Advisors and asset managers are increasing the use of alternative investments and expanding their range of options, according to the latest Trends in Alternative Investments™ report

Despite historical limitations to access alternative investment vehicles and their known liquidity challenges within the private sector, asset managers and advisors are expanding alternative offerings through new products and platform access to drive adoption, according to the latest Cogent Syndicated Trends in Alternative Investments™ report from Escalent.

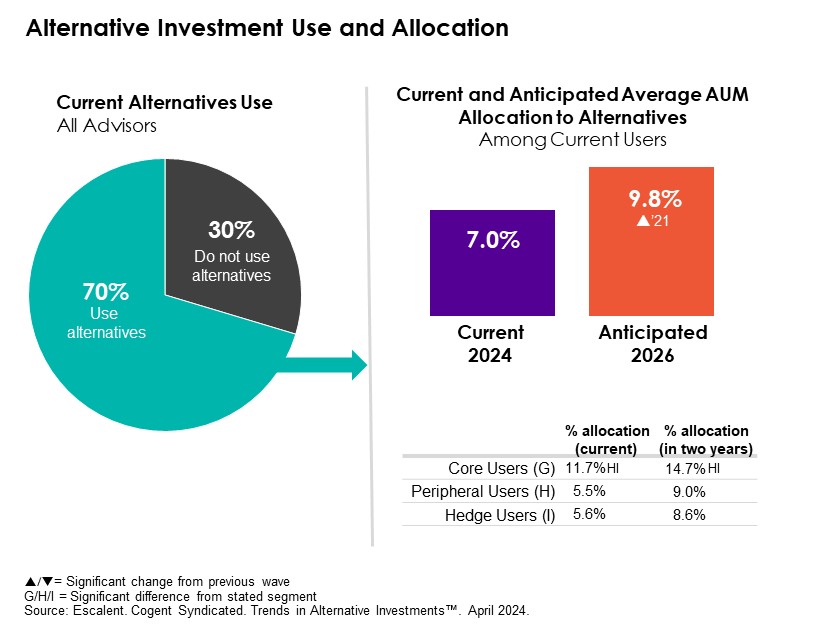

Currently, more than four in ten advisors (44%) who use alternative investments consider these products peripheral in their client’s portfolios, while 32% consider them a hedge, and just 24% a core component. However, as advisors’ knowledge base and comfort level increases in the alternative investment space, it will spur growth and expansion. According to the report, advisors anticipate increasing their allocation to alternatives from 7% to just under 10% within two years, driven in part by advisors with less than $100M in AUM. As advisors modify the standard 60/40 portfolio allocation to include alternative investments (making them core to the portfolio), these allocations could rise to 15%.

“There is a noticeable rise in overall comfort levels with alternative investments, alongside an increase in platform and technology access. For example, platform providers such as CAIS and iCapital have continued to expand points of access to all advisors, resulting in a surge of interest and use as these platforms provide not just access but expanding transparency and back-office support,” said Kristin Hall, senior product manager at Cogent Syndicated and lead author of the report. “The growth of alternatives is also being propelled by increased press coverage and a slight uptick in investor ownership. This suggests that we can anticipate a continual increase in use moving forward.”

Liquidity, as it relates to alternative investments, remains a key challenge, with access to alternative investments with liquid and semi-liquid structures being cited as the top reason to invest. Advisors recommend an average of 12-14% of the clients’ portfolios be allocated to liquid alternatives, compared with 4-8% in illiquid instruments. Registered Investment Advisors (RIAs) especially show a preference for liquid alternatives, with some reporting over 20% of portfolio allocation to these investments.

On the investor side, millennial investors are leading the alternatives trend. Contrary to the general population, millennial investors are familiar with alternative investments, with nearly seven out of ten expressing some degree of familiarity and 11% currently having investments in this asset class (a rise from 7% in 2022). Millennials are particularly interested in REITs, followed closely by liquid alternatives, private equity and private credit.

“As advisors and investors weigh the possibility of incorporating more alternative investments into portfolios, the importance of financial advice will play a key role,” said Hall. “Advised investors show a greater interest in understanding these investments, and as alternatives become more accessible, financial advisors will be at the forefront of guiding the self-directed investors toward these opportunities.”

About Trends in Alternative Investments™

Cogent Syndicated conducted an online survey from February 8 to February 25, 2024 of a representative sample of 611 financial advisors. In order to qualify for this study, survey participants were required to have a book of business of at least $5 million and offer financial advice or planning services to individual investors on a fee or transaction basis. In determining the sampling frame for this study, Cogent relied upon the most recent Discovery registered representative and RIA databases. To ensure the population for this research was representative of the universe of financial advisors, the databases were analyzed to determine the current distribution of advisors by AUM, channel, age, gender and region. Quotas were then established to produce a final set of respondents that is truly reflective of the advisor population. Minimal weighting was applied to adjust for any deviations from the actual marketplace distribution. The data have a margin of error of ±3.96% at the 95% confidence level. Cogent Syndicated will supply the exact wording of any survey questions upon request.