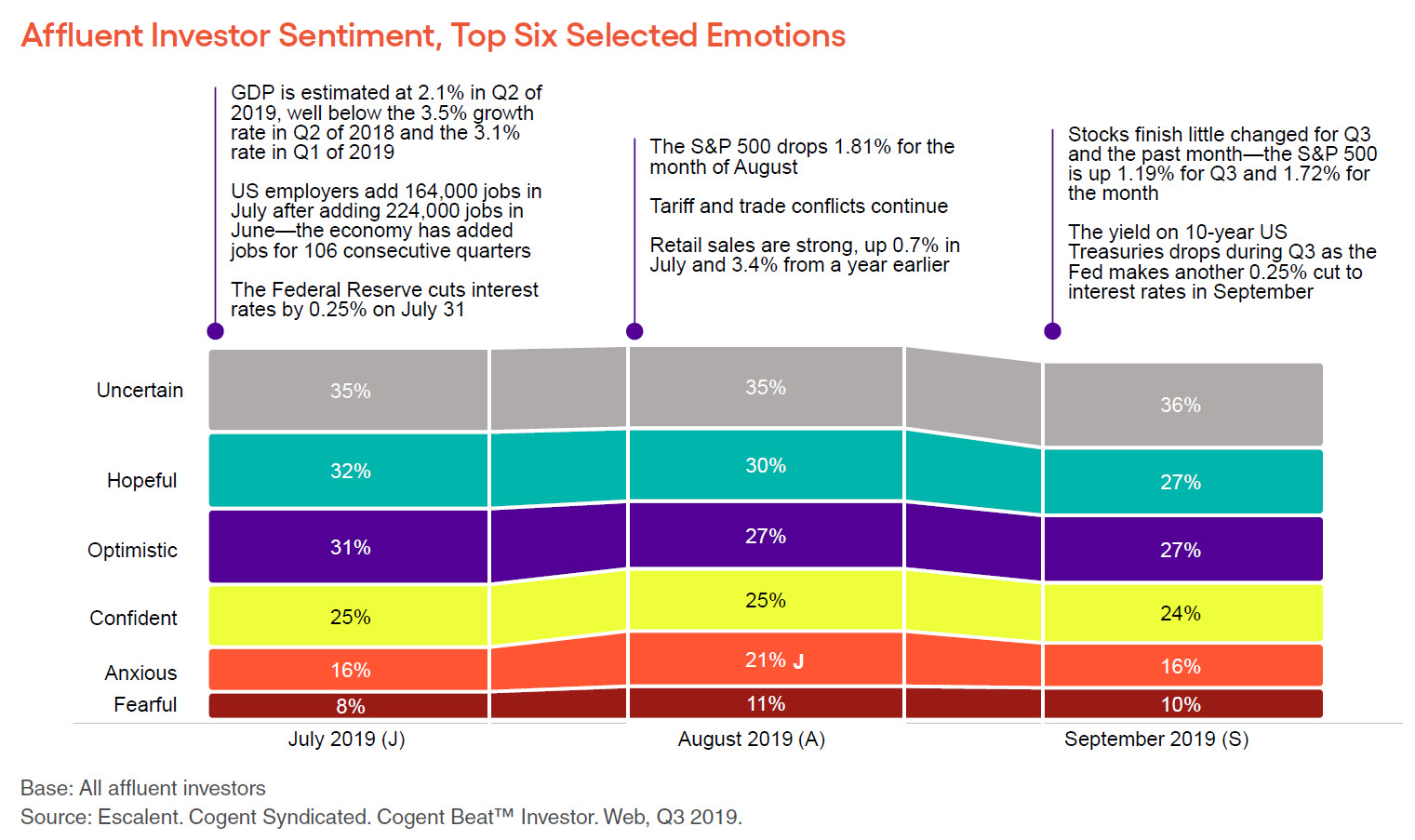

The Stephen Covey quote, “If there’s one thing that’s certain in business, it’s uncertainty,” seems to epitomize how affluent investors were feeling in the third quarter of 2019—a period marked by tariff disputes, a slowing global economy, stock market volatility and two rate cuts by the Fed that helped drive down bond yields. While investor confidence was stable and remained at relatively high levels buoyed by favorable income trends—particularly among middle income households—uncertainty was the dominant emotion expressed by investors toward the financial markets in Q3 2019. Playing into this theme of uncertainty, concerns over the global economy (Brexit, Iran, Saudi Arabia and China) and domestic economic policies had investors feeling less hopeful and optimistic as the quarter drew to a close than they did as it began.

