The double whammy of rising interest rates and an uncertain economic environment, while causing havoc in many industries, has created a boon for annuity providers and producers. According to LIMRA’s US Individual Annuity Sales Survey, total annuity sales were up 21% in the first nine months of 2023 compared with last year. Moreover, LIMRA is forecasting continued growth for individual annuity sales in 2023, with the potential to surpass the record sales set in 2022. But just how long can annuity sales keep growing? And what will happen when interest rates, inevitably, start to come down?

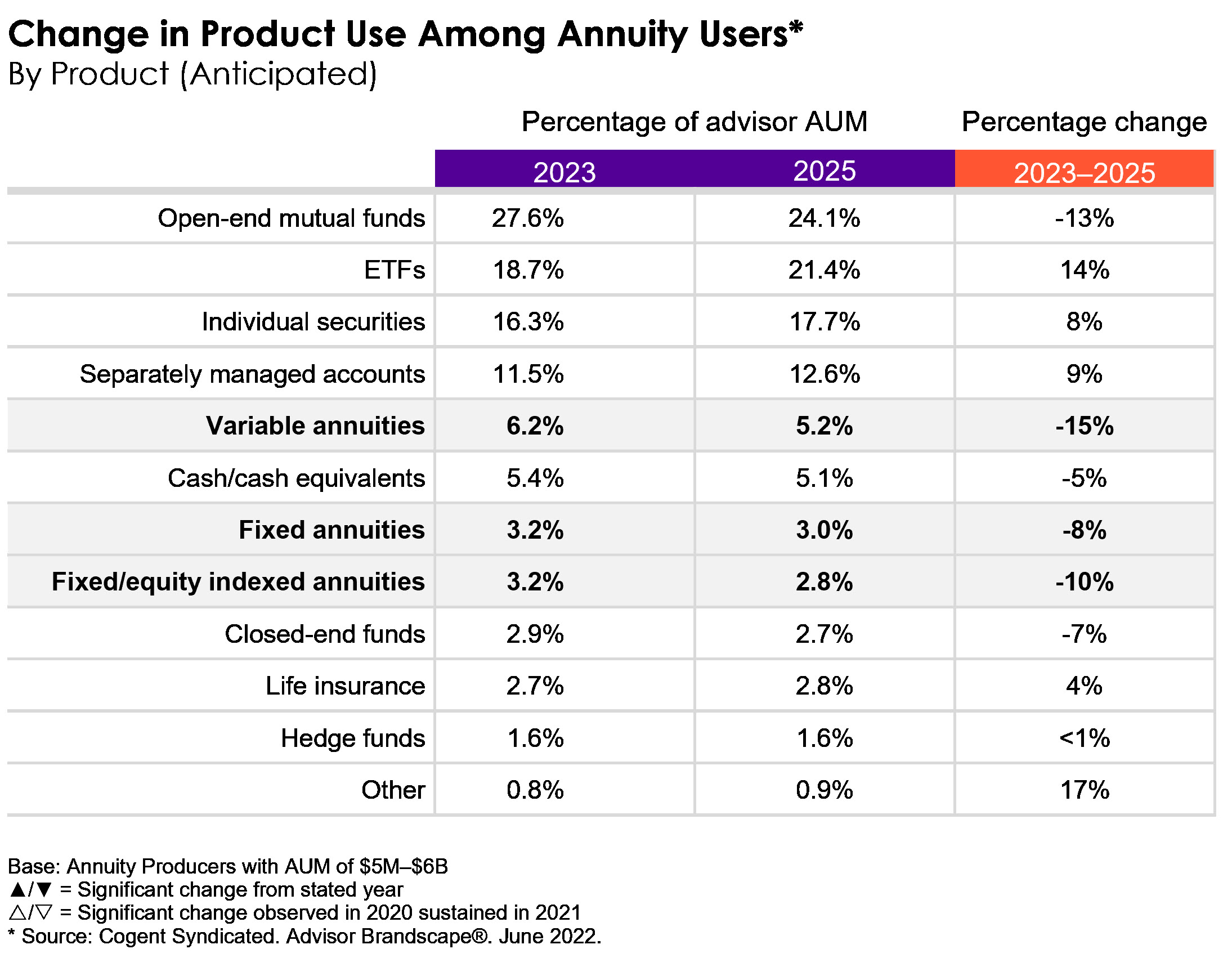

Despite record sales to date and rosy predictions for continued growth, our latest Annuity Brandscape™ report found that annuities are poised for a substantial decrease in advisors’ overall allocation. In fact, annuity producers anticipate double-digit declines in their allocations to variable and fixed indexed annuities in the next two years, with a corresponding increase to ETFs and individual securities.

