Editor’s Note: This is the second in a series of short blogs on gender and racial disparity in financial services. When it comes to diversity and inclusion, all of financial services—Escalent included—has an imperative to make changes. We need to do better. Change is going to take sustained, hard work but we must not shy away from progressing with something that cannot be accomplished all at once.

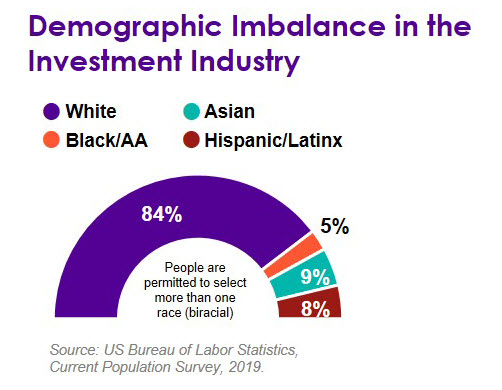

Financial literacy and trust are major factors in the lack of engagement in financial services among minorities. While financial literacy education is more readily available than ever before, the absence of diversity within wealth management companies continues to be an engagement barrier. To eliminate racially charged miscues and build trust, we need equal representation on all sides of the table.

- Among employees: Asset management firms have snapped up Chief Diversity Officers in recent years as awareness of stark demographic imbalances at their firm increases.

- Among clients: The financial crisis has negatively and disproportionately impacted People of Color, women, younger people, small business owners and gig workers, according to recent surveys. An incredible 56% of Black Americans report being worried about their financial future. Alongside this, more people are expecting to work longer than planned. This dim outlook will change the face of financial wellness initiatives and retirement planning.

- Within products: It has been claimed that the asset management field at large has only 1% of assets under management managed by women- and minority-owned firms.

Making Progress

With Black Lives Matter at the forefront of debates in SEC meetings, some firms are making progress. Firms in the industry are:

- Hosting discussions in the workplace

- Encouraging employees to share their own stories of inequality

- Establishing funds to tackle injustice

- Donating to NAACP and other organizations that promote racial equality

- Opening offices in Atlanta and other diverse cities

- Supporting hate crime bills

- Creating new roles, such as “Global Head of Diversity”

- Supporting executives making statements (e.g., on social media) condemning racism, inequality and violence

As industries, financial services and research both know there is a lot of work to be done to achieve equity, diversity and inclusion. For us, it’s not just about conversation—it’s about action. As a member of our newly established Diversity & Inclusion council, we are taking steps in the right direction in terms of how we do business, who we do business with, and how we attract diversity-minded and diversity-rooted individuals into market research.

The new generation of investors signifies the need for a shift in priorities within the wealth management arena as well. With a renewed interest in the power of ESG investing, there is a strong shift of focus from the “E” (environmental) to the “S” (social); access to wealth management and financial literacy information is crossing racial borders more than ever, and the priorities of those investing will inevitably lead to differences in where investors want their dollars to go. My colleague Holly Kilbourn put it well when she said:

“Though I often think of ESG investing as related to the environment, it also covers inequities and should consider racial disparities. As we see ESG gaining more traction, we have to be careful that it could all too easily become just another buzzword. I look forward to playing a research role in helping companies remain intentional about what they stand for so that we do not miss out on the opportunity to see real change happen.”

If you would like to learn more about how we’re measuring racial and gender equality in financial services, send us a note.