The financial literacy of employees and investors remains an ongoing concern. The common definition of literacy is “competence or knowledge in a specified area.” As organizations seek to evaluate financial literacy, it is important to focus on the competence factor in the current learning environment.

At a time when more information is available than ever, by many orders of magnitude, most consumers will simply wait to google a term when they “need to know” it. Unfortunately, many financial situations do not come with triggers to cue individuals that now they need to know something. Rather, consumers need to start with a functional understanding of key concepts so they can execute financial planning and investing.

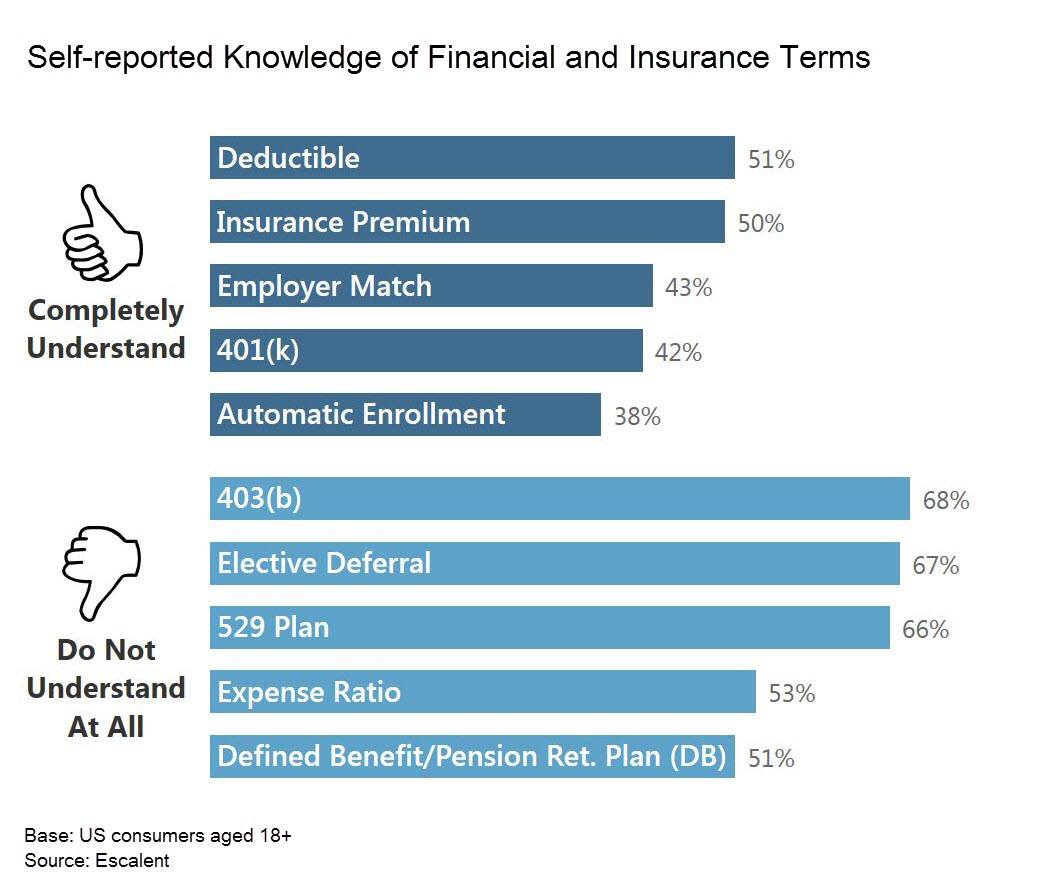

In a self-funded study, our financial services research division presented US consumers aged 18+ with a list of commonly used financial and investment terms to gauge a public level of understanding. Respondents self-evaluated how thoroughly they understand the given terms. For some of the terms, a working and ongoing understanding of the concept is important to routine saving and investing.

Expense ratio is an example of a concept that is important for investors to have a functional understanding of, because not planning with expense ratios in mind will cost investors’ money every single day of their investing lives. Yet a majority (53%) of those we asked said they don’t understand the term at all.

A comparable number said the same thing about defined benefit plans. However, lack of knowledge around DB plans is less problematic, as interaction with a DB plan—like getting a new job that has a pension—provides a trigger and the opportunity to acquaint oneself with the concept. There are also far fewer DB plans offered in today’s economy.

Even some of the better-understood terms are not at the levels they need to be to ensure financial wellness. Terms like “401(k)” and “employer match” are “completely understood” by less than half of respondents. As the US turns to 401(k)s as a primary replacement for DB plans, these terms need to be understood well by virtually all.

Despite their lack of knowledge, 50% of consumers indicate they are motivated to understand financial and investment terms better. With so many consumers willing to learn, why is there a knowledge gap?

Competency and feeling educated can be critical factors in increasing investments, as confident investors are more likely to act. Financial literacy, as our previous Cogent Syndicated studies have shown, also significantly increases participation in retirement plan participation and investing overall.

What can asset managers and firms do to promote financial literacy?

- Watch your language. Less jargon is always better, but beyond that, contextual language is important. Tell investors why they need to know something, don’t just assume they know what you know.

- Tell investors what they need to know. The desire is there but the ability to prioritize is an issue. We expect we will soon see more algorithmic-driven educational experiences where exposure to concepts and terms is driven by financial situations or surveys.

When leveraged the right way, this financial knowledge gap offers an opportunity for firms to position themselves as trusted financial partners by presenting information that is easier for consumers to understand. Becoming a trusted partner creates a lasting impression on consumers that can ultimately lead to higher consideration and brand loyalty. For investors, being more financially literate can boost engagement with their finances and investments, as it gives them confidence and helps them make more informed decisions around where and when to move their money.

Want to know more about our research in financial services? Send us a note and let’s chat!