As utilities face increasing deregulation and competition from distributed generation, they need to refocus their key performance indicators (KPIs) on metrics that describe customer actions and sentiment rather than on the somewhat passive metric of operational satisfaction.

Recently, utility executives have been asking us to help them develop or evolve their KPIs to include Customer Effort, Customer Advocacy, Net Promoter Score® (NPS) and Ease of Doing Business. Given that the industry is primarily monopolistic, this presents some unique challenges in identifying KPIs that provide effective and useful metrics for utilities today.

How Should a Utility Evaluate Which Metrics to Use for Its KPIs?

Escalent has been tracking many utilities’ performance on these metrics for five years through energy industry research, which gives us a unique overview of the industry as a whole. When developing effective and useful KPIs, we recommend metrics that:

- Apply to all customers regardless of whether they’ve had a recent transaction experience with the utility. This includes residential customers, small and medium businesses, and large commercial customers.

- Can be influenced by all employees and all departments of the utility.

- Align with the utility’s strategic direction, mission and vision.

- Have historical performance data that can inform target-setting for the future.

- Have demonstrated relatively consistent performance over time.

We tend to guide utility clients away from any metric that is based on a “net” calculation—like NPS. By definition, these metrics exclude some customers from their calculations, violating rule #1 above. Likelihood to Recommend is also an artificial metric for regulated utilities, since customers don’t usually have a choice of energy providers.

Examples of Effective and Useful KPIs for Utilities

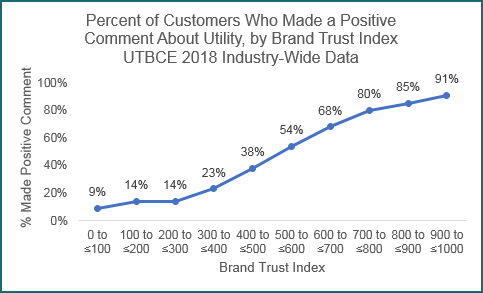

We often recommend Customer Advocacy. It measures customers’ actual experience making a positive comment about their utility—whether via a one-on-one conversation or in a public forum such as social media. This metric meets the criteria above: it applies to all customers, can be influenced by all employees and departments of the utility, and generally aligns with utilities’ mission and vision of generating positive customer sentiment. Through the Utility Trusted Brand & Customer Engagement™: Residential study (UTBCE), we can determine an individual utility’s historical performance on Customer Advocacy as well as evaluate the utility’s consistency on this metric.

We see that Customer Advocacy is highly correlated with Brand Trust across all 130+ utilities measured in the study. Brand Trust, in turn, is a key driver of customer engagement and an indicator of likelihood to adopt the utility’s optional programs and services.

One caveat regarding Customer Advocacy: It isn’t widely measured in other industries so benchmarking opportunities are limited—something to consider if benchmarking is critical to your company’s leadership.

Ease of Doing Business is another metric we recommend. It incorporates most of the criteria listed above and provides feedback for customer effort in transactions. Even customers who haven’t had a recent transaction can rate Ease of Doing Business, as they may view “doing business” simply as using the energy provided to their home or business, or receiving communications from the utility.

Additionally, we often assist utilities in setting Tier 2 KPIs that are more limited in scope—for example, satisfaction with phone agents or website ease of use. These Tier 2 measures help drive improvements in the top-level KPIs.

As with any effective strategy, what you measure will depend a lot on what drives your business and what you need to know to improve business. Please send us a note if you would like to know more about the process we use to identify the right KPIs for your company.