In an era where technological innovation is advancing at breakneck speed, the automotive industry is undergoing a seismic shift. Once upon a time, buying a new car meant making a long-term investment with the expectation that the vehicle would serve you reliably for many years.

But with the rise of electric vehicles (EVs) and the relentless pace of software-driven advancements, the traditional long lifecycle of cars is quickly becoming a relic of the past.

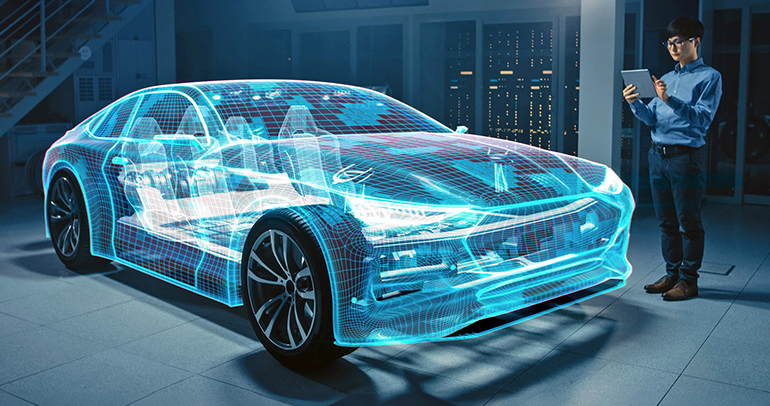

Today’s cars are no longer just vehicles; they’re becoming high-tech products with features that evolve rapidly—much like the smartphones and gadgets people upgrade every one to two years on average. This shift towards shorter product lifecycles is turning the automotive industry on its head, forcing automakers to rethink how they design, manufacture, market and ultimately sell their vehicles.

This blog is the second in a series of opinion pieces from our Automotive & Mobility team that considers the future of automotive design, vehicle development and what consumers will like, want and be willing to buy in the future.

A New Reality of Car Design Evolution and Revolution

As shorter product lifecycles become the new norm, the automotive industry finds itself at a crossroads, grappling with the tension between evolution and revolution.

On one hand, the shift demands an evolutionary approach—continuous, incremental updates to keep up with technological advancements and shifting consumer expectations. Auto brands that embrace this evolution, prioritising software updates, modular components and flexible ownership models, will stay relevant and responsive.

On the other hand, the rapid pace of change driven by EVs and digital innovation requires a revolutionary mindset. Companies must be willing to disrupt their own business practices, challenging traditional manufacturing cycles and rethinking what it means to “own” a car.

The winning and surviving auto brands in this new and constantly changing global market landscape will be those that strike the right balance, blending evolution with bold, revolutionary leaps.

Agile Manufacturing: Can Legacy OEMs Keep Pace?

As the industry accelerates, legacy automakers must undergo a radical transformation.

The days of long development cycles of five or more years for internal combustion engine (ICE) vehicles and fixed model designs are coming to an end. Instead, automakers need to adopt agile manufacturing processes—ones that can pivot quickly to update vehicles with the latest technologies.

This will likely mean building cars on modular platforms, where specific components such as automated driving technology or infotainment systems can be upgraded without replacing the entire vehicle. For many original equipment manufacturers (OEMs), success will depend on how fast they can shift from a hardware-first approach to a software-first mentality.

The car companies that treat vehicles like tech products—constantly evolving and upgrading—will gain significant momentum. Chinese automakers including SAIC, BYD, Nio and Geely are proving this right now.

Sustainability Paradox: Solving One Problem, Creating Another?

EVs promise reduced emissions and a cleaner future, but faster product turnover in the automotive industry simultaneously introduces a sustainability paradox. With shorter product lifecycles, each upgrade cycle demands new materials and increased manufacturing, raising questions about waste and resource consumption.

To resolve this, automakers need to embrace a circular economy approach. This means designing vehicles with modular components that can be easily upgraded, repaired or recycled, such as batteries. This shift would encourage sustainable consumerism, where vehicles evolve without being discarded, reducing environmental impact even as models update quickly.

The auto brands that succeed will be those that balance innovation with responsible and sustainable design, creating vehicles that adapt over time. Honda’s O Series EV platform, due in 2026, promises to be ‘Thin, Light and Wise’ as opposed to espousing the conventional image of being ‘thick and heavy.’

Are Cars to Become the New Smartphones?

The rise of EVs and connected vehicle services continues pushing cars into the realm of high-tech products with rapid advancements in software, hardware and new features happening every year. Like smartphones, today’s vehicles are software-driven and capable of over-the-air (OTA) updates. Automakers can now add or refine features after the car leaves the factory, but it begs the question: Is this enough to drive sales, improve customer satisfaction and enhance brand loyalty?

Just as consumers expect to upgrade their smartphones every one to two years, we might soon see the same expectation for cars. Imagine owning a car for a couple of years and watching it become quickly outdated as new brands and models arrive packed with increasingly advanced autonomous features, battery technology or infotainment systems.

With faster product lifecycles, the traditional model of buying and owning a car may soon be a thing of the past. The future could see cars treated like tech devices where owning one for more than two years may seem as outdated as keeping an old iPhone.

The End of Ownership: Subscriptions and Flexibility as the New Normal

Vehicle subscription services are already available and may eventually replace long-term ownership, allowing consumers to change or cancel their car with as little as three months’ notice.

Car subscription models—often including servicing, insurance and maintenance—offer flexibility and affordability for more people, encouraging customers to swap cars more often for a newer model as technology advances. For example, Volvo’s subscription service includes three years warranty, car switching with three months’ notice, roadside assistance, annual inspection, service plan option including tires, home delivery, driveaway insurance, Google digital services for four years and a loan car when needed.

This shift could fundamentally change the relationship people have with their cars, turning them into on-demand services, much like we access music or films through Spotify or Netflix.

Implications for Tomorrow’s Market Research and Consumer Insights for OEMs

Shorter product lifecycles have major implications for automotive market research. With new models arriving faster, auto brands need real-time insights to keep pace with changing consumer expectations, technology preferences and competitive landscapes.

Traditional, slower research methods won’t meet these demands; instead, brands require agile, iterative research approaches that deliver consumer insights quickly and adapt to ongoing changes.

In this environment, continuous customer feedback using qualitative research and quantitative research solutions with rapid testing of product features, design concepts and user experiences will be essential.

Brands that succeed will leverage faster, tech-enabled research methods—such as digital surveys, virtual focus groups, online insights communities and AI-driven trend analysis—to stay responsive and competitive.

For research professionals, this shift represents both a challenge and an opportunity to redefine how customer insights support new and successful vehicle development and innovation.

Connect with us below to discuss what shorter product lifecycles mean for your new product design process and how we can help ensure you infuse the right customer input at the right time.

Want to learn more? Let’s connect.