Creating Need and Overcoming Skepticism

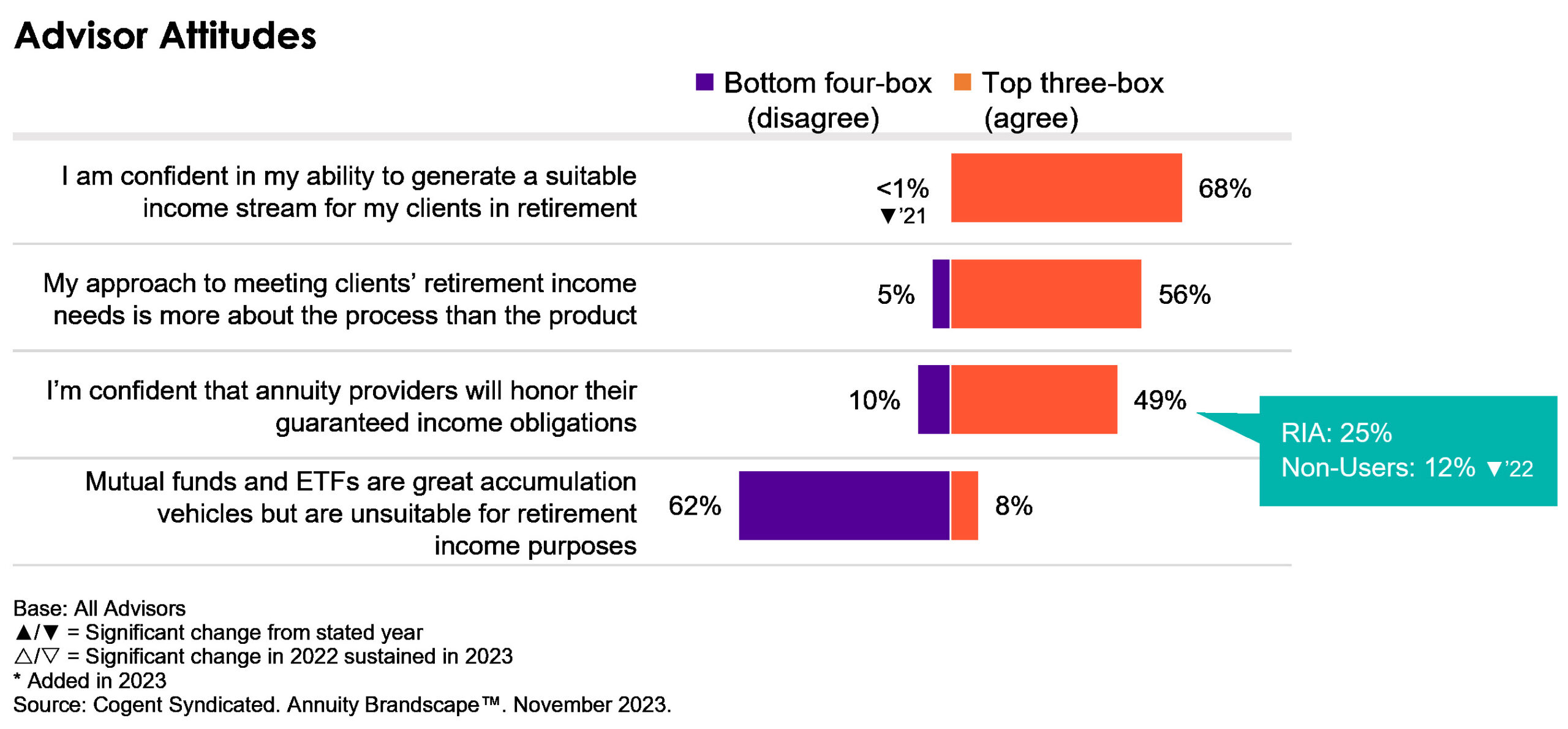

Advisors pride themselves on their ability to match suitable investment products to their clients’ objectives. Nearly seven in ten advisors are confident in their ability to generate a suitable retirement income stream for their clients and more than half say their approach to meeting clients’ retirement income needs is more about the process than the product. Along the same line, just over six in ten advisors disagree with the premise that mutual funds and ETFs are great accumulation vehicles but are unsuitable for retirement income purposes. These strong sentiments present significant challenges for annuity providers in convincing advisors that there’s a place for annuity products in their clients’ portfolios.

Perhaps more concerning, just one-quarter of RIAs are confident insurance providers will honor their contractual obligations. It’s no wonder that more than six in ten (62%) advisors who do not sell annuities are RIAs, directionally up from 52% a year ago. Moreover, only 12% of annuity non-users report such confidence, down significantly from 29% a year ago. These signals of increasing skepticism need to be faced head-on if annuity providers hope to expand the base of producers selling their products.

