Editior’s Note: Cogent Syndicated’s annual US Institutional Investor Brandscape has just published – read on for a sneak peek at the introduction to the report.

By looking at the numbers, one would think that 2023 was a banner year for institutional asset managers. While much of the year was plagued by rising inflation and stock market volatility, the fourth quarter brought the “everything” rally in which global stock markets surged, bond yields dropped (effectively erasing year-to-date losses), and the Federal Reserve signaled potential rate cuts in 2024 amid easing inflationary concerns—all of which strengthened institutional portfolios.

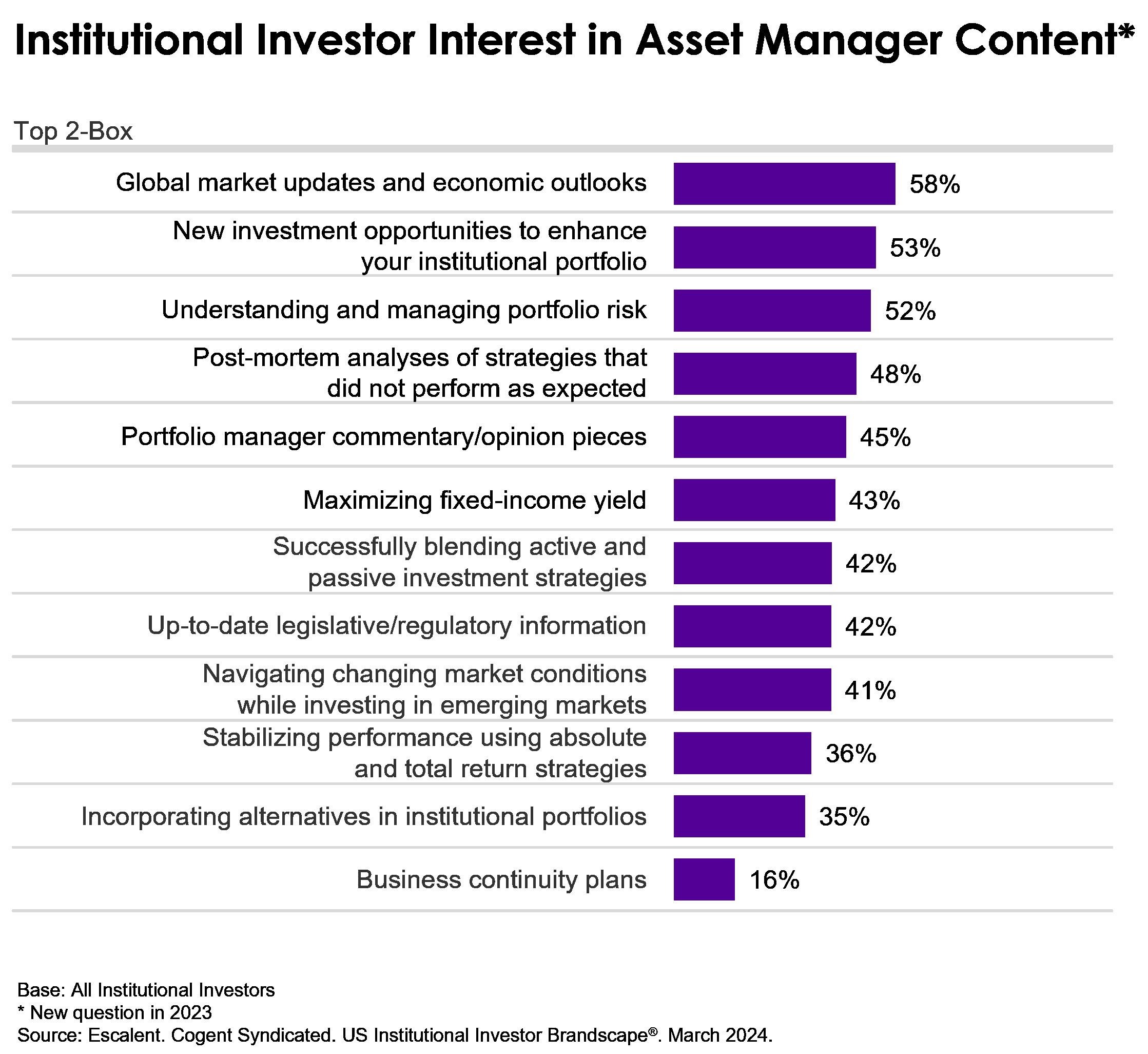

Yet institutional investors are not content with these short-term gains and are demanding more from their asset manager relationships. Many continue to seek opportunities that drive higher returns, drive higher yields and reduce costs. They are often turning first to incumbent asset managers for solutions that are easier and more efficient to integrate with minimal disruption. At the same time, institutional investors’ appetite for knowledge, particularly related to global market updates, economic outlooks, new investment opportunities and managing portfolio risk, continues. This adds pressure on asset managers to not only deliver solid investment returns but also practical, insightful market perspectives.

