As advisors strive to serve more affluent clients, there’s been a slowdown in growth for third-party model portfolios as advisors remain more reliant on models available through their home office. Fewer advisors expect to increase their use of model portfolios over the next year as concerns about underperformance, lack of control over customization, limited fund options and perceived high fees continue as barriers to use. Yet advisors serving affluent clients plan to significantly boost their allocations to separately managed accounts (SMAs), highlighting an area of growth opportunity.

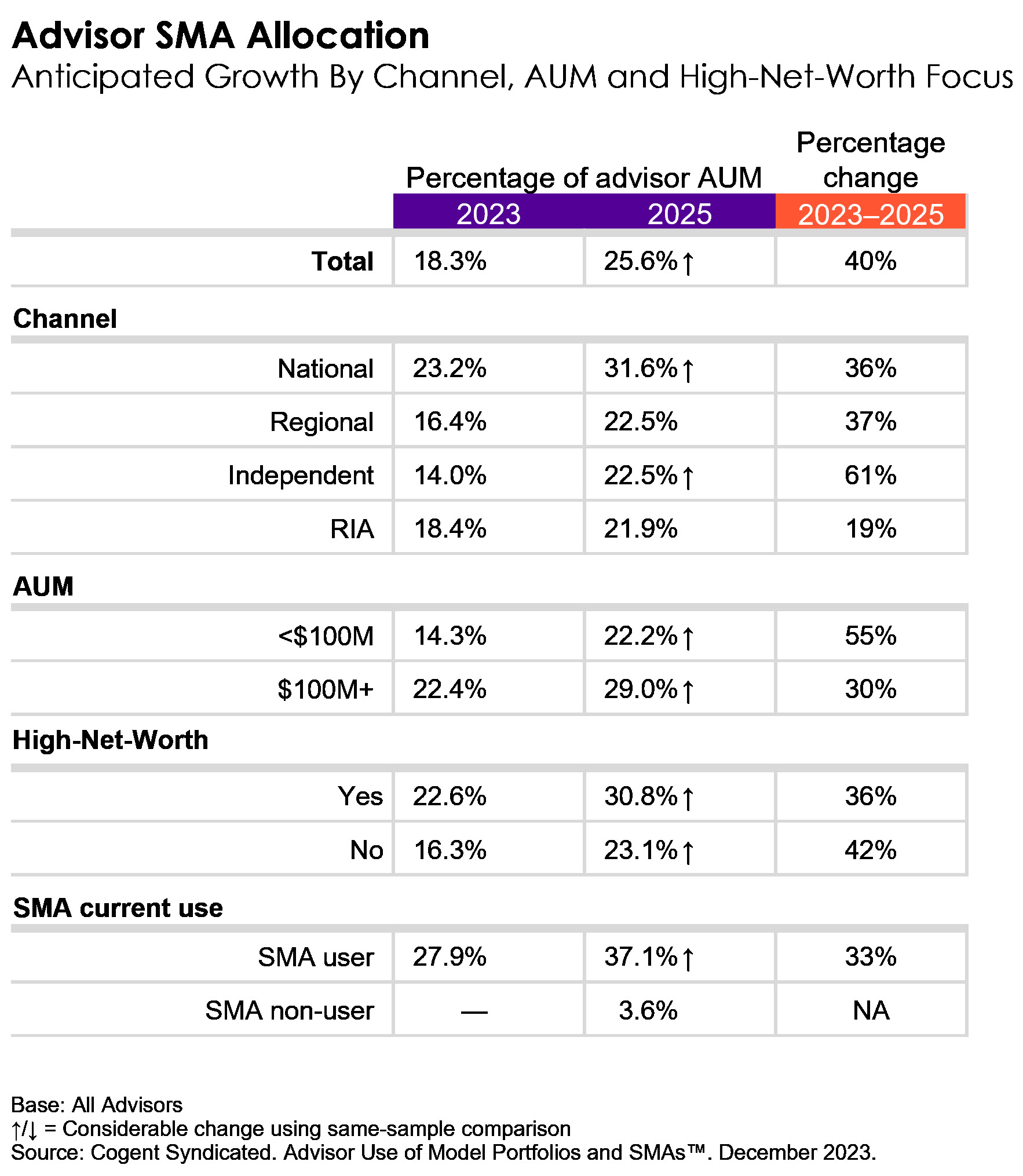

Cogent Syndicated’s annual Advisor Use of Model Portfolios and SMAs™ report, published last month, examines the competitive landscape for third-party model providers and asset managers. This year’s report finds that while growth has stalled for advisor use of model portfolios, SMA allocations are forecast to grow from 18.3% today to 25.6% two years from now. Growth is being fueled across advisor channels and AUM levels as options for customization proliferate. Advisors focused on serving high-net-worth clients expect their average allocations to SMAs to reach a striking 31% by 2025, up from 23% currently. As a result of increasing interest in the SMA category, six asset managers achieve significant increases in unaided consideration.

To encourage broader consideration and use of model portfolios for their high-net-worth clients, advisors suggest that providers highlight the quality and breadth of investment options (including access to alternative investments), demonstrate value for the money, and offer ways to provide more customization/personalization for increasingly sophisticated clients, including tax efficiency. Providers should also communicate the support services available to advisors, including portfolio construction and best practice education on how to integrate third-party model portfolios into existing platforms. Notably, some model portfolio providers are succeeding better than others in meeting these needs, as brand consideration and use are distinct among high-net-worth-focused advisors.

The Advisor Use of Model Portfolios and SMAs report includes more information on differences in brand perceptions and use for leading model portfolio providers and SMA managers. To learn more about the full report and how your firm can leverage our data to build your business, click below.