Unlike other innovations in DC plan design such as auto-features and managed accounts for which Mega plans have paved the way, ESG investing does not appear to have more or less influence by plan size. Most plan sponsors are knowledgeable of the subject, although perceptions of ESG as a viable investment strategy are mixed. Those with favorable views cite aspects such as good corporate citizenship, concern for social issues, clean energy and sustainability among ESG investing’s positive qualities. The more skeptical describe ESG as limiting investments to a smaller universe or handcuffing a manager in exchange for lower returns.

Generally, DC plan sponsors employ a conservative investment philosophy, ensuring their plan participants have access to the right complement of investment choices to meet their retirement goals without being overwhelmed. Regardless of the size of their employee base or the amount of assets they oversee, plan sponsors consistently cite the requirements of solid returns with low fees and expenses for the investment options they include in their fund menus. Equally prevalent across all plan sizes is the influence of financial advisors and consultants, who plan sponsors regularly turn to for guidance in evaluating and monitoring investment managers and investment options.

When asked about the importance of ESG investing in investment selection, some plan sponsors cite moderate influence while others say they are not currently using ESG criteria as a screening tool or that they have had limited discussions on the topic within their investment committee meetings. A minority, particularly those representing mission-based organizations in industries such as health and wellness, note the increasing importance of ESG in their decision-making process. Overall, however, plan sponsors say that ESG factors pale in comparison to the primary factors they abide by: fulfilling their fiduciary duty and acting in the best interest of plan participants by selecting strong-performing investments with low associated costs.

When asked the extent to which advisors and/or investment consultants are discussing or recommending ESG investment options, the majority of DC plan sponsors say that the topic has not been broached. While plan sponsors are hearing a lot about ESG investing in the media and webcasts, most say that their advisor or consultant is not recommending ESG strategies and, as a result, few plans are incorporating such investment options. A handful of plan sponsors have directly asked their advisor to discuss ESG investing with the investment committee but admit that the conversations have not yet generated much action.

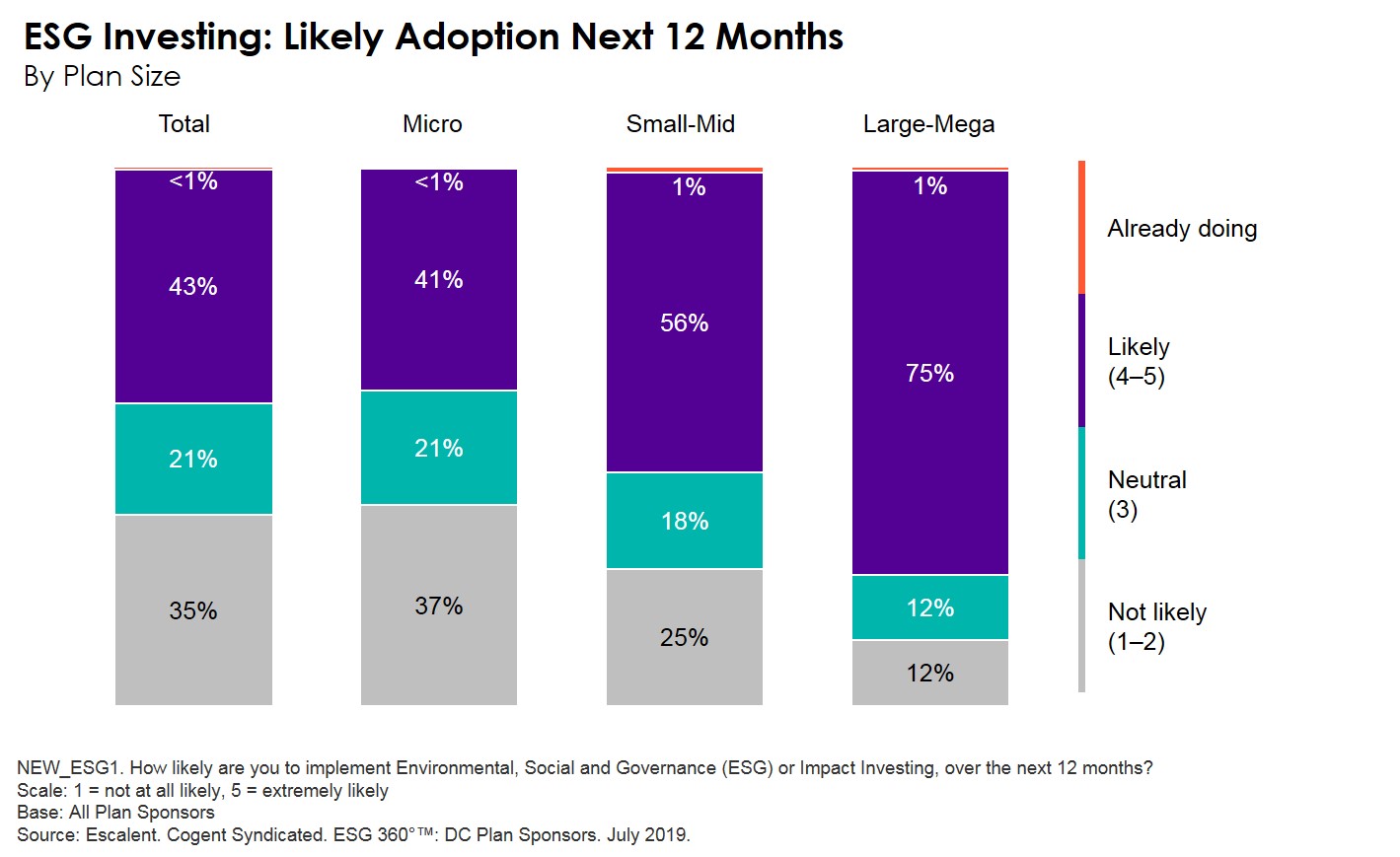

With the lack of employee demand to date, absence of advisor recommendations and minimal impact on current manager selection, it’s no surprise that very few DC plan sponsors have already incorporated ESG investing in their retirement plan menus. What is surprising is the percentage of plan sponsors who say they are likely to implement ESG or impact investing over the next 12 months. More than four in ten plan sponsors overall and three-quarters of Large-Mega plan sponsors report strong interest in incorporating ESG investing in the near future.

How they go about incorporating such investments, either as an investment option or series of options within the core menu or as an option through a self-directed brokerage window, remains to be seen. All signs point to the Mega plans acting as trendsetters, with the rest of the market watching carefully from the sidelines.

Want more ESG trends? Check out our blog on institutional investors or click below to learn more about our ESG 360° reports!