Prevailing wisdom in the asset management industry holds that growth in environmental, social and governance (ESG) investing is being fueled by institutional investors. In fact, the 2020 Report on US Sustainable and Impact Investing Trends* stated that, of the $16.6 trillion in assets to which money managers apply ESG criteria, $12.0 trillion (72%) was managed on behalf of institutional investors and $4.6 trillion (28%) on behalf of individual investors. Yet recent insights from Cogent Syndicated suggest that the balance of power may soon be changing.

Last fall we surveyed over 700 financial advisors and 2,000 affluent investors to gauge their interest in ESG investing and assess the extent to which their perceptions had changed over the past year. We found that ESG investing is permeating through the financial advisor community, growing in use and prominence as information on performance-boosting alpha and long-term benefits of ESG strategies becomes more widely available. And while few affluent investors currently use ESG investments, nearly half (47%) report strong interest.

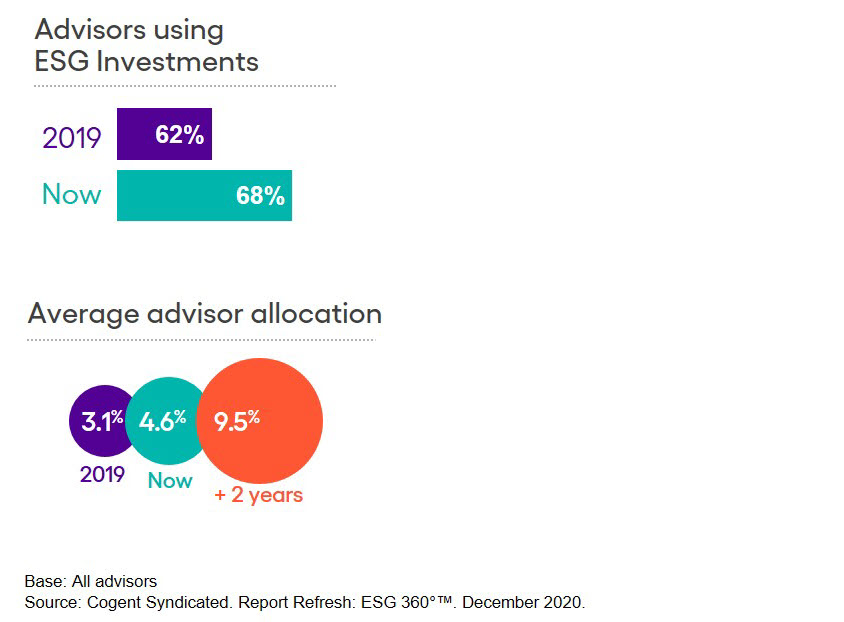

More than two-thirds (68%) of advisors are now using ESG investments, up from 62% in 2019. The average advisor allocation to ESG investments is currently at 4.6%, up significantly from 3.1% a year ago. Overall, advisors project the level of AUM allocated to the category to climb to 9.5% two years from now. Importantly, advisors younger than 45 expect their allocation to ESG investments to nearly triple in two years, from 4.8% to 11.2%.

Affluent investors using ESG direct nearly half (49.2%) of their assets to the category and expect their allocation to grow to nearly 60% two years from now. Meanwhile, likely adopters appear a bit more cautious, anticipating an average allocation of 23.4% in two years’ time.

Perhaps most poignant, younger affluent investors, particularly Gen Xers, feel strongest about the importance of customization in ESG strategies. In fact, one-quarter (24%) of Gen X investors consider it extremely important for an investment manager to personalize or customize an ESG investing strategy to their specific interests. Savvy asset managers will recognize this need and shift their ESG product strategies from the disclosure-heavy requirements of institutional investors to more nimble, flexible and scalable offerings that can be tailored to the interests of individual investors.

Want to know more about trends in ESG investing? Given the dramatic changes the industry and the world are experiencing, our new Report Refresh: ESG 360° study uncovers how the opinions, attitudes and behaviors of affluent investors and financial advisors are changing with regards to ESG investing. These fresh insights enable asset managers to more effectively position their ESG offerings to meet evolving and growing demand. Send us a note to learn more.

* Source: Report on US Sustainable and Impact Investing Trends, US SIF Foundation, November 16, 2020