You might think that assessing the performance of a given investment is simple and straightforward. But think again. To gauge whether investment performance is “good” or “bad,” the approaches are as varied as shades of gray. Is performance measured by historical return over time? Or performance compared with a stated benchmark? Or how closely the return has matched an index? Or the relative volatility compared with the overall market? Turns out, investment performance depends to a great extent on the perspective and expectations of the investor.

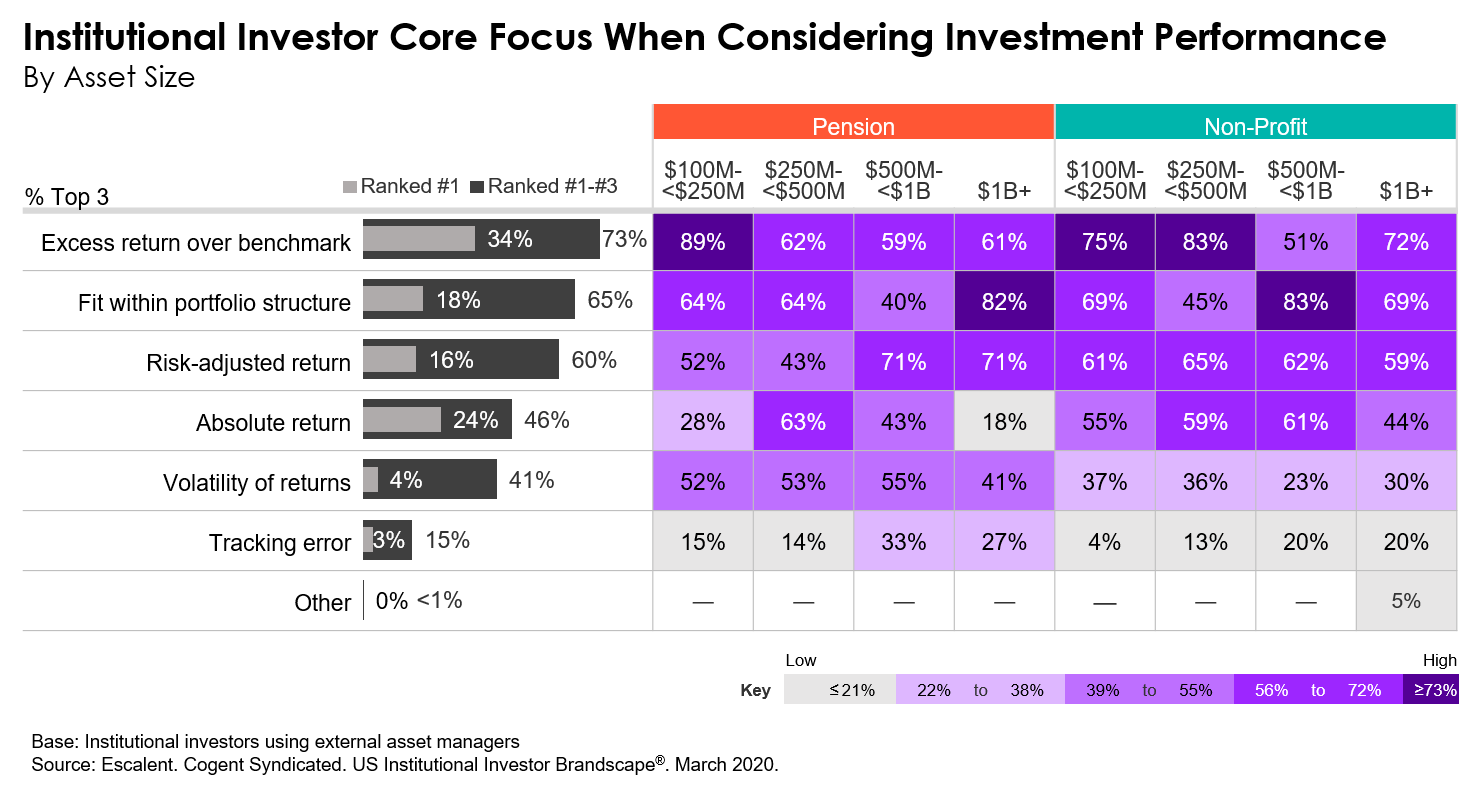

In the institutional market, investment performance is consistently rated as one of the most important criteria used in selecting a new asset manager. In order to gain a deeper understanding of the aspects institutional investors most value when it comes to assessing investment performance, we asked institutional investors to rank the top three aspects they focus on. Excess return over the benchmark is the leading factor, ranking in the top three among nearly three-quarters (73%) of all institutional investors. However, the top priority does vary by asset size:

- Pensions with $1 billion or more in assets prioritize an investment’s fit within their portfolio structure when assessing investment performance, and place comparatively little value on absolute return.

