Increasingly, advisors are recognizing the potential appeal of ESG investing, particularly for their clients who want their investment dollars to serve a greater purpose than simply generating a satisfactory return. Yet the fundamentals of investment selection including strong performance, appropriate risk management and competitive fees remain paramount in advisors’ minds. Ever vigilant in maintaining their clients’ trust in identifying the best investment choices to achieve financial goals, advisors are entering the world of ESG investing with considerable skepticism. While more than six in ten (62%) advisors are currently using ESG investing in some capacity, the average AUM allocation to these strategies is quite low. Overall, advisors are only allocating an average of 5% of their total AUM to ESG investments.

These advisor perceptions and modest allocation levels signal that asset managers have more work to do to convince financial advisors of the value of ESG strategies. There are many tactics that ESG managers can employ in this endeavor, but which will be most effective? Where should asset managers invest their marketing dollars and efforts to grow their ESG assets in the financial advisor community?

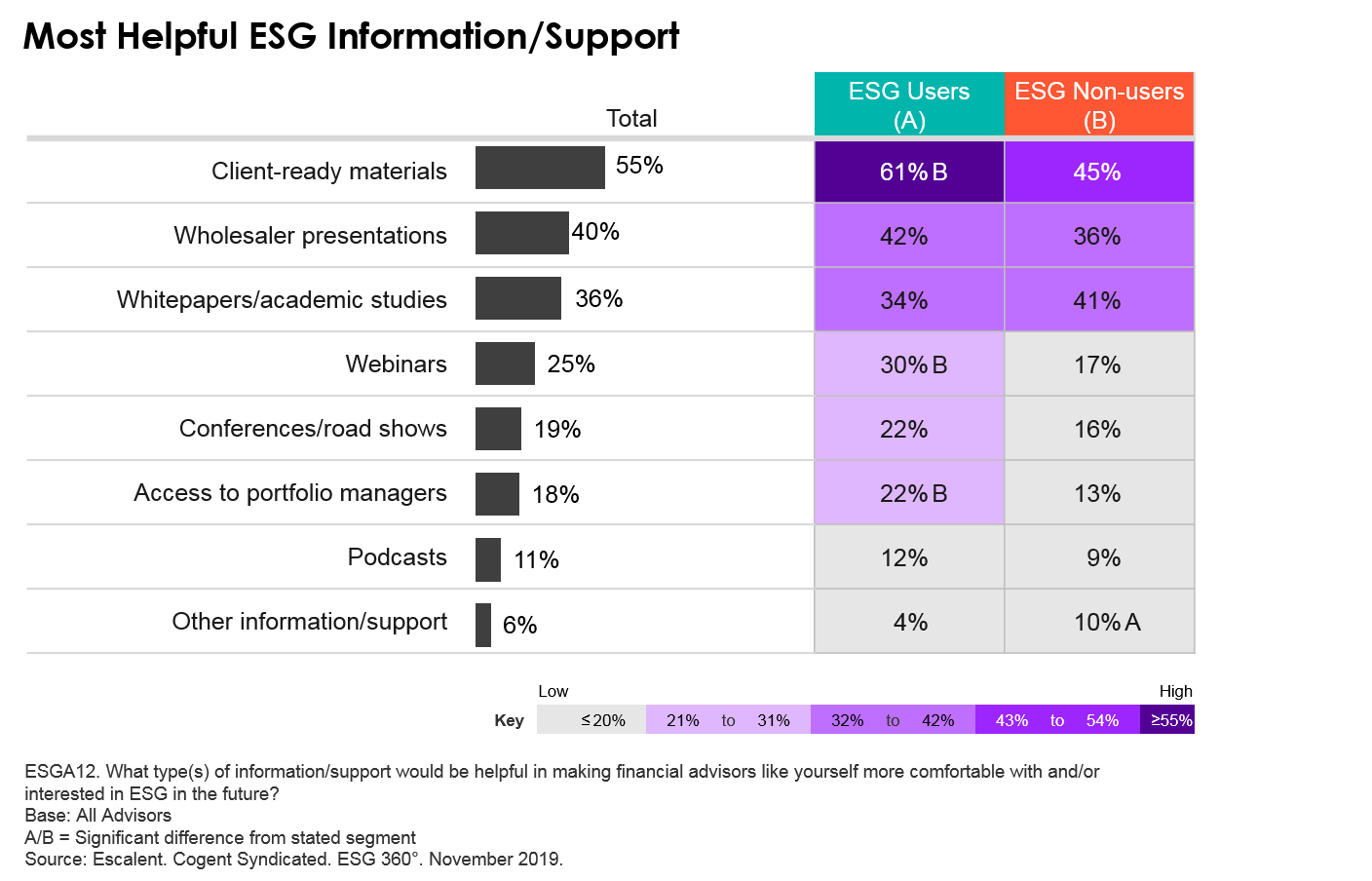

To help answer these questions, we asked a representative sample of over 500 financial advisors to identify the type(s) of information and support that would make them more comfortable with and/or interested in ESG investing. The most popular answer from more than half of all advisors? Client-ready materials. We know from prior research conducted by Cogent that there are two types of client content in financial advisors’ minds. Some advisors look for simple, graphic-rich content that can be used in meetings or as a takeaway to support the introduction of basic investment concepts. Other advisors seek more advanced thought leadership-style excerpts that can be used to supplement an ongoing dialog and respond to key market events. Despite their content preference, advisors are clearly seeking information to facilitate discussions about ESG investing with their clients.

