Despite industry expectations that third-party model portfolios will dominate strategies and play a significant role in decision-making for advisors in the near future, few new advisors have actually adopted such tools over the past year. Instead, growth is coming almost entirely from advisors already using model portfolios. This finding demonstrates that the experience of advisors relying on these types of models has been positive so far, but that use may eventually reach an upper limit.

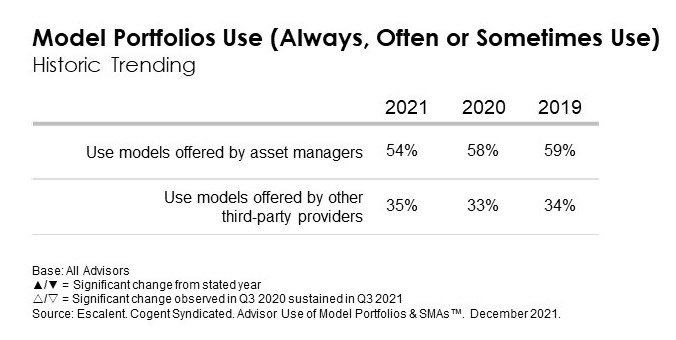

The proportion of advisors using model portfolios from asset managers (54%) and other third-party providers (35%) is unchanged over the past three years. Meanwhile, more than half (52%) of advisors remain most reliant on model portfolios they create or modify themselves (using always or often).

Looking ahead, Cogent expects increased advisor use of model portfolios, driven by engaged and active users. Just over one-quarter (27%) of advisors using model portfolios report increasing their use since the pandemic took hold—a significant increase from 14% last year. In particular, heavy users of model portfolios provided by asset managers and other third-party providers say they recently increased their use (41% and 51%, respectively).

Advisors who increased their use of third-party model portfolios have articulated a shifting vision for their role, highlighting a desire to focus more time on client management. As clients look for more personalized and hands-on approaches from their advisors, third-party model portfolios become more and more attractive. Once advisors see consistency in results and put their trust in those models, they’re able to spend less time managing individual investment selections and more time working with clients directly.

Yet not all advisors are convinced. Some advisors feel that model portfolios do not perform as well as a more active approach in a volatile market environment. At the same time, advisors managing larger books of business worry that model portfolios are not customized enough to meet the specific needs of their high-net-worth clients. Notably, advisors managing larger books appear to have fewer concerns about the appropriateness of SMAs for their high-net-worth clients.

To attract new advisors, providers must address common misperceptions hindering adoption and extol the benefits according to their most engaged users, particularly in terms of the suitability of model portfolios to manage client assets in a volatile market environment. In addition to testimonials, providers should be offering education opportunities and highlighting critical results that will move the needle. This will help advisors who are seeking to get out of the weeds of investment selection and back into the business of building long-term relationships with their clients.

Advisor Use of Model Portfolios & SMAs™, our newest Cogent Syndicated report, tracks advisor use of model portfolios and perceptions of leading model portfolio providers.

Click below or send us a note to learn more about the full report.