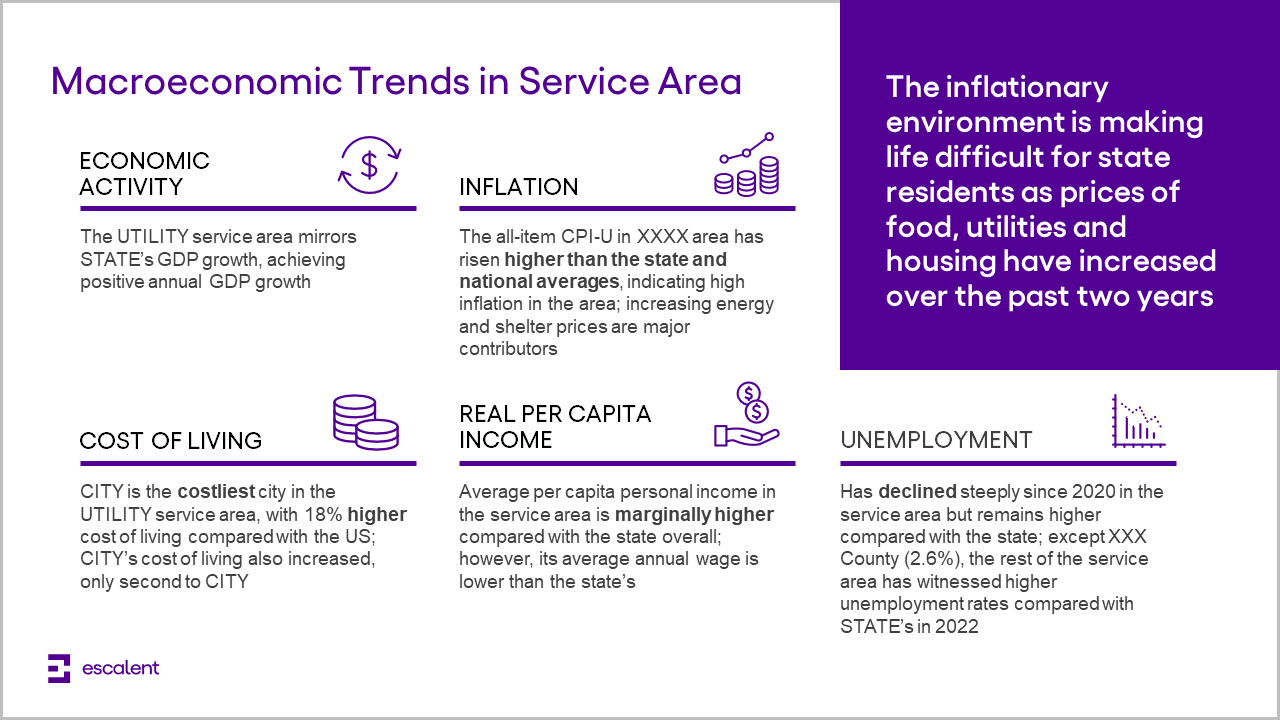

Gain macroeconomic visibility: Learn how inflation, unemployment, housing prices, consumer pricing and other macroeconomic factors are impacting state residents and, more specifically, your residential customers. In this sample assessment, you can see how residents of this state or service area are challenged by macroeconomic trends such as slow economic growth, high inflation and rising cost of living.