Wholesaler presentations and white papers or academic studies are the next most popular items, valued by current ESG investing users as well as advisors who have not yet directed any client assets to ESG investments. ESG investing users appear more interested in additional information asset managers provide via webcasts and access to portfolio managers.

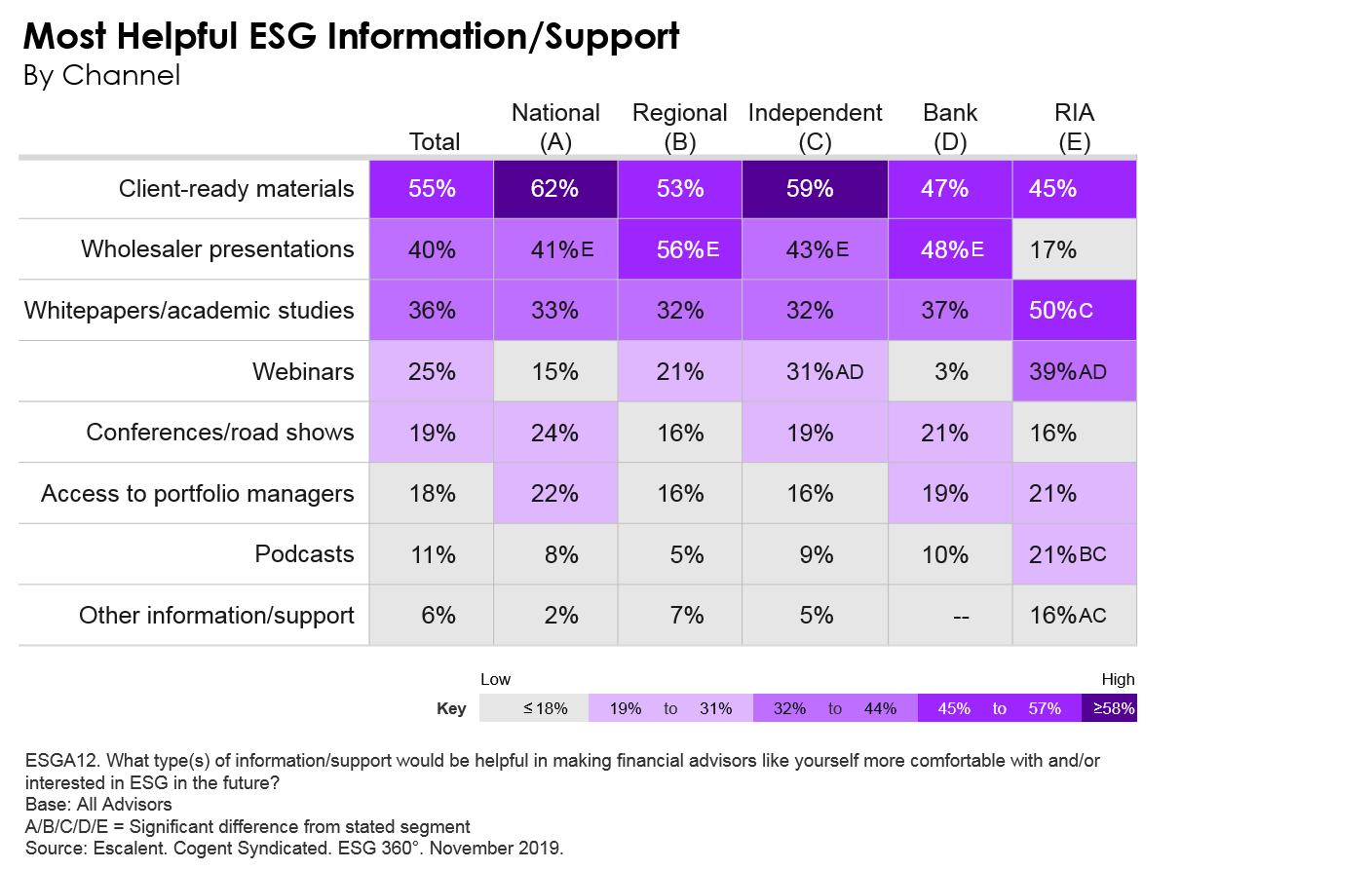

Importantly, there are distinct preferential differences in ESG investing support by channel. National wirehouse advisors along with independent planners express the strongest interest in client-ready materials, while regional and bank-based advisors find the most value in wholesaler presentations. Meanwhile, RIAs report considerably more desire than their peers in the broker/dealer channels for white papers, academic studies, webinars and podcasts.

As ESG investing become more mainstream, and more investors learn about the options available for sustainable, environmental and social investments, advisors will need to become well-versed in the category. The investment firms that are first to support advisors in growing their ESG knowledge will be best positioned to thrive in the ever-evolving asset management world.

Our ESG 360° series uncovers and evaluates trends in environmental, social and governance (ESG) investing using both quantitative and qualitative techniques to provide deep, focused insights on the broad term of ESG investing. Click below to learn more.