Real-life challenges aside, saving for retirement—as complicated as it can be—is relatively easy for those fortunate enough to have access to an employer-sponsored retirement plan. Target date funds and automatic plan features, for example, have inevitably created the “set it and forget it” mentality that exists across corporate America.

But how should retirees tackle the formidable drawdown years and start making plan withdrawals without outliving retirement savings? That’s an entirely different ballgame that even the most seasoned professionals have yet to solve for.

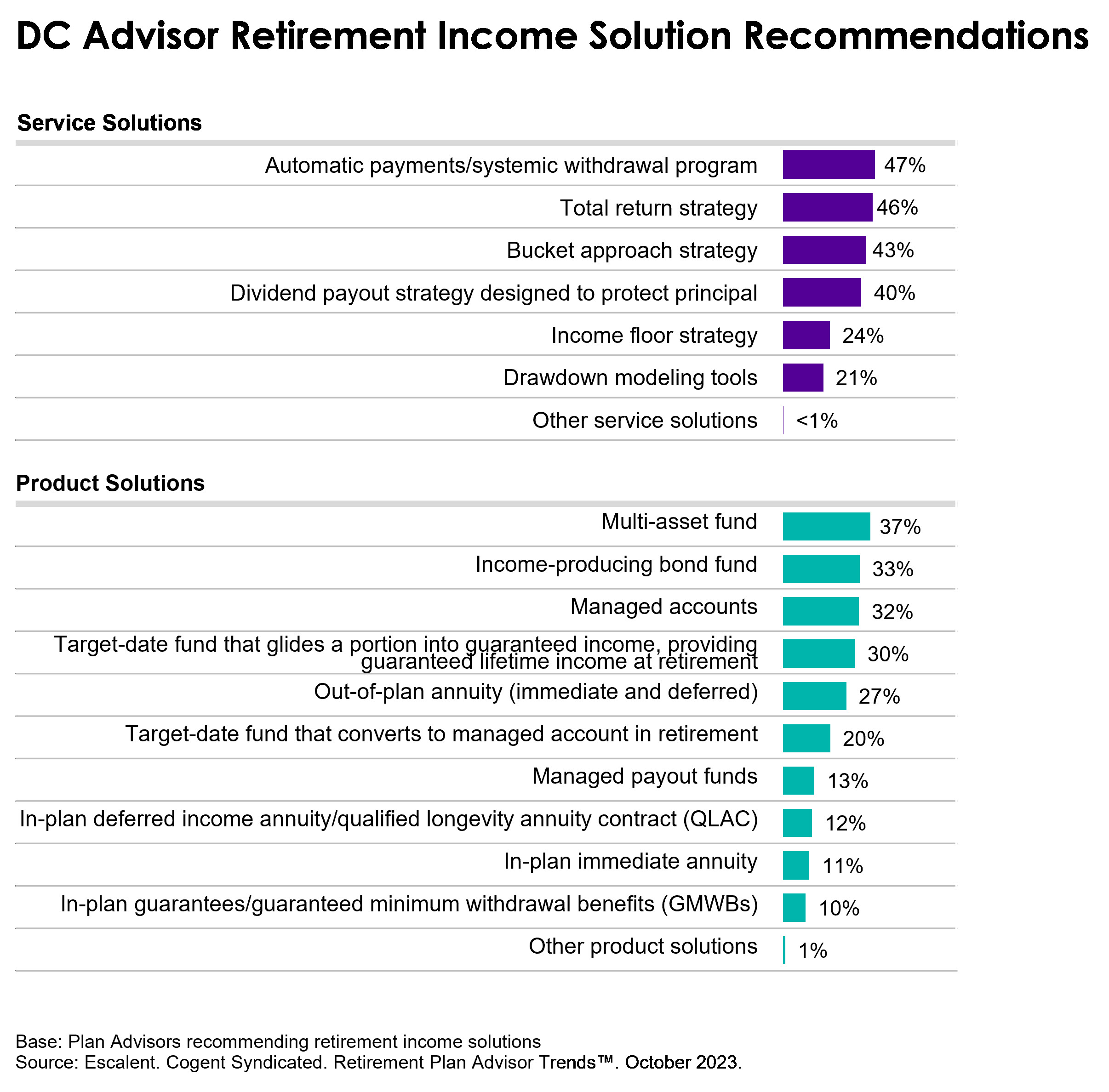

In fact, data from our latest Retirement Plan Advisor Trends report reveal DC advisors are relying on a myriad of service and product retirement income solutions to help participants traverse the decumulation phase. How and what solutions DC advisors are piecing together to provide cohesive strategies and solutions is evidence that continued industry innovation is needed.

Among DC advisors actively recommending retirement income solutions, four in ten rely on automatic payments, total return strategies, bucket approach strategies, and dividend payout strategies as the popular service solutions. Multi-asset funds, income-producing bond funds, managed accounts and target-date funds that glide a portion into guaranteed income are the most common product solutions.

Plan Sponsors Are Also Struggling for Suitable Solutions

These results align with our latest plan sponsor findings, which show plan sponsors grappling to find retirement income solutions that meet the needs of their respective participant populations. Per our 2023 Retirement Planscape study, fewer Large-Mega plan sponsors are offering retirement income solutions (49% vs. 61% in 2021), validating their struggle to identify the appropriate solution for their workforce.

