Despite ongoing concerns about the impending retirement crisis in America, the good news is that the overwhelming majority of affluent investors either have a retirement plan in place or are actively working on one. However, successfully planning for retirement means more than just a setting up a 401(k). These affluent investors are looking for guidance from financial advisors, particularly with generating in-retirement income. The 2019 Investor Brand Builder report dives into trends in retirement income and reveals four implications for the industry.

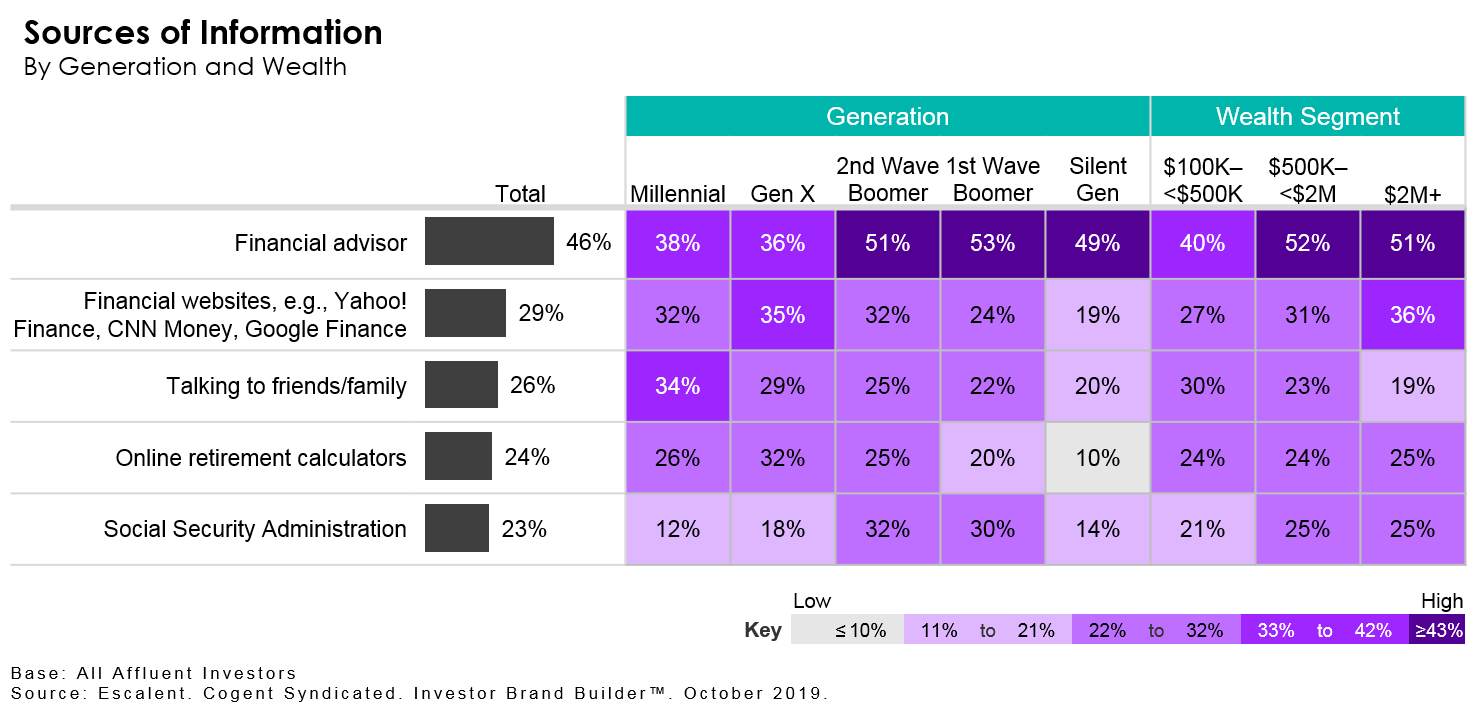

1. Affluent investors are planning for retirement, but they are looking to financial advisors for help. Almost nine in ten affluent investors already have a retirement plan (69%) or are working on one (18%). Not surprisingly, the proportion of affluent investors with a retirement plan increases with age and wealth level, with at least 85% of 1st Wave Baby Boomers, Silent Generation investors and those with at least $2 million in investable assets indicating they have a retirement plan in place. Financial advisors are the leading source of information for retirement planning across all generation and wealth segments, particularly among older and more-affluent investors.

2. Social Security is the leading source of income in retirement—particularly among Baby Boomer and Silent Generation investors. Millennials, however, are significantly less confident in the long-term viability of Social Security and already predisposed to other sources of retirement income, creating an opportunity for advice providers to augment Millennial portfolios with IRAs, other investments and employer-sponsored plans.

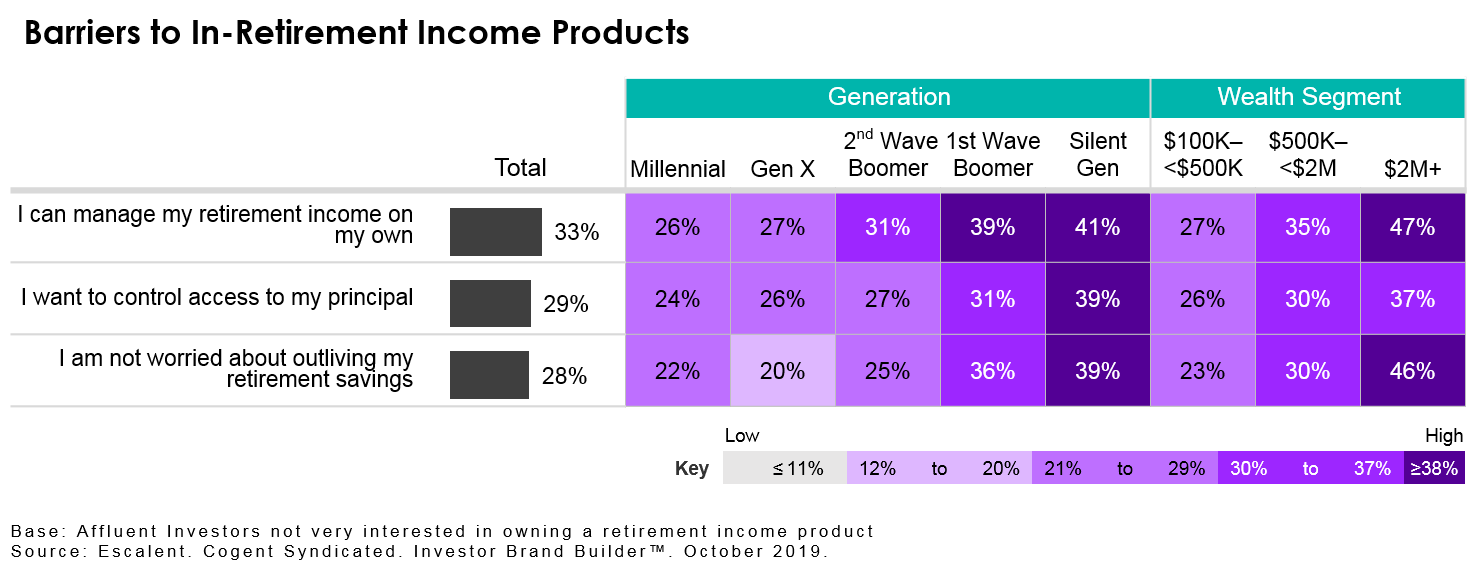

3. Affluent investors favor strategies that employ existing investments over products specifically designed to produce income in retirement. The preference for strategies that use existing assets is strongest among older and more-affluent investors. In contrast, Millennials and the emerging affluent (those with $100,000 to just under $500,000 in investable assets) would prefer investment products specifically designed to generate in-retirement income. Among investors interested in owning a retirement income product, their primary goal is ensuring they do not run out of money. Meanwhile, those lacking interest in in-retirement products feel they can manage their own retirement income and are less concerned about outliving retirement savings.

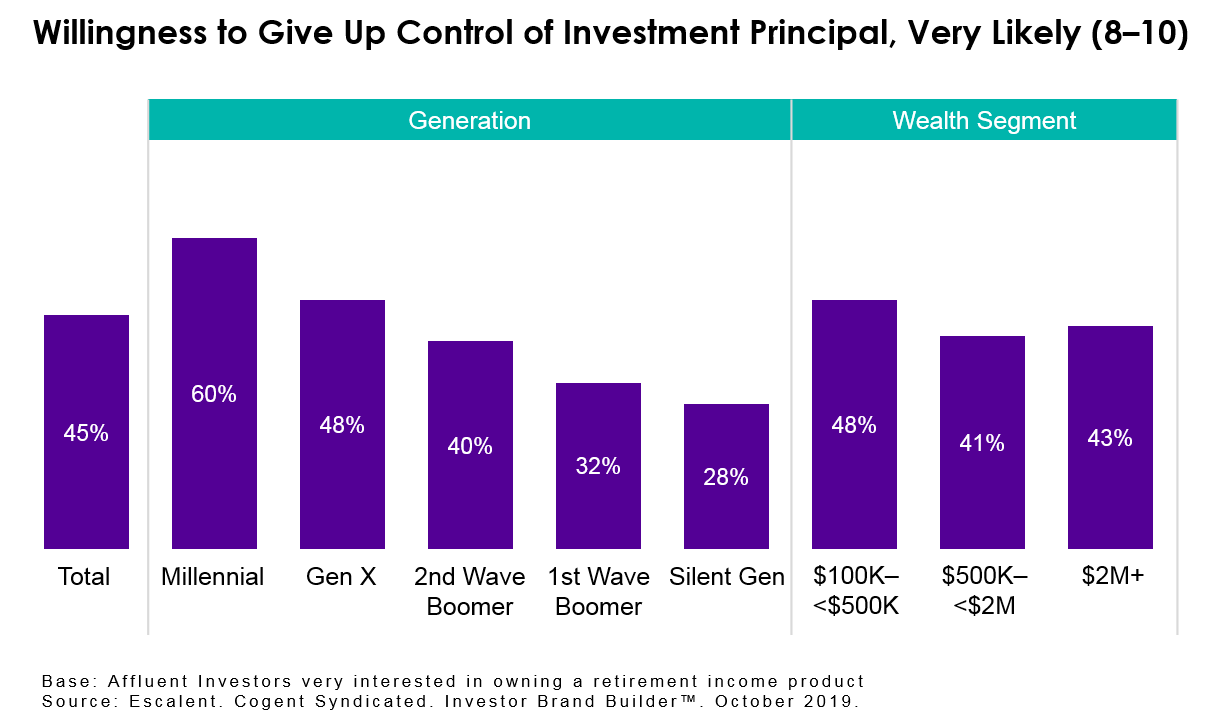

4. The closer the generation is to retirement, the less likely it is to trade control of investment principal for guaranteed retirement income. There is an inverse relationship between age and willingness to give up control of investment principal in exchange for guaranteed regular income payments in retirement. That is, six in ten Millennials (60%) are very likely to give up control versus approximately three in ten Silent Generation investors (28%).

Interestingly, even in an era typified by a proliferation of information sources, investors most commonly turn to financial advisors for assistance with retirement planning and income. However, to fully take advantage of these opportunities, advice and product providers must take care to recognize and cater to the unique needs of affluent investors at different life stages—from Millennials to those in the Silent Generation. Millennials appear to be the most receptive to income-generating products, while older, more-affluent investors would be more appropriately served by advice strategies that optimize income from their existing investments.

For more information on the full Investor Brand Builder report, click below.