Strong brand awareness is important when trying to win new customers, but what if your brand already has nearly universal name recognition and still isn’t winning? Negative brand perceptions may be holding you back.

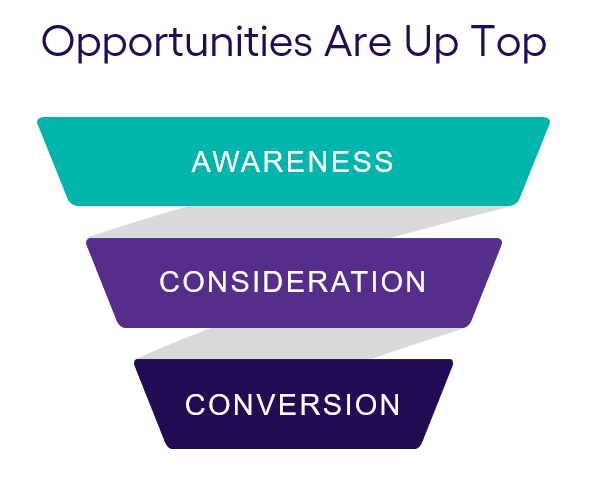

While brand awareness is the first step in the purchase funnel, converting from awareness to consideration can be a challenge—even for some of the well-known, and seemingly dominant, brands. In mortgage lending this is particularly true for large national banks. To make it to the bottom of the funnel where more tangible factors such as process and price become more important, you need to ensure your brand is perceived favorably by consumers to get past the stage of being considered.

National Banks and the Barriers to Mortgage Lending

Let’s look at a real-life example. At the beginning of the pandemic, my husband and I decided to start looking to buy our first house. Buying a home—especially a first home—can be nerve-racking. After the seller accepted our offer, we had to complete a lot of detailed paperwork as well as the inspection and the appraisal—meaning there were many opportunities for things to go wrong and delay closing, adding more stress.

When choosing which companies to work with during the home-buying process, we relied heavily on input from friends and family. When it came to mortgage lenders, they told us story after story about certain banks selling off their mortgages shortly after buying their home or struggling to get in touch with the bank during time-sensitive parts of the process. While we reviewed quotes from a few institutions, including a national bank, we ultimately decided to go with a recommended small, regional mortgage broker with a slightly higher rate to minimize any potential stressors—a key example of how brand perceptions can prevent your brand from being considered.

Improving Consideration Metrics by Mapping Your Path to Purchase

We know from our research that the purchase journey is getting shorter—meaning that rather than actively comparison shopping, many consumers are relying on their current perceptions of brands when deciding which to consider. When you factor in economic uncertainty, the need to understand which levers to pull when it comes to messaging and marketing activities is even more critical.

Our path to purchase approach emphasizes looking to the top of the funnel to better understand the many dynamic paths consumers take into consideration as well as the factors and key perceptions driving the consumer decision-making process. Leveraging these two elements allows companies to invest resources into the most important aspects of the customer journey, allowing brands to make meaningful changes in perceptions.

Within this approach, we capture not only the key consumer behaviors that occur at the top of the funnel, but seek to understand shoppers who know which brand they plan to choose before they even need to make a purchase.

These inputs give mortgage lending companies a specific kind of information: the actionable kind. Starting at the top of the funnel will give your brand a complex picture of how consumers interact with it at different touchpoints, and help you make informed decisions about how to improve consideration with the right message at the right time.

For more information, download Want to Win More? Your Guide to Boosting Customer Growth Using Our Award-Winning Path-to-Purchase Approach.