The COVID-19 pandemic has completely shifted landscapes and dramatically altered everyday consumer behaviors, such as stopping by the store after work or grabbing a bite to eat with coworkers or friends. It has also plunged the global economy into a recession, with investors, businesses and consumers alike desperately hoping for a quick recovery.

As the world grapples with the pandemic’s far-reaching impact, observers are keeping a close eye on economic activity—or lack thereof—and consumer attitudes toward spending during this period of uncertainty. We recently asked consumers about their feelings regarding a wide range of topics—from their security in personal finances to their confidence in a speedy economic recovery in the wake of COVID-19.

Past Recessions

Historically, savings rates spike in the aftermath of crises. In a financial downturn, consumers initially reduce discretionary spending, but then spend a higher portion of reduced incomes on discretionary items, creating a temporary economic fall. Then, we typically see consumers hunker down and save.

In the early aughts, the savings rate was around 4% until the “dotcom bubble” burst, at which point savings increased. Unfortunately, the savings rate stayed low during the 2005-2007 recovery, causing significant concern the US had a savings problem. The issue “solved itself” in the worst possible way in the wake of the 2008 crash, when savings rates spiked to a lofty 12% by 2012, effectively slashing the nation’s GDP.

The relatively stable 6-8% savings rate since then has set the stage for a robust economic recovery—until now.

Looking to Recovery

While it’s natural for shoppers to want to “pull back” during periods of uncertainty, consumers injecting cash into the economy is critical to accelerating the recovery. Each industry’s rebound will look a little different, but 73% of US GDP is driven by consumer spending.

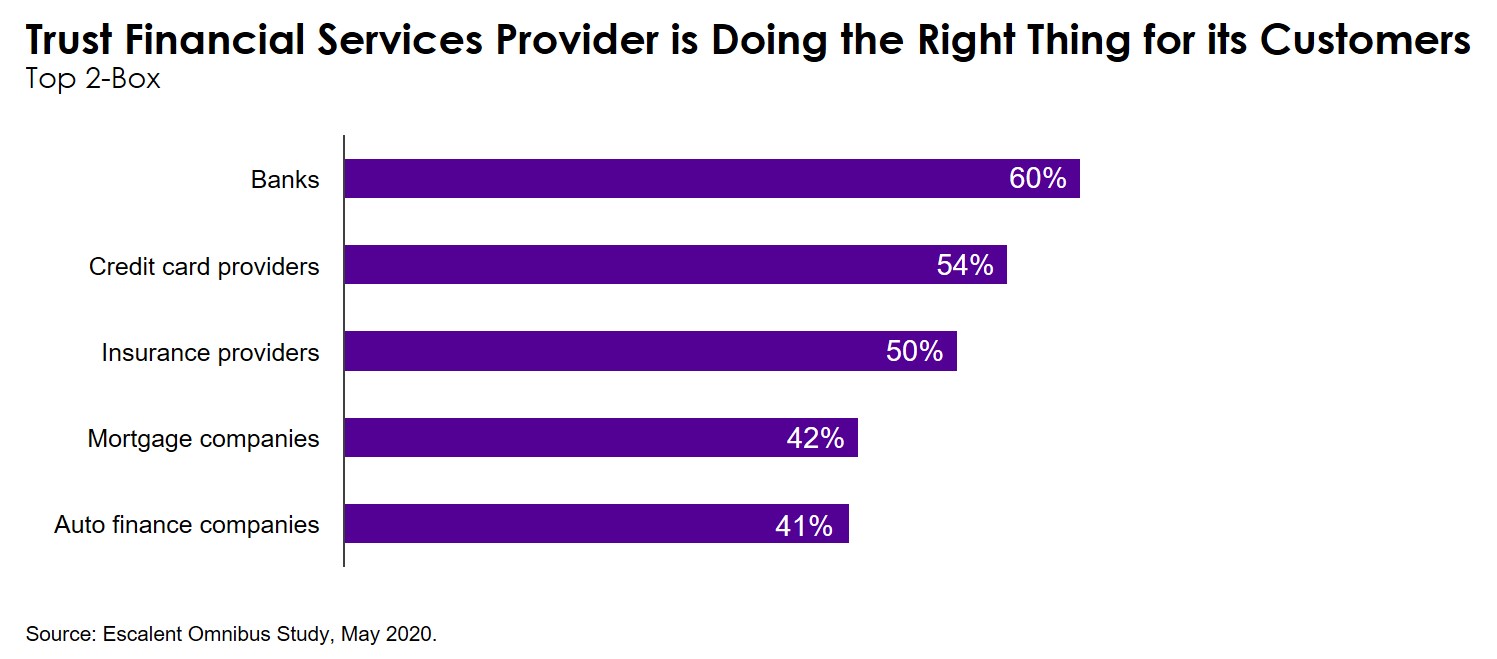

If you think our economic maladies stem from consumer distrust of financial service institutions, think again: more than half of consumers say they trust banks and credit card providers to do right by their customers—levels which may be higher due to more frequent contact and stronger relationships. While only 40-50% trust insurance providers, mortgage companies, financial advisors and auto finance organizations, it may be a result of customers having more to lose in the long-term.

Ironically, one of the key findings shows that roughly one-third of consumers optimistic about the economy expect to more closely monitor spending and save more in both the short- and long-term than their pessimistic counterparts—a significant disconnect which will likely heavily slow economic recovery. On both ends, consumers reported they were more likely to shop online and local, and more closely monitor their household spending across the board.

The two biggest indicators of where the economy will go moving forward are personal savings rate (inverse relationship) and trust. To have optimism towards the economic rebound, consumers must focus less on what’s in the back pocket and more on how they can be a part of the repair process.

For all of the latest COVID-19 insights from our financial services team, click below to read all of our Financial Services COVID-19 Market Research Perspectives.