With data indicating a preference among institutional investors for consolidation of their asset manager relationships along with evidence of the largest asset managers broadening their capabilities in new asset classes or new markets, the growth path facing less-established firms is becoming increasingly steep. Yet an undercurrent of unmet needs among institutional investors suggests opportunity for challenger brands that can demonstrate a unique ability for partnership and collaboration, supported by specific asset class expertise.

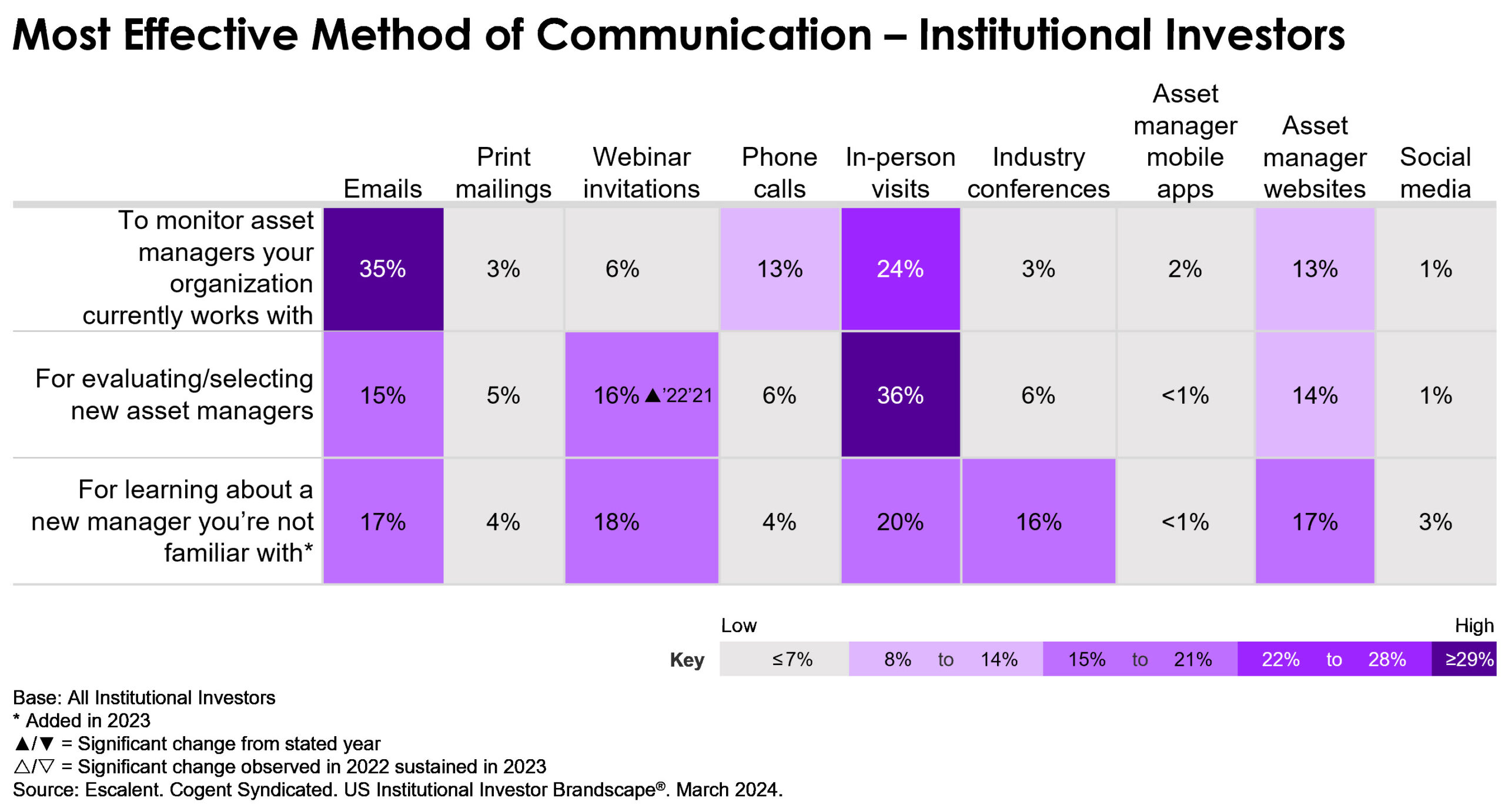

Reaching the institutional investor audience with the optimal combination of outreach and content is an area in which many firms struggle. While many are understandably tempted to leverage digital mediums such as social media, websites, emails and webinars, our data suggest that in-person interactions are by far the most impactful for prospective managers to increase their consideration potential. But it is just as important for asset managers to reinforce existing relationships with the appropriate balance of optimal contact frequency and valuable content.

To aid institutional asset managers in defining their value and finding their voice, we present our annual review of the US institutional market, examining key investment trends and anticipated behaviors of investors overseeing defined benefit pensions, non-profits, defined contribution retirement plans and insurance company general accounts, along with a comprehensive competitive analysis of more than 50 leading institutional asset managers. Our goal, as always, is to help firms understand the marketplace, define their place in it and identify their best opportunities to compete.

For more information on the full report, click below.