The trend toward working remotely has been accelerated by the pandemic, with many companies embracing the change for the long haul for their employees. Tech giants Twitter and Square have reported that the option to work from home would be a permanent one regardless of when the pandemic ends.

Many articles have outlined employees’ preference to work from home (WFH) now that they have experienced it for an extended period. Escalent wanted to know how many workers expect to work from home permanently and how that impacts the telecom landscape. We recently conducted a study among 1,432 consumers, asking them about the impact of COVID-19 on their telecom needs, how brands are responding to the pandemic, and the subsequent impact on their loyalty and switching behaviors. We found some interesting patterns regarding consumer perceptions of the telecom brands and what drives their behavior, particularly with respect to the evolution and prospect of 5G.

WFH: Does This Change Consumer Behavior?

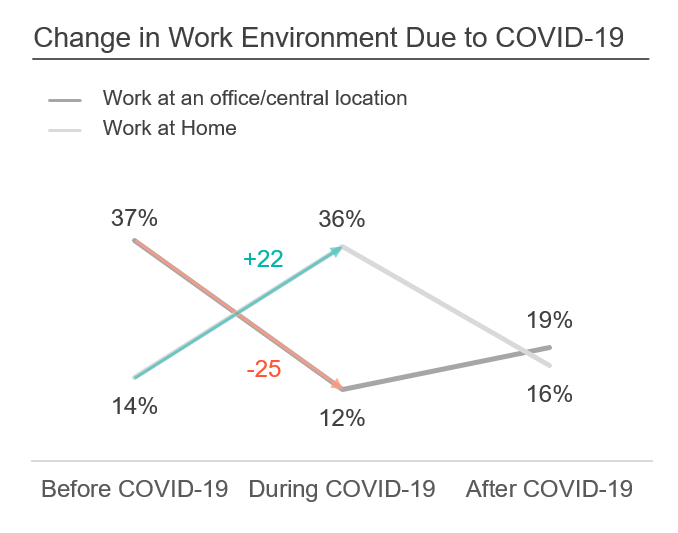

According to our study, 25% of employees have moved from an office or central location to their own home office when the pandemic hit. And, when asked if they will return after COVID-19 restrictions lift, 19% of all workers say that they will go back to the office—which is down from 37%.

The impact on the wireless sector is significant, as out of those who are working from home since COVID-19 hit, four in ten have purchased a new smartphone. As this remote-office trend continues and becomes the mainstay, hotspot wireless capabilities and data speeds and consistency will continue to drive consumer behaviors. Speed and reliability have become even more crucial to maintain and improve, as consumers will be relying more on their own personal broadband’s bandwidth rather than the corporate, commercial-grade bandwidth in their company offices.

Churn: Clues to Future Consumer Demands

Less than four percent of consumers have switched wireless carriers during the pandemic. But of those who did, half have reported switching due to unlimited tethering and the need for reliable hotspots, while over one-third report their new carrier provided unlimited data and voice, which speaks to the increasing needs for service and signal that can stand a heavy load on a prolonged basis.

