More than four in ten US adults (43%) now qualify as affluent investors (that is, they have $100,000 or more in investable assets), according to this year’s Investor Brand Builder report. That’s slightly higher than in the past two years, with the Millennial cohort expanding and 1st Wave Boomer and Silent Generation cohorts shrinking. However, like the well-known 80-20 Rule (Pareto principle), a small number of affluent investors comprise the lion’s share of dollars invested. And affluent investors across all age and wealth cohorts are consolidating the number of relationships they have with both mutual fund and ETF providers, which means there’s an opportunity for wealth management firms to win additional assets as investors consolidate their accounts.

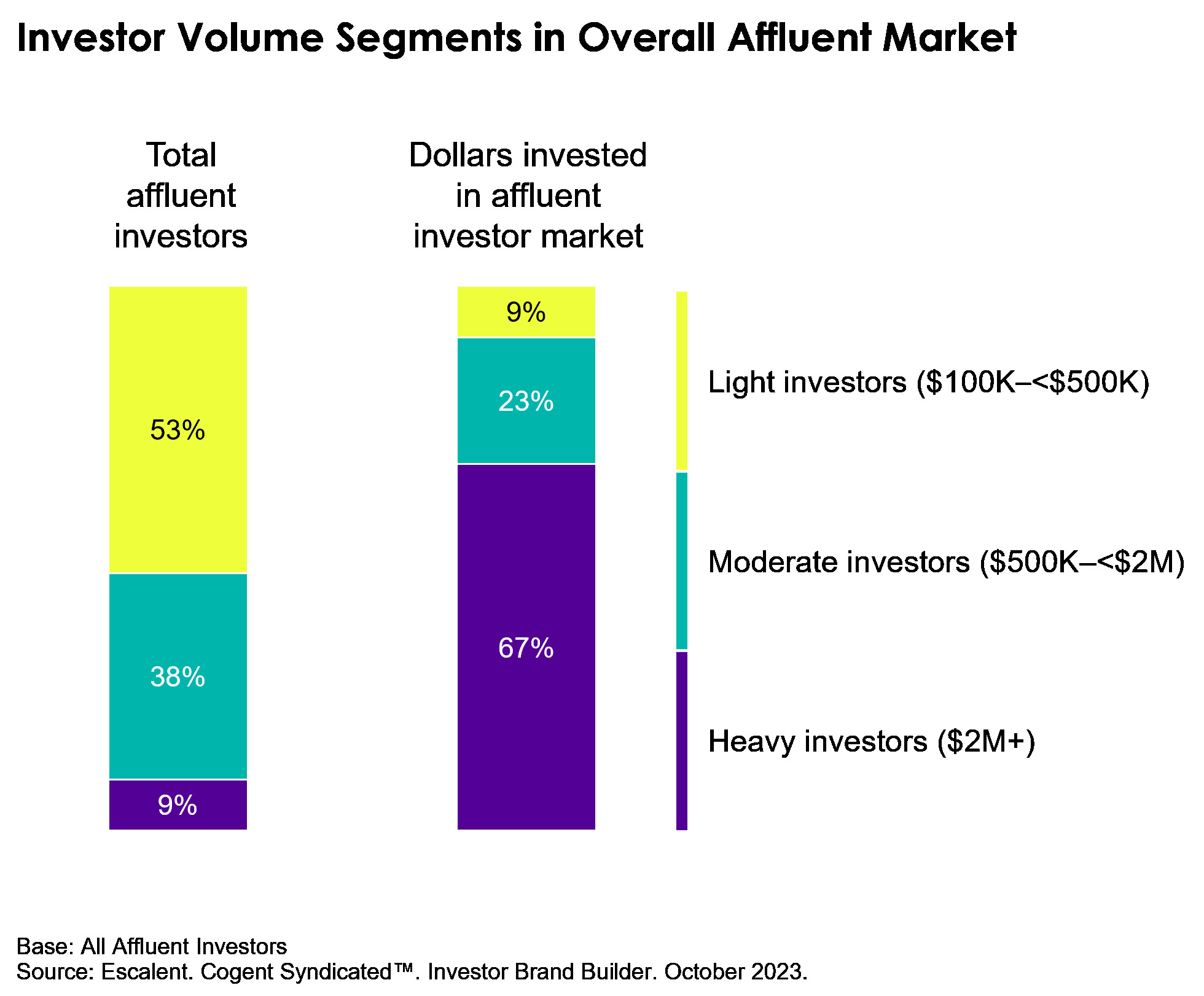

A Small Group Controls the Majority of Assets

Fewer than one in ten affluent investors (9%) qualifies as a heavy investor (meaning, they have investable assets of at least $2 million), representing more than two-thirds—67%—of dollars invested with any firm in the industry. On the other end of the spectrum are light investors ($100K–<$500K in investable assets), who comprise more than half—53%—of the total affluent investor population yet only 9% of all dollars invested.