Making the Case for Annuities

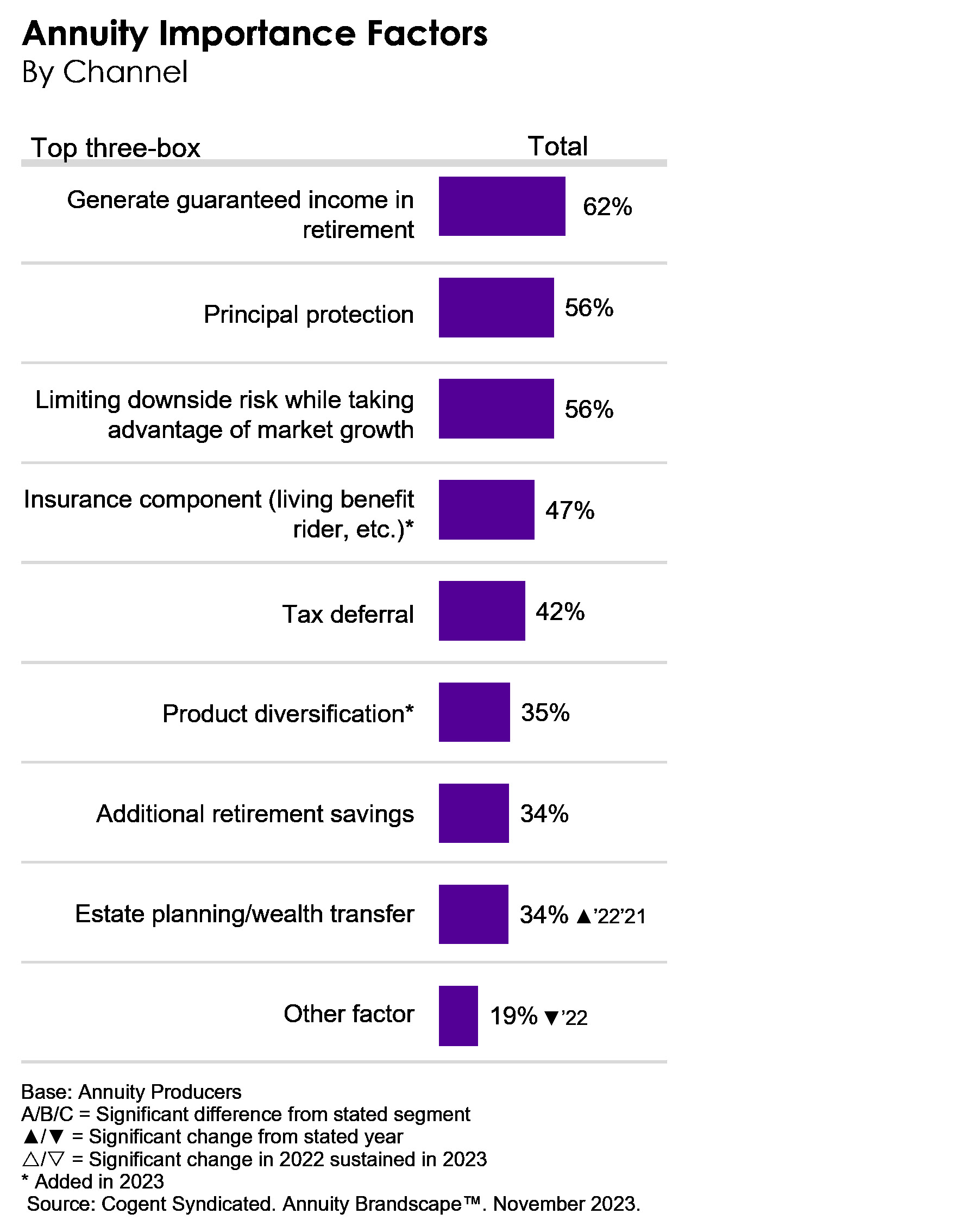

In an economic environment that will likely turn more volatile in the upcoming presidential-election year, annuity producers point to several risk-mitigation strategies that can serve as motivating factors for offering annuity products. While offering peace of mind of a guaranteed income stream is important for many, more than half of all annuity producers and six in ten Regional-Independents—who represent the largest proportion of annuity users—value protecting clients’ principal and limiting downside risk. In addition, more annuity producers see the value in offering annuities to support estate planning/wealth transfer (34%, up from 21% in 2022 and 25% in 2021).

Following a record sales year in 2022, annuities are poised to capture an even greater slice of investors’ dollars as they seek stability in their portfolios. Yet the rising tide is not necessarily lifting all boats, as annuity providers find themselves in an intense competitive battle for advisors’ attention. With equal attention to the message as well as the product features and compensation structure, providers can set themselves up for continued success.

Cogent Syndicated’s Annuity Brandscape report provides a holistic view of the annuity landscape including product use, drivers of consideration and user experience, and tracks more than 40 annuity providers in the areas of brand equity, differentiation, penetration and loyalty. Click below to learn more.