As asset managers targeting the institutional market try to differentiate, many are incorporating ESG (environmental, social and governance) factors in their investment strategies to varying degrees of success. Currently, few US institutions are incorporating ESG factors in their portfolios, but use is considerably higher in the non-profit sector, where institutional investors are more apt to seek investment strategies that align with their organization’s mission.

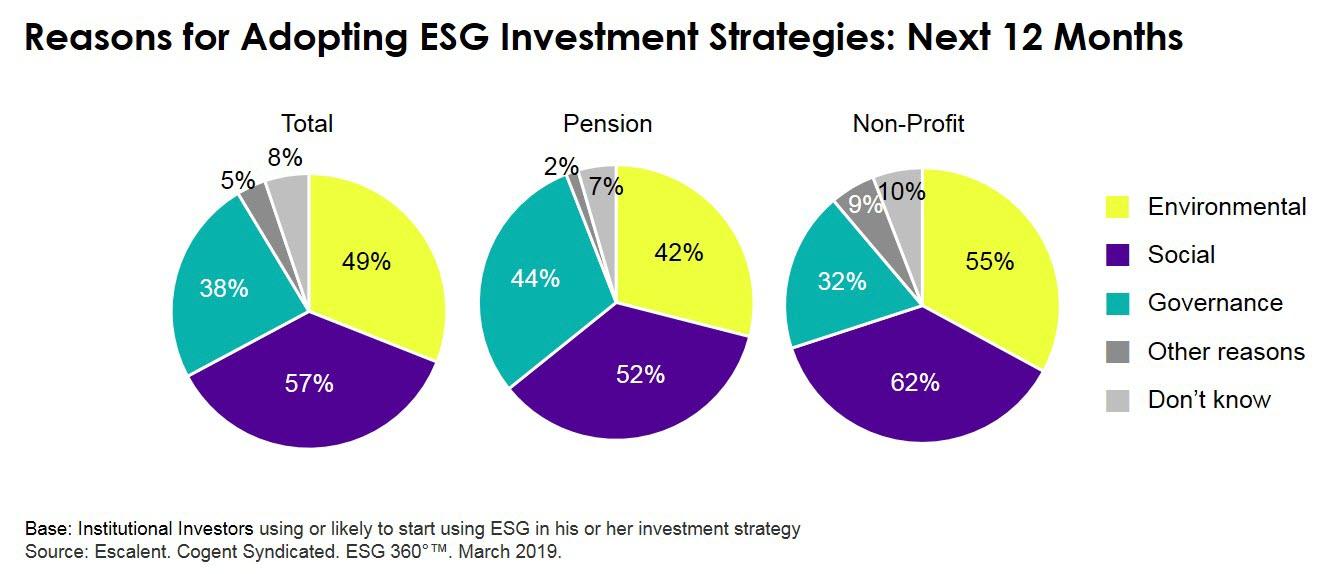

Within the broad category of ESG investing, the individual components draw institutional investors for very different reasons. When institutional investors are asked to identify the reasons they are most likely to adopt ESG investing, the majority of pensions and non-profits point to social aspects including diversity, human rights and consumer protection.

- Environmental aspects, including climate change, nuclear energy and sustainability, resonate more with non-profit institutions.

- Governance, including management structure, employee relations and executive compensation, is more of a draw for pension investors.

- The social component of ESG investing, encompassing aspects of diversity, human rights and consumer protection, is of particular interest to tax-exempt organizations and investors representing public DB and Taft-Hartley pensions.

Institutional investors are taking a “first, do no harm” approach, avoiding association with businesses that may draw negative publicity. In addition, there is widespread recognition of the importance of diversity in the workforce and the benefit it brings to the research process and decision-making. While adoption of ESG investing in the US institutional market is relatively low, institutional investors and the consultants that serve them recognize the growing trend toward ESG investing. Given this increasing momentum along with the challenge many asset managers face in effectively differentiating themselves in the institutional market, ESG investing could be a means of gaining a considerable competitive advantage.

Click below for more information on the full report.