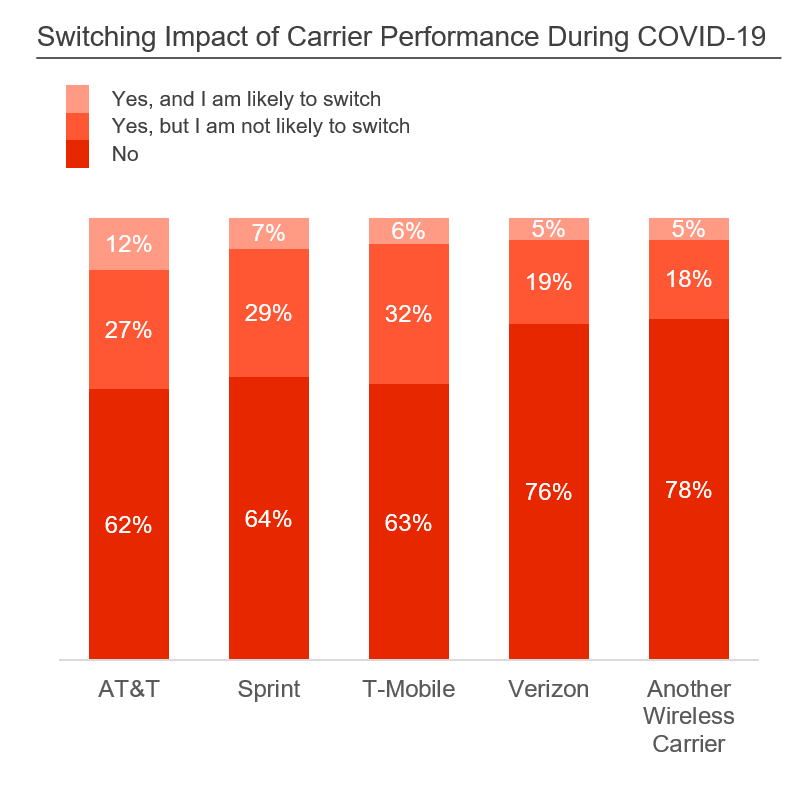

When looking forward six months—comparing consumer intent among AT&T, Sprint, T-Mobile and Verizon—AT&T should take note as it has the most consumers who are likely to switch, while Verizon’s customers show the highest level of loyalty and lowest likelihood to switch.

It will be particularly important to keep an eye on switching behavior as we continue to deal with the ups and downs of the pandemic. Lives are changing regularly and telecom companies need to support a full household that demands stable, reliable use of data for long stretches of time. Brands will want to watch their loyalty levels and adjust accordingly. Something to watch closely is what happens when the offers that providers were so generous to pay forward to customers come to an end. Each provider took steps to aid consumers at the start of the pandemic with additional data packages and no late fees or cutoffs for nonpayment, so customer sentiment and behavior may change if these perks are pulled back too soon or abruptly.

Loyalty: Why Customers Are Staying With Their Telecom Provider

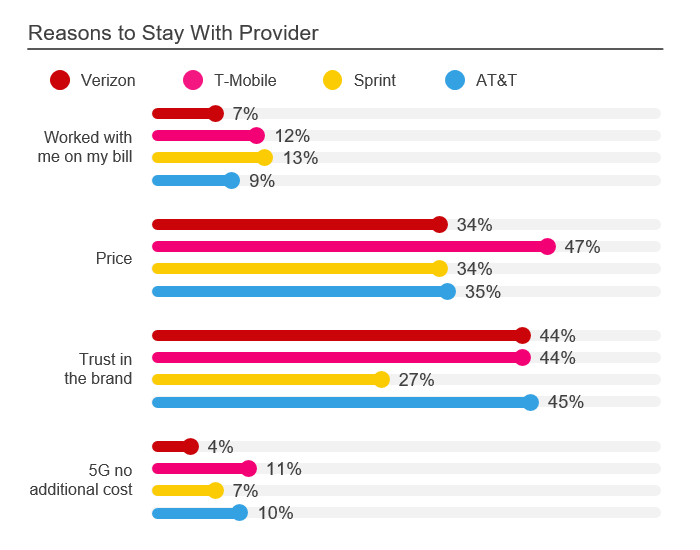

Perhaps the most compelling findings from our research are the reasons consumers are staying with their provider during the pandemic. It comes down to:

- Price: T-Mobile wins for best pricing strategy. Customers list price as their reason to stay with T-Mobile significantly more than for any of the other providers, including newly acquired Sprint—another “value” provider. Additionally, T-Mobile and Sprint are recognized more often than other providers for working with their customers on payments when the pandemic hit. This indicates the level of providers’ willingness to work with consumers as well as the varying financial needs of the different demographics of providers’ customer bases—AT&T and Verizon customers report higher income and employment compared with Sprint and T-Mobile customers.

- Trust: While AT&T, T-Mobile and Verizon score similarly in trust, Sprint’s reputation continues to erode even after its merger with T-Mobile as only 27% cite trust as a reason to stay.

- 5G: For the first time, we find that 5G has a lot of pull for consumers despite most consumers not yet having access to the technology. Compared with Verizon at only four percent, T-Mobile’s customers (11%) cite significantly more often that their provider will offer 5G at no additional cost when it is available in their area.

We should note that the impact of 5G may be more of a combination of pricing and trust than a 5G factor since most consumers don’t have 5G yet. But, different 5G pricing approaches have made a big splash. While T-Mobile promises not to charge for 5G, Verizon initially added a surcharge. Despite Verizon walking back the surcharge, consumers are still holding a grudge which has negatively impacted the perception of the brand. This puts T-Mobile in an increasingly better position with consumers as it relates to what they do when 5G is available in their area.

What’s Next for Telecoms?

The new world requires an evolved understanding of today’s and tomorrow’s wireless customer needs, which includes a significantly larger base of remote workers with potentially fewer resources. While pricing will always be important, consistent connectivity is vital—and is now more important than ever. Hotspot capability is becoming increasingly more important and even drives switching behaviors.

That said, it is important to stay on message while recognizing the needs of the consumer—needs that will continue to change among an evolving demographic.

Want more information on what we are seeing as COVID-19 disrupts how we work, play and communicate or need help positioning your telecom brand in the marketplace?