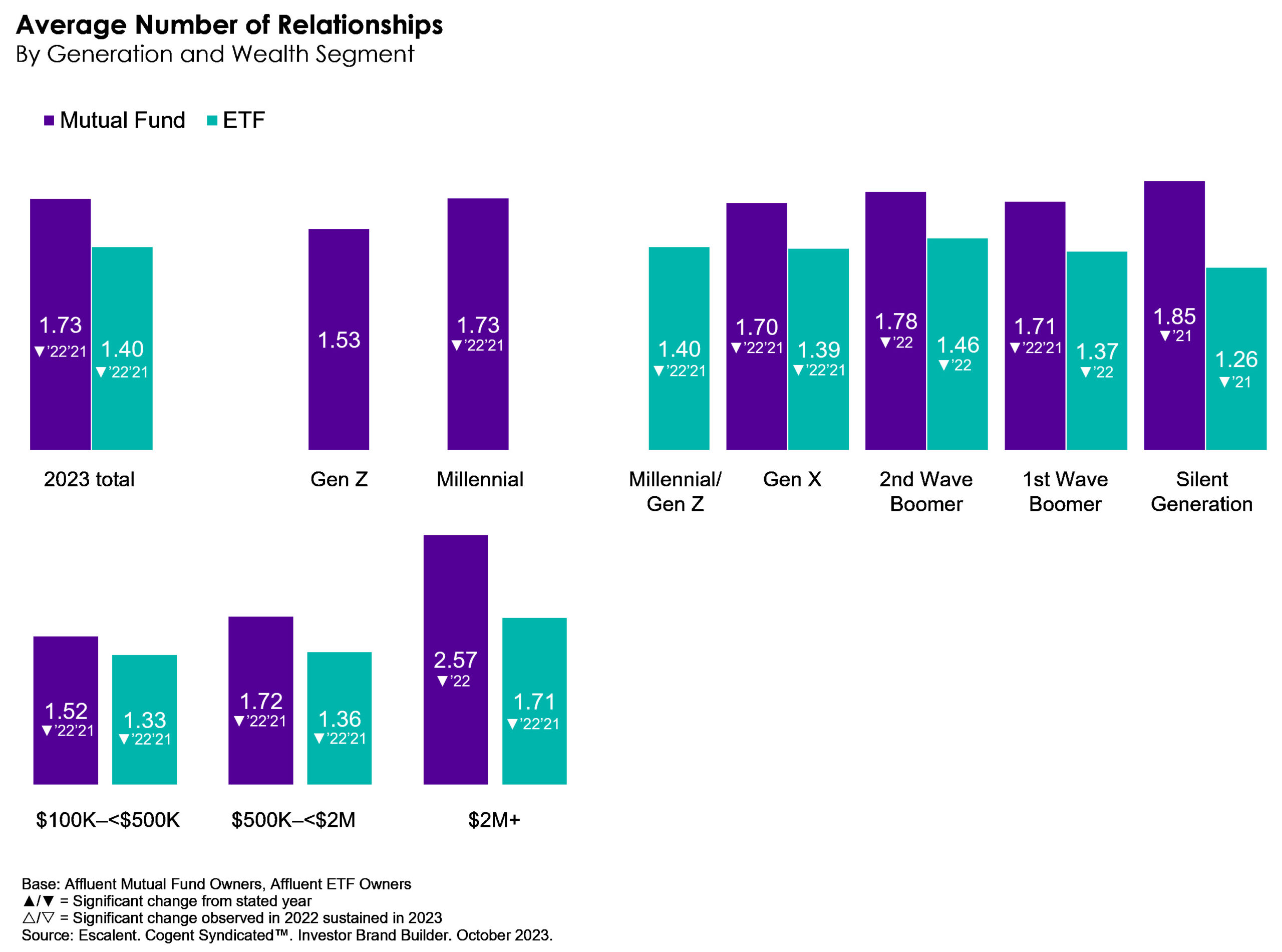

Investors Are Consolidating Their Mutual Fund and ETF Relationships

Across all age and wealth cohorts, affluent investors are consolidating their mutual fund relationships. Overall, affluent investors hold mutual funds with 1.73 firms on average, down significantly from 2.35 in 2022 and 2.28 in 2021. Even among Heavy Investors, the average number of mutual fund relationships has declined significantly from 3.19 in 2022 to 2.57 this year. As the average number of mutual fund relationships declines, the top three firms are growing their respective footprints.

As with mutual funds, we see evidence that ETF owners in all age and wealth segments are consolidating their ETF relationships with fewer firms. The average number of firms with which affluent investors hold ETFs is significantly lower this year (1.40) than in 2022 (2.16) and 2021 (2.14). Even among 2nd Wave Boomers and the $2M+ investable asset group, those with the most ETF relationships, the average number of relationships is down significantly from 2022 to 2023. Much of the consolidation in ETF relationships is moving to the top three firms—each increasing its number of primary relationships.

