Connectivity plays a vital role in a fleet’s success: Companies rely on technology and software as the connective tissue to unite people, equipment and data in order to operate.

Connected services include telecommunications, internet, mobile devices, vehicle telematics solutions and customer relationship management systems, to name a few. On average, fleet companies use eight such services. However, integration between these products and services is proving elusive. That’s according to Escalent’s latest Fleet Advisory Hub™ report, which examines the state of connected services in fleet businesses and the overall ecosystem of connected fleet operations by going beyond take rates of vehicle telematics and vehicle-focused services.

There are significant benefits to connecting a fleet business via smart technology. But connectivity also raises a challenge: how to combine data from disparate systems across the enterprise—not only connecting the vehicles.

Connected Fleet Tunnel Vision

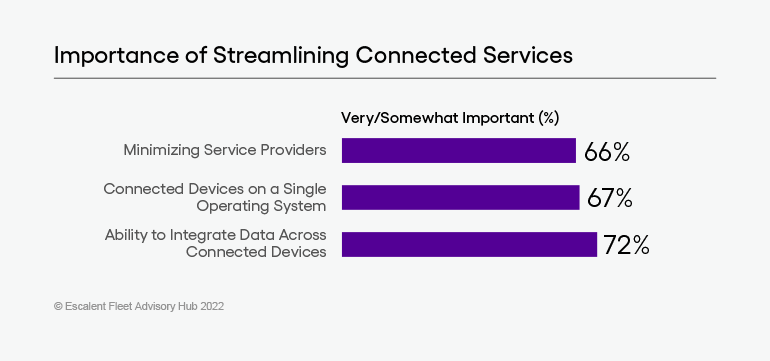

Decision-makers value simplicity. Seventy-two percent told Escalent that integrating data across connected devices was important. Meanwhile, 66% said they wished to minimize service providers, highlighting a potential weakness in the deployment of multiple connectivity solutions among fleet businesses. Even where telematic solutions are implemented effectively, fleets may miss the opportunity to integrate telematics data with the rest of the business ecosystem.

Education could be the key. Currently, 46% of decision-makers say they primarily learn about connected services through internet searches. Only 23% cited their manufacturer fleet representative—and 21% their telematics services provider—as a primary source of knowledge.

In a business built on relationships, service providers and vehicle manufacturers could be more involved in coaching fleet customers. In doing so, they would be better positioned to influence their customers’ path to purchase. These trusted advisors can ensure fleet decision-makers receive accurate and relevant information by inserting themselves into the learning journey. This can aid fleet decision-makers in “connecting the dots” across the broader enterprise.

Organizational Fleet Business Complexity

For fleets, convenience means ease of transaction and the ability to streamline solutions. That makes existing relationships and bundled or complementary systems particularly attractive.

To illustrate with an example, many fleet decision-makers told Escalent they either opted for telematics providers they had an existing relationship with or with manufacturers that had a telematics solution packaged with their vehicles. This is reflected in the dominant service providers. Verizon Connect is the most frequently used provider, with 32% indicating they use the company for telematics. AT&T follows at 27%, with Ford Pro at 17%.

However, the collaborative nature of enterprise-level decision-making adds complexity to the sales process. Sixty-two percent of participants said their company solicits input beyond a solitary decision-maker.

This creates a longer and more challenging cycle for sellers, who often need to convince multiple stakeholders that have different viewpoints and considerations. For example, representatives from human resources are likely to approach the process from a different perspective from those in fleet management.

Providers need to develop adaptable value propositions—and understand the business well enough to know who is responsible for the final decision.

Identifying Connected Service Differentiators

The technology used in connected services is evolving so quickly that it can be difficult for brands to do more than keep up. As a result, few have unique selling propositions across the competitive landscape.

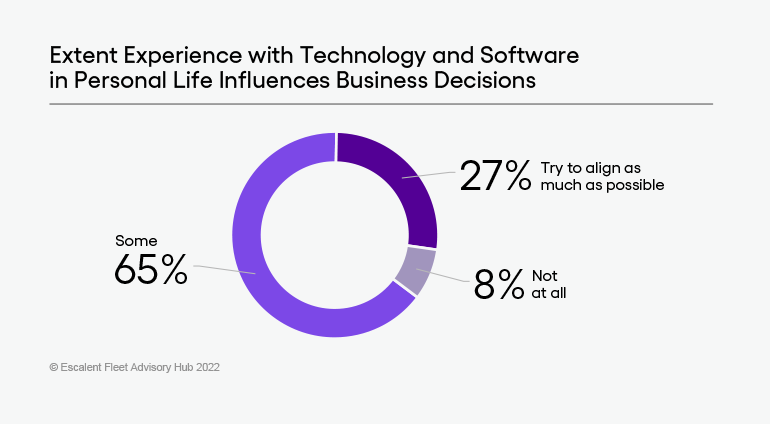

Without a clear understanding of how each connected service brand stands out, fleet decision-makers default to what they know. Two-thirds said personal experiences with technology or software somewhat influence their business decisions. Another 27% indicated they try to align personal and business technology as much as possible.

Beyond leaning on existing relationships, providers need to do more to differentiate themselves. This is particularly true for telematics providers.

Within the telematic solutions market, most brands use similar messaging and benefits, ultimately creating an even more obscure decision for fleet leaders. This could explain why marketing efforts are doing little to sway fleet decision-makers to work with specific providers. As a result, cost and convenience are the key criteria used to select a telematics provider over solution-specific benefit statements. There’s an opportunity for a front-runner to emerge by clarifying its messaging to inspire a diverse group of stakeholders or by becoming more specialized in particular areas of telematics and connected solutions.

Protecting Fleet Business Assets and Privacy

Personal experience with technology generates sales, but it also plays another role in business operations. One-third of companies using mobile phones and tablets said they allow employees to bring their own device to work. This poses a potential security threat to companies that are often unprepared for a data or security breach. Fewer than half of businesses use an antivirus or antispam service to protect workers’ devices, or even require employees to lock such devices with a password or similar mechanism.

Decision-makers agree that data privacy and security are essential. Despite this, many enterprises don’t have robust protections in place. This represents an additional chance for service providers to proactively participate in fleet customer education by helping to raise awareness and mitigate risk.

Beyond Singular Connected Fleet Solutions

Despite rapid technological advances, most fleet businesses are in the early stages of their digital transformation journeys. The lack of appropriate data protection is just one example of this. The sector is still grappling with integrating individual services across the broader business ecosystem.

Solution providers and vehicle manufacturers can play a role in bridging this gap. Many are eyeing opportunities to marry telematics to broader fleet management solutions through strategic partnerships or mergers. Others are already offering products that layer multiple connected services. Those who wish to differentiate themselves must keep pushing for greater connectivity—and find new ways to effectively communicate their benefits.

By looking beyond singular solutions, service providers and vehicle manufacturers can become stronger trusted partners to fleet businesses, helping decision-makers prepare their companies—and not just vehicles—for a connected future.

If you’d like to learn more about Fleet Advisory Hub, our findings and how we can help you refine your strategy and offerings to better meet the needs of fleet businesses, click the button below to send us a note.

About Fleet Advisory Hub™

The results reported come from our 2022 report on the ecosystem of connected commercial vehicle and fleet businesses and comprise a subset of commercial vehicle and fleet decision-makers drawn from the Fleet Advisory Hub audience. Participants were recruited from an opt-in online panel of business decision-makers and interviewed online. Escalent will supply the exact wording of any survey question upon request.