This time last year we were settling in to stay-at-home orders and recognizing that our personal and professional realities were different. And while many of those orders have been lifted thanks to vaccines, we’re still not back to normal. This year’s Advisor Brandscape® report digs in to how financial advisors are continuing to adjust. To effectively engage and communicate with advisors, asset management firms need to understand and recognize these changes in style and expectations and adjust their strategies.

Advisors are expecting some of the changes they made to their business structure and workplace arrangements over the past year to become permanent. Most advisors now assume that working from home at least some of the time will be the new normal, with nearly two-thirds of advisors expecting to have increased flexibility to work from home in the future. When communicating with investment providers, advisors report sustained higher recall for digital modes of communication and lower recall for traditional touchpoints, including in-person interactions, since the pandemic took hold.

Wholesaler interactions remain the most impactful, albeit narrowly focused, touchpoint. That said, the job of the wholesaler has changed, with the majority of wholesaler interactions still taking place remotely via phone and videoconference. While many advisors appreciate the accessibility and efficiency of these types of virtual meetings as a way to maintain personal relationships with wholesalers they know, it can be difficult for wholesalers to build the same level of rapport remotely when developing new relationships.

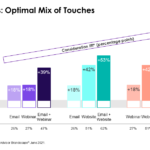

All of this makes digital communication channels more critical than ever when seeking to grow market share. The optimal mix of marketing touches is the combination of email, webinar and website exposure, which has the potential to boost advisor consideration by 65 percentage points. On their own, website visits are the most vital touchpoint, with the potential to boost advisor consideration by 42 percentage points, a bigger boost than last year. Firm websites represent an important way for providers to communicate as advisors grow more accustomed to self-service on their own schedule when needed. For the first time this year, webinars are now part of the optimal communication mix. Webinars featuring well-known investment experts are attracting the most attention.

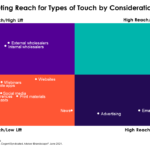

While the combination of website and webinar touches offers the highest potential to boost advisor consideration (at 68 percentage points), advisor engagement with these types of touches is still relatively low. Including email in the marketing mix is more realistic for providers given advisors’ stated preference for email and that emails offer providers the widest reach. Other digital touchpoints, including mobile apps and social media, hold high potential but currently have low utilization.

Looking ahead, asset managers will need to do more to integrate their outreach and get the right materials to the right advisors at the right time. In addition to arming wholesalers with digital materials they can share, firms have an opportunity to drive engagement through email campaigns and social media posts with materials addressing current advisor concerns to drive more advisors to the website, where they can access additional resources and product information.

Want to know how your firm stacks up in recall for key advisor touchpoints? Contact us to learn more.