Latest Retirement Plan Advisor Trends™ report from Escalent demonstrates value of brand recognition, perseverance

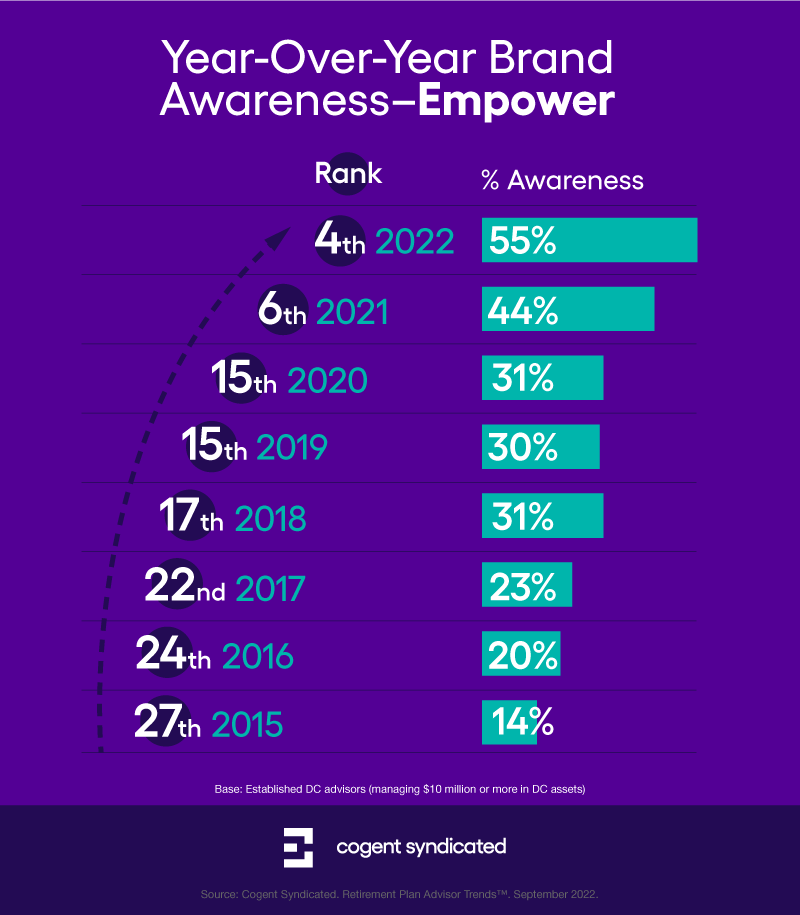

A new Cogent Syndicated report from Escalent shows Empower is now recognized by more than half of Established DC advisors managing $10 million or more in DC assets (55%), up from 44% in 2021 and 31% in 2020. The brand now ranks fourth in overall awareness behind the historical market leaders Fidelity Investments, American Funds and Vanguard.

This was one of the key findings from Escalent’s Retirement Plan Advisor Trends™ report, which is designed to help retirement plan providers and DC investment managers maximize market share by better understanding financial advisors who sell and support workplace retirement plans.

Established in 2014, Empower went all in to build its presence among the plan advisor population – a radically different direction than that chosen by firms with more well-known consumer-facing brands. Heavily focused on connecting directly with advisors through education, support and conferences has proved successful to its steady climb up the rankings. Empower’s brand recognition has significantly increased among Established DC advisors since Cogent Syndicated began tracking the brand in 2015:

“It’s been eight years and we are now seeing the fruits of Empower’s brand building prowess in action,” said Sonia Davis, senior product director at Escalent. “Building its business through acquisitions and using advisors as a lynchpin to gain traction in the DC ecosystem, Empower is proof that it takes time to build a brand and this is one way to do it. Other plan providers can learn from this approach and should certainly keep their eye on Empower as the firm strengthens its competitive position.”

Further, the report explored the top drivers of consideration for advisors when choosing a DC plan provider. Underscoring the value of relationships, being easy for advisors to do business with emerges as a top consideration driver. Brand trustworthiness continues to play an influential role, particularly among DC specialists, while reliability is also a key attribute to demonstrate.

To learn more about the Retirement Plan Advisor Trends™ report, visit escalent.co.

About Retirement Plan Advisor Trends™

Cogent Syndicated, a division of Escalent, conducted an online survey of a representative cross section of 538 plan advisors from August 19 to August 30, 2022. Survey participants were required to have an active book of business of at least $5 million and be actively managing DC plans. Strict quotas were set during the data collection period, and post-fielding statistical weighting (where necessary) was applied. The data have a margin of error of ±4.23% at the 95% confidence level. Escalent will supply the exact wording of any survey question upon request.

Click below for more information about the full report.