For plan sponsors, systematic withdrawal programs are the most popular service-orientated solution, while managed accounts remain the most popular product solution. This year, in-plan immediate annuities edge out managed payout funds for second place, suggesting that plan sponsors are warming to the notion of including annuity products within their 401(k) plans as the SECURE Act intended to promote.

Demand Is Growing Among Participants

While DC advisors and plan sponsors are exploring the merits of different service and product offerings, many participants are doubting their future ability to convert their savings into real-life income in their retirement years. According to our latest plan participant research, just one in ten Gen Xers (10%) is extremely confident in their future ability to draw down assets in retirement, making them an ideal target for in-retirement income products and other types of support.

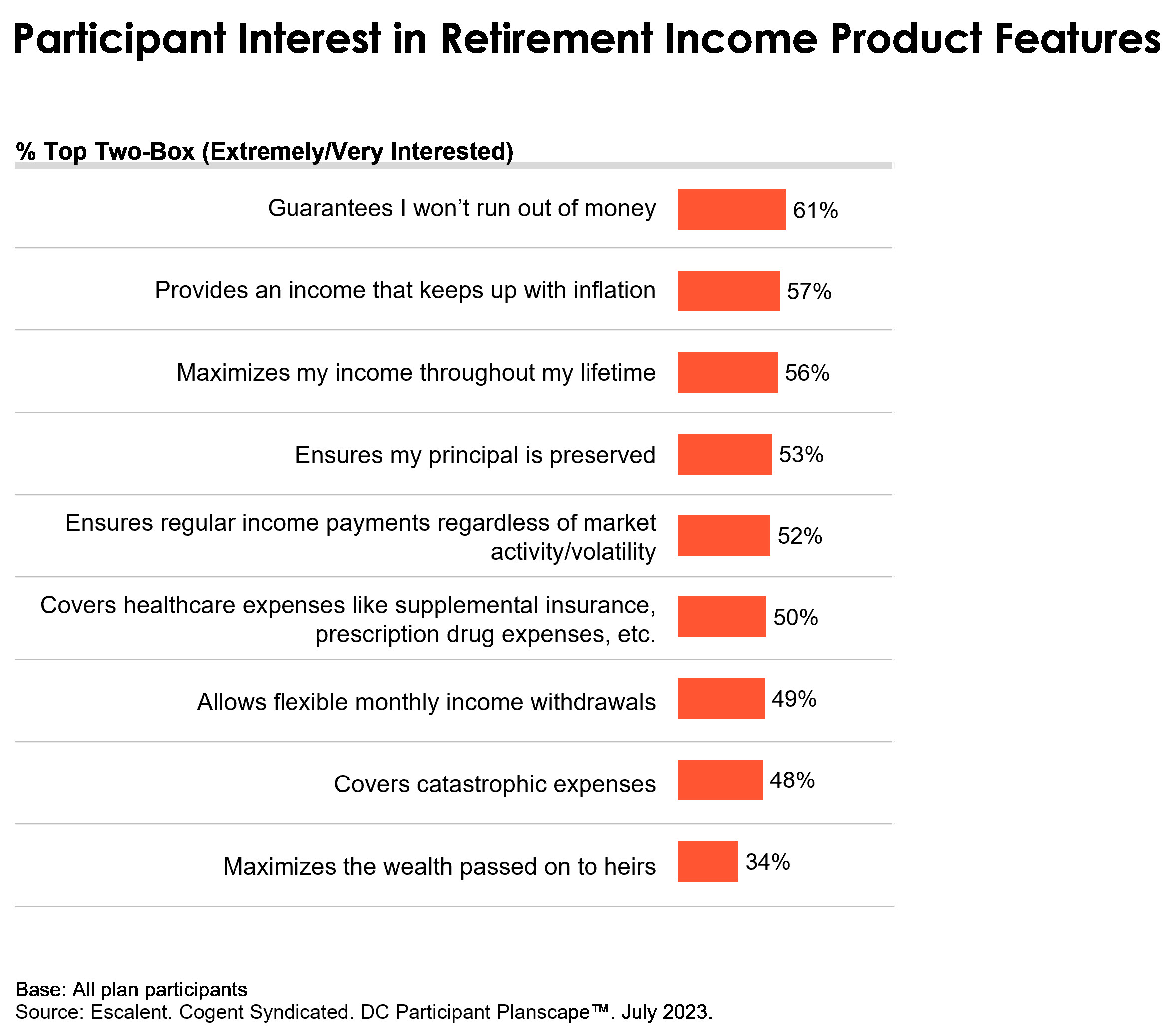

Meanwhile, one in five participants (20%) is using retirement income products within ESRPs, a notable uptick from 16% in 2021 and 18% in 2022. When polled on different product features, six in ten participants are “extremely” or “very interested” in retirement income products that guarantee they won’t run out of money. Additional features drawing strong overall appeal from at least half of participants include products that keep up with inflation, maximize income over the course of a lifetime, ensure principal is preserved and ensure regular income payments regardless of market activity.

The Opportunity for Providers

For those willing to innovate, the opportunity to solve for the daunting decumulation years is out there. With many different variables at play spanning life expectancy, healthcare needs and rising inflation, creating viable solutions isn’t as easy as enrolling participants into a target date fund and automatically increasing their deferral rates each year, but is sorely needed in the marketplace.

Cogent Syndicated’s Retirement Plan Advisor Trends report gives firms an in-depth understanding of the attitudes and preferences of the most critical players in the distribution of DC plans to help providers find these and more opportunities to grow market share and strengthen plan advisor loyalty. Click below to learn more.