The role of the 401(k) plan sponsor is becoming increasingly complex. Just as they cleared one set of pandemic-related hurdles, plan sponsors were hit with a myriad of others spanning employee retention and acquisition efforts, cybersecurity risks, the ever-changing landscape of regulatory compliance, and the impacts of market volatility.

In this year’s Retirement Planscape study from Cogent Syndicated, we asked plan sponsors to articulate what specific steps firms could take to make their roles easier. Recommendations include “more targeted videos/animated communications [for participants]” and “ensuring the investment lineup is robust enough for all employee classes” to “maintaining a plan design that differentiates us from other employers as we compete for talent.” In fact, many of these challenges and topics were described in recent thought leadership pieces that plan sponsors deem most valuable.

In addition to plan sponsors’ stated needs, we analyzed the effectiveness of a variety of pathways that plan providers and investment managers could take to enhance consideration potential and drive business growth. For plan providers, the most direct pathways to consideration are being Diacritic (a combination of product and service innovation, choice in investment options and thought leadership) and demonstrating Reliability (through brand trustworthiness, being easy to do business with, and plan sponsor service and support).

Meanwhile, the most efficient way for DC investment managers to build consideration is by strengthening perceptions of Reliability (brand trustworthiness and style purity) and Expertise (target date solutions, investment philosophy, investment research, portfolio/risk management, and investment performance). Yet not every brand can pursue the same pathway—the key is to choose the right path based on an informed understanding of your current brand perceptions and the most pressing issues your target customers face.

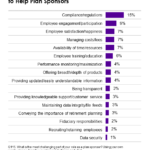

As employers strive to optimize their 401(k) offerings, providers must be sensitive to plan sponsor challenges and responsive to evolving needs. But what do plan sponsors want help with? We asked what plan sponsor’s biggest challenges are and what support they could really benefit from the firms they work with. Compliance and help with regulations is the biggest opportunity followed by help with employee engagement and participation in the plan.

The full Retirement Planscape report dives even deeper into how plan providers and investment managers can help plan sponsors, and in turn, retain DC plans and plan assets. Every day we’re striving to help firms understand their unique place and positioning within the DC market and identify the best pathways to success.

Click below to learn more about the full report and how it can help your firm. Or, send me a note and we can take a look at how your firm performed among your competitors.