With the much-anticipated launch of Disney+, the streaming wars are heating up. On its November 12 launch day, 10 million people subscribed to the newest video streaming service, just 11 days after the launch of Apple TV+.

And while Disney fans seem eager to spring for another streaming subscription, what’s not so certain is how many subscriptions consumers are willing to pile on before they say, “enough is enough.” From Netflix and Amazon Prime Video to Hulu with Live TV and HBO, the streaming services landscape is already crowded. But providers continue to pack in.

NBCUniversal’s streaming service, Peacock, is set to launch in April 2020, while AT&T’s Warner Media will launch HBO Max in May 2020. As revenue models begin to shift and more providers close off their content, consumers are left with the burden of paying for and managing more subscriptions, or offloading those they no longer need. For instance, AudienceProject predicts that Netflix will lose 7% of its subscribers to Disney+.

What’s more, as cable subscribers continue to jump ship—with more than two million lost in the past quarter alone—consumers who have tried to save on live TV costs with virtual multichannel video programming distributors (vMVPDs), such as Sling and Hulu with Live TV, will also feel the impact of the subscription economy. Add rising programming costs, and vMPVDs themselves are on shaky ground. In fact, AT&T has lost 195,000 streaming video subscribers in Q3 2019, and PlayStation Vue is set to shut down on January 30, 2020.

Changes are happening quickly in this space, and with the consumer in the middle, the telecom team wanted to learn about consumers’ subscription and pricing preferences to help video streaming and content providers find the best way forward. With the help of our partner quantilope, we surveyed 320 consumers in November to find out how many subscriptions they’re willing to take on, and how much they’re willing to pay for the content they prefer. Here are our findings.

The Current State of Streaming

More than 85% of video streamers surveyed report that they subscribe to between one and three streaming services. The most popular services named were Netflix, Amazon Prime Video and Hulu with Live TV. On the other end of the spectrum, people were least interested in PlayStation Vue, Philo and fuboTV.

Overall, consumers pay an average of $38 per month for all of their services regardless of age. That averages out to about $15 per subscription, which adds up quickly as more subscriptions are added to the stack. The rising cost of video subscriptions—along with subscriptions for everything from makeup and meals to razors and vitamins—is a contributor to “accumulating consumer debt,” reports CNBC.

And while customers are universally satisfied with the content they subscribe to, our research shows that as the number of subscriptions increases, satisfaction with the overall experience of managing these subscriptions decreases. Customers are clear that they don’t want to be forced into managing more and more subscriptions to keep the same content.

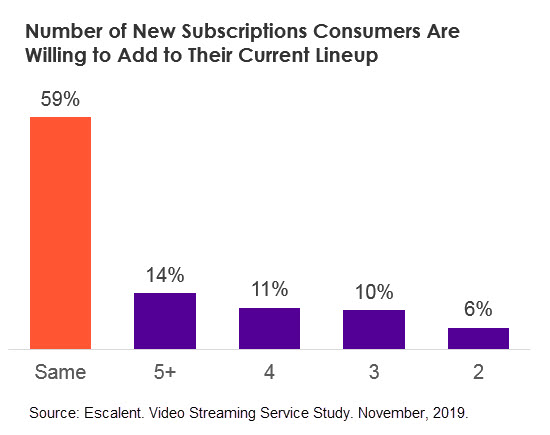

Further strengthening that point, 60% say they wouldn’t be willing to subscribe to additional streaming services to get the same amount of content, even though that’s what the industry is pushing for. As more streaming options come to the field, we expect a significant amount of competition in relation to the content offered and how many subscriptions consumers are open to paying for.

What Consumers Are Willing to Pay

While it appears that consumers may soon be reaching the limit to the number of subscriptions they’re willing to subscribe to, there still seems to be some tolerance left. Right now, customers are adding more subscriptions without necessarily pulling costs away from other subscriptions they already have.

This shows that providers choosing to keep their content under their own control—or in a “walled garden”—rather than licensing it to other streamers are using a model that works. For now, if consumers are forced to add more subscriptions to get the content they want, they’re willing to pay for it.

For example, the optimal price consumers say they prefer to pay for the maximum amount of subscriptions is $30, with a per-subscription price of $10. And they’re willing to add more subscriptions even if the cost exceeds that $30 mark—up to a point. When consumers hit $40 in total spend, they are more resistant to taking on additional costs.

Rather than sticking to a budget to help manage their streaming subscriptions, consumers are identifying which services they want, calculating how much they need to pay per service, and then paying the price to get their preferred content.

However, there is a point at which consumers will walk away. Once subscriptions go above the $50 mark, subscribers say that’s too high.

Time to Plan Your Next Move

The streaming video landscape has been changing drastically for the past several years, and the pace promises to pick up significantly in 2020. As walled gardens continue to take root, we already see traditional video providers and vMVPDs falling by the wayside. And, while customers are happy with their content and streaming services, industry forces could shift without notice.

To survive in this environment, streaming video providers will need to understand where they can provide the most value, and then identify how they can bundle their services with larger content providers. Think about how Verizon has partnered with Disney+ and T-Mobile with Netflix to give customers service they can’t find anywhere else.

If you’re not sure how to navigate the streaming wars, we can help. We have deep industry expertise and use proven research methods to help companies like yours come out ahead. To get more details about our streaming services survey, or to set up a meeting, send us a note today.