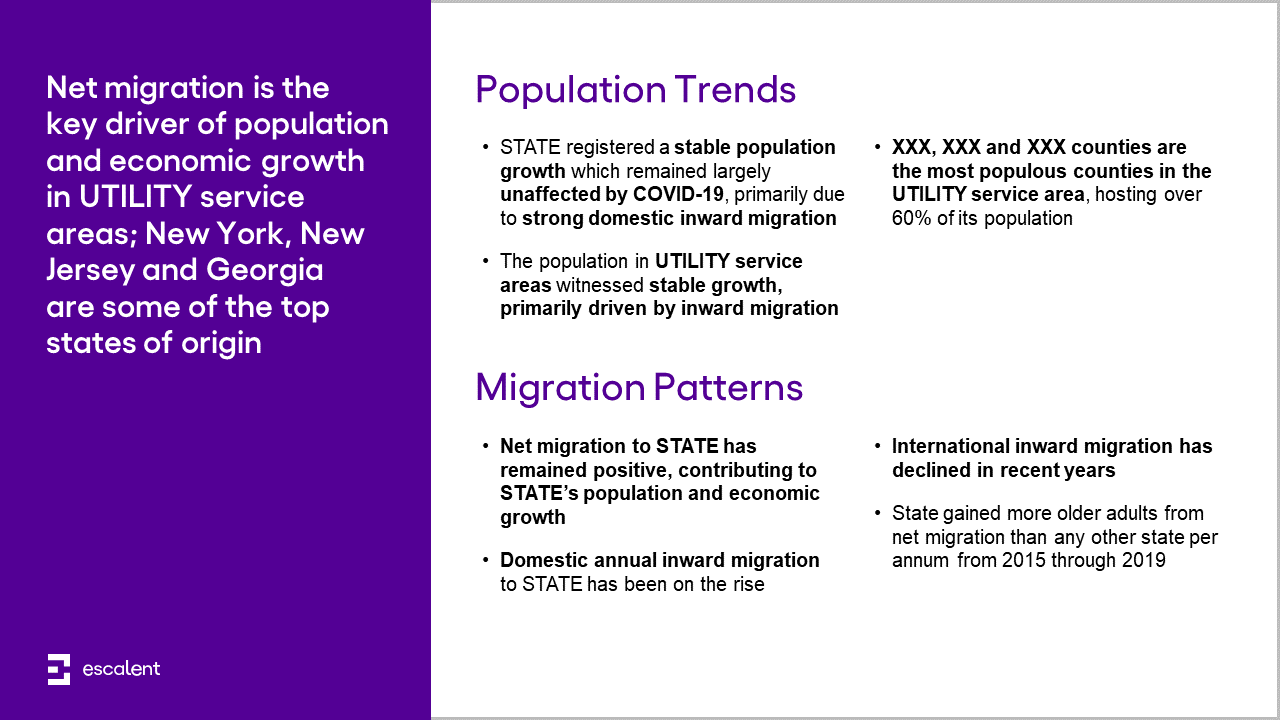

Identify migration patterns and population characteristics: Understand migration patterns of residential customers, including where your new customers are coming from and why, as well as which customers are most likely to leave and why. Receive population characteristics of your new residential customers, such as age distribution, education levels, income levels and utility rate comparisons to better understand who they are and how to meet their expectations.

In this sample assessment, you can see population trends and migration patterns of state residents and customers over the past several years, as well as new customers’ key characteristics.

Take the Next Steps to Understanding Your Residential Customers and Fulfilling Their Needs

Know your customers and their expectations: Your residential customer base has changed and continues to change. Furthermore, the cost-of-living crisis is causing consumers to reevaluate how brands serve them, their families, their communities and their world. It is imperative to deeply understand who your new residential customers are and how you can meet their expectations.

Consider macroeconomic variables: Gain visibility into how inflation and other macroeconomic factors are impacting state residents and your residential customers more specifically. This will help you put yourself in your customers’ shoes and develop empathy for your customers’ wants, needs and challenges.

Get to know migration patterns: Understand where your new customers are coming from and why, as well as which customers are most likely to leave and why. This will help you determine how to modify or enhance your services as well as improve your communication strategy to ensure you meet your customers where they are.

Stay relevant in consumers’ lives: As prices continue to rise, along with consumer uncertainty, it’s important for utilities to demonstrate reliability and resiliency to build consumer confidence. Utilities should also offer programs and services to help consumers take control of their energy use and save money. Actions like these will lead to greater satisfaction and brand trust.

If you’d like to better understand your residential customers’ needs with insights from The Macroeconomic Landscape Insights Assessment, reach out to talk with one of our Energy experts.

Want to learn more? Let’s connect.