- Pensions with at least $500 million in assets hold higher risk-adjusted returns compared with smaller pensions.

- Smaller pensions’ and non-profits’ top priority is excess return over the benchmark, which is less important to larger institutions.

- Non-profits with $100 million to less than $250 million in assets feel tracking error is relatively unimportant.

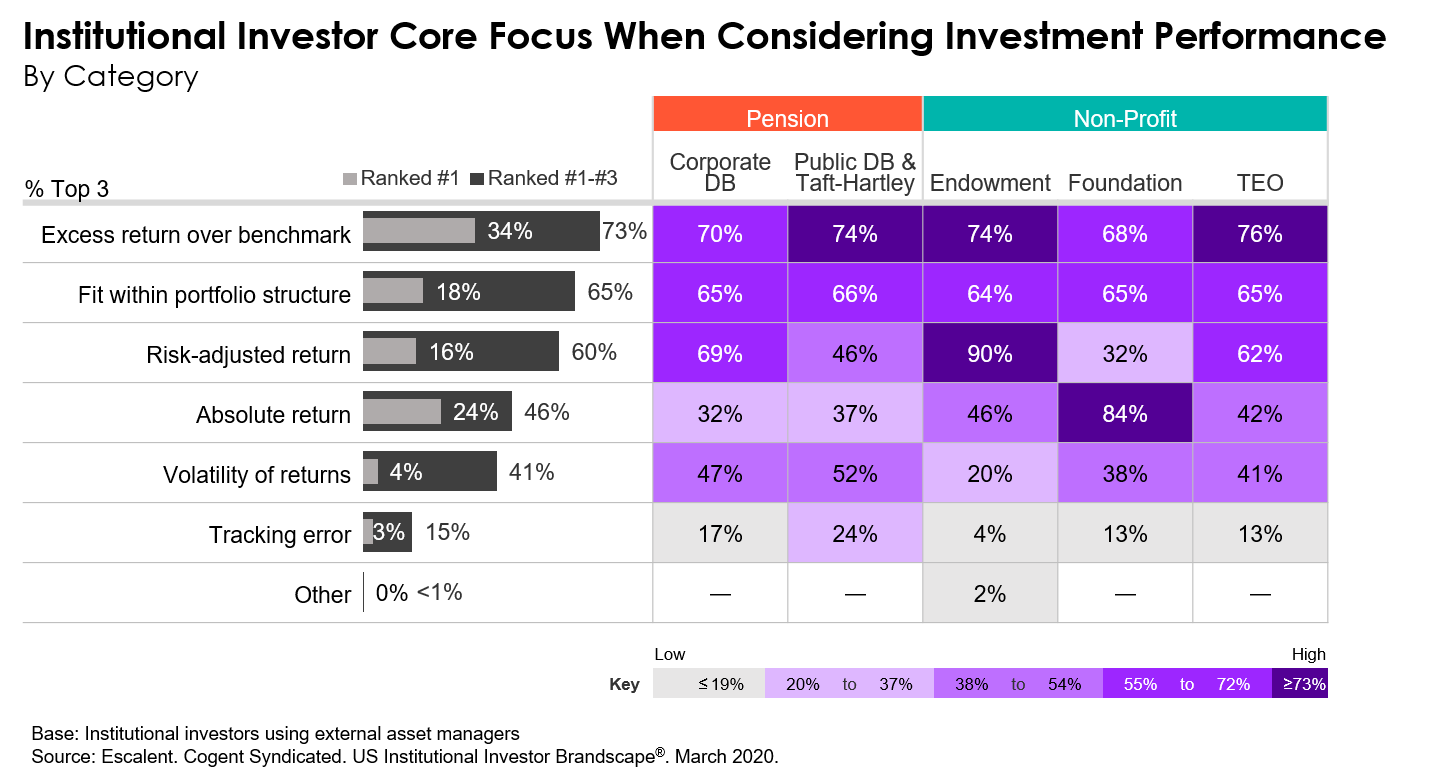

We also discovered some important variation in the opinions of pensions versus non-profits when it comes to gauging investment performance. Most notably, risk-adjusted return stands out as the top investment performance factor endowments consider when they select a new asset manager, while absolute return ranks first among foundations. Both corporate DB pensions and public DB and Taft-Hartley pensions focus on excess return over the benchmark as the most importance factor for investment performance, but corporate DB pensions rank risk-adjusted return as more important when compared with public DB and Taft-Hartley pensions.

The key takeaway for asset managers serving the institutional market is to know your customer. Make sure you understand the objectives each client has for the particular investment strategy you’re hired to execute and how your specific investment fits into and complements the client’s overall portfolio. Set expectations appropriately and monitor your performance relative to the requirements of each individual client.

Click below to learn more about the US Institutional Investor Brandscape report and how it can help your firm identify key trends in investment strategy and asset manager selection, usage and loyalty in the institutional market.