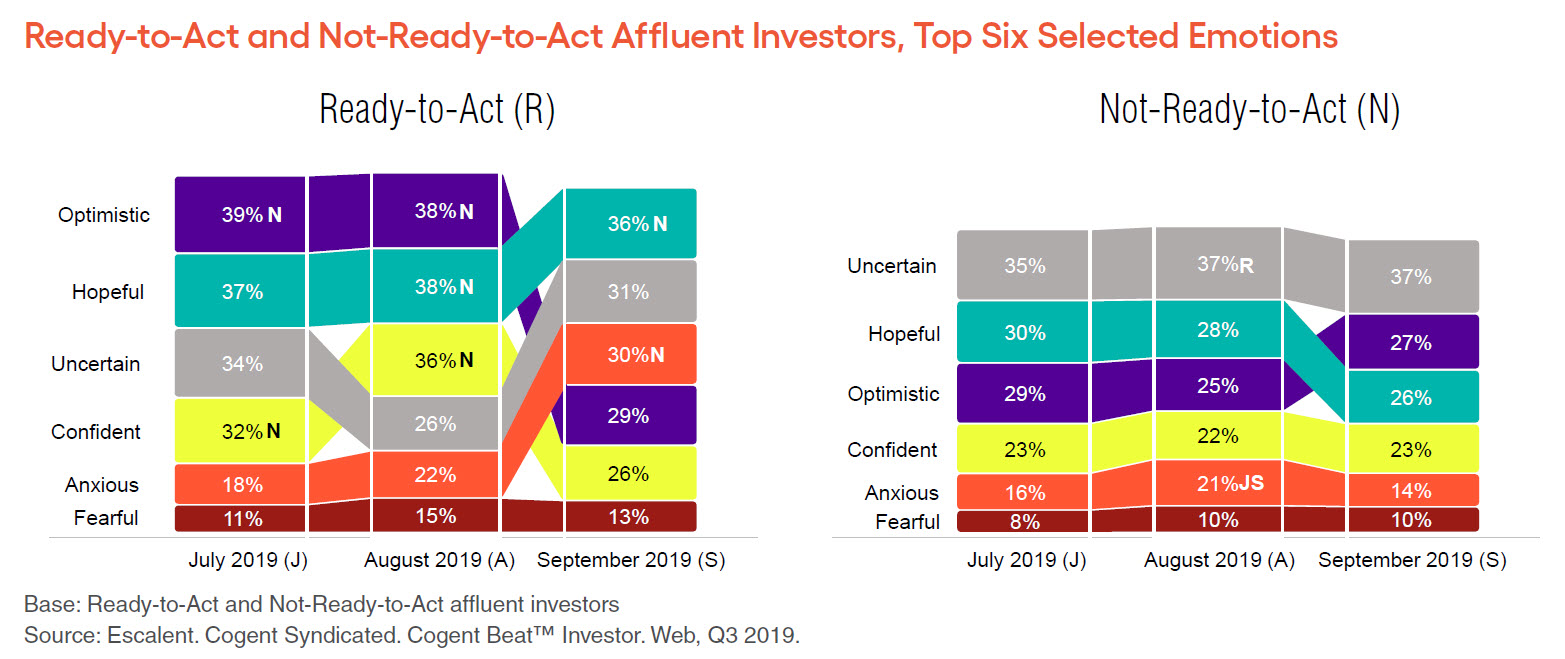

A more in-depth look into investor sentiment comparing ready-to-act (RTA) investors with those who do not report purchase intent reveals some key differences between the two segments. During July and August, RTA investors were feeling more optimistic, confident and hopeful than their not-RTA counterparts, maintaining a relatively positive mind-set in the face of market volatility that initially surfaced in Q2. And while the dominant sentiment of RTA investors in September was still hopeful, concerns over an economic slowdown became more pronounced and contributed to a decline in feelings of optimism and confidence.

Conversely (and outside of a spike in feelings of anxiety in August), investors planning to stay the course evidenced greater stability in their investment-related emotions in Q3, with uncertainty being the prevailing sentiment throughout the quarter. Research has shown that investors are as emotionally driven in investing as they are for other purchase decisions.1 As such, it is important to assess investor sentiment not only during boom and bust cycles but also when economic signals are mixed. For product and advice providers, it is critical to keep a finger on the pulse of any shifts in investor sentiment to quickly adapt marketing messages to changes in prevailing trends over time.

Importantly, and as has been noted here and in past Cogent Syndicated research, investors with purchase intent report greater sensitivity to market activity and other environmental events in contrast with not-RTA investors. Financial services firms that can effectively harness this higher level of engagement and resulting sensitivity among those with purchase intent, and work with these investors to identify the appropriate solution(s) to their needs, will be better positioned to win over prospects and gain additional share of wallet from existing clients.

We track investor sentiment on a monthly basis through Cogent Beat Investor and share these findings each quarter through our newsletter. Click below to subscribe and get on our distribution list!

1 Based on similar movement in the University of Michigan’s Index of Consumer Sentiment.