Taking a page out of DC plan sponsors’ books, DC advisors cite good customer service as the main reason they recommend their chosen plan providers to prospective clients, even more than low fees and expenses. It’s no coincidence that the financial services industry’s most seasoned DC advisors are working with larger plans this year, as larger plans often expect more sophisticated and responsive service capabilities.

According to Cogent Syndicated’s 2019 Retirement Plan Advisor Trends report, the proportion of advisors with higher DC AUM levels is growing. In fact, one-third of all advisors (32%) are now classified as Established DC advisors (managing at least $10 million in DC AUM), a significant increase from 27% in 2017 and 2018. The percentage of DC specialists (managing at least $50 million in DC AUM) has also increased, from 17% in 2017 to 21% today. At the same time, DC specialists currently work with a median of 15 plans, fewer than the 20 plans cited in 2017 and 2018, suggesting that the size of the plans these elite producers are servicing is growing larger and, consequently, is upping the ante for service expectations.

In turn, DC advisors are prioritizing client service above all other factors including low cost, brand recognition, product availability and digital capabilities when it comes to DC plan provider selection. Customer service is cited by nearly four in ten DC advisors (39%) as the primary reason for recommending a plan provider for sponsor consideration and is noted most frequently among Regional producers, RIAs and producers with higher DC AUM levels.

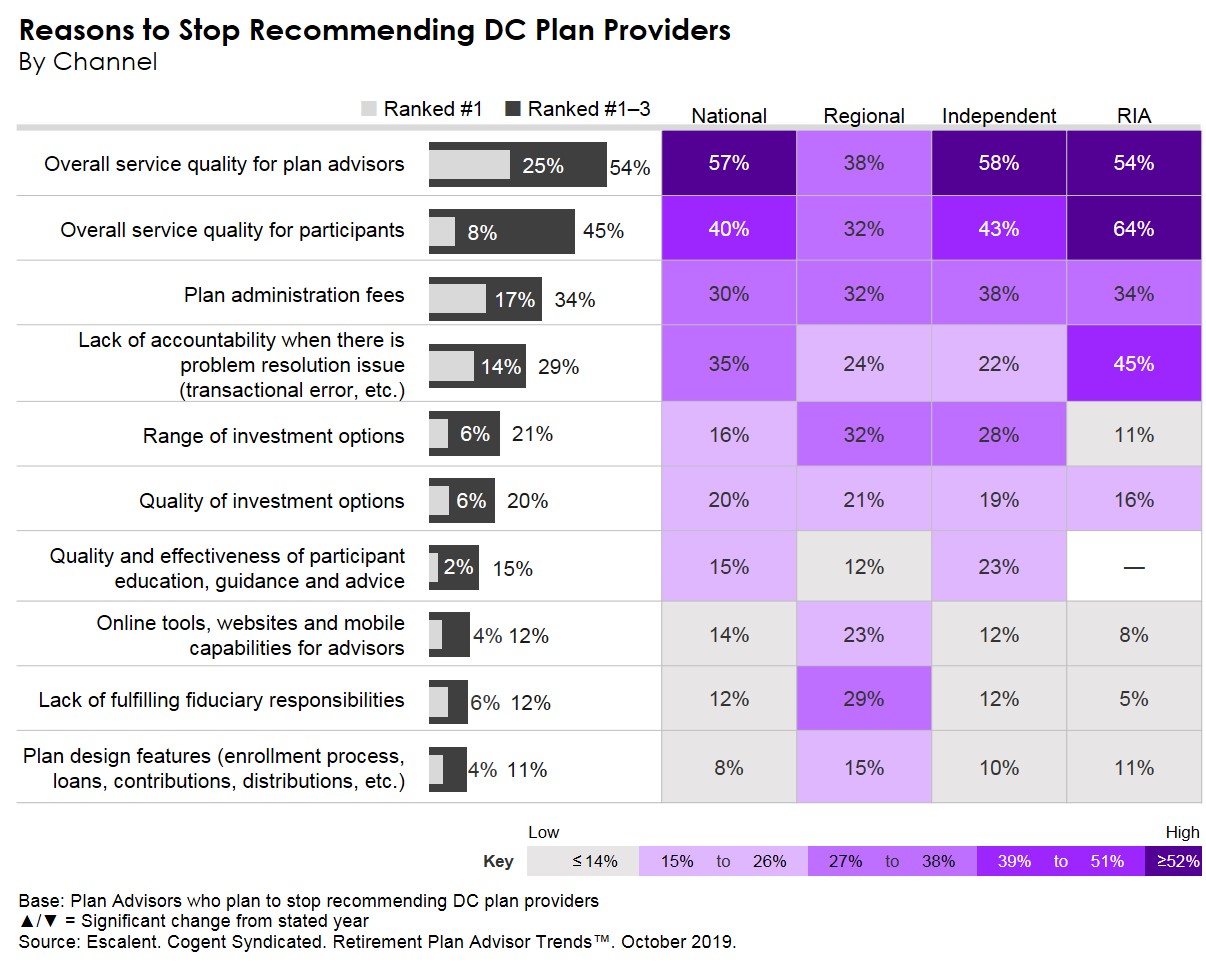

Perhaps even more telling: service quality concerns surpass plan administration fees as primary reasons for halting provider recommendations. Overall service quality for plan advisors (54%) and overall service quality for plan participants (45%) are cited more frequently than plan administration fees (34%) as key triggers for switching. Nearly half of RIAs (45%) cite lack of accountability—a sore spot commonly cited by DC plan sponsors—as a key trigger for ceasing provider recommendations.

The upside for DC plan providers? Many of these threats can be easily thwarted through stronger client service initiatives and advanced training, actions that can be much more profitable in the long run than cutting costs or reducing fees. In an era in which digital platforms are becoming commoditized, strong, personalized customer service can be a true brand differentiator.

Click below to learn more about the Retirement Plan Advisor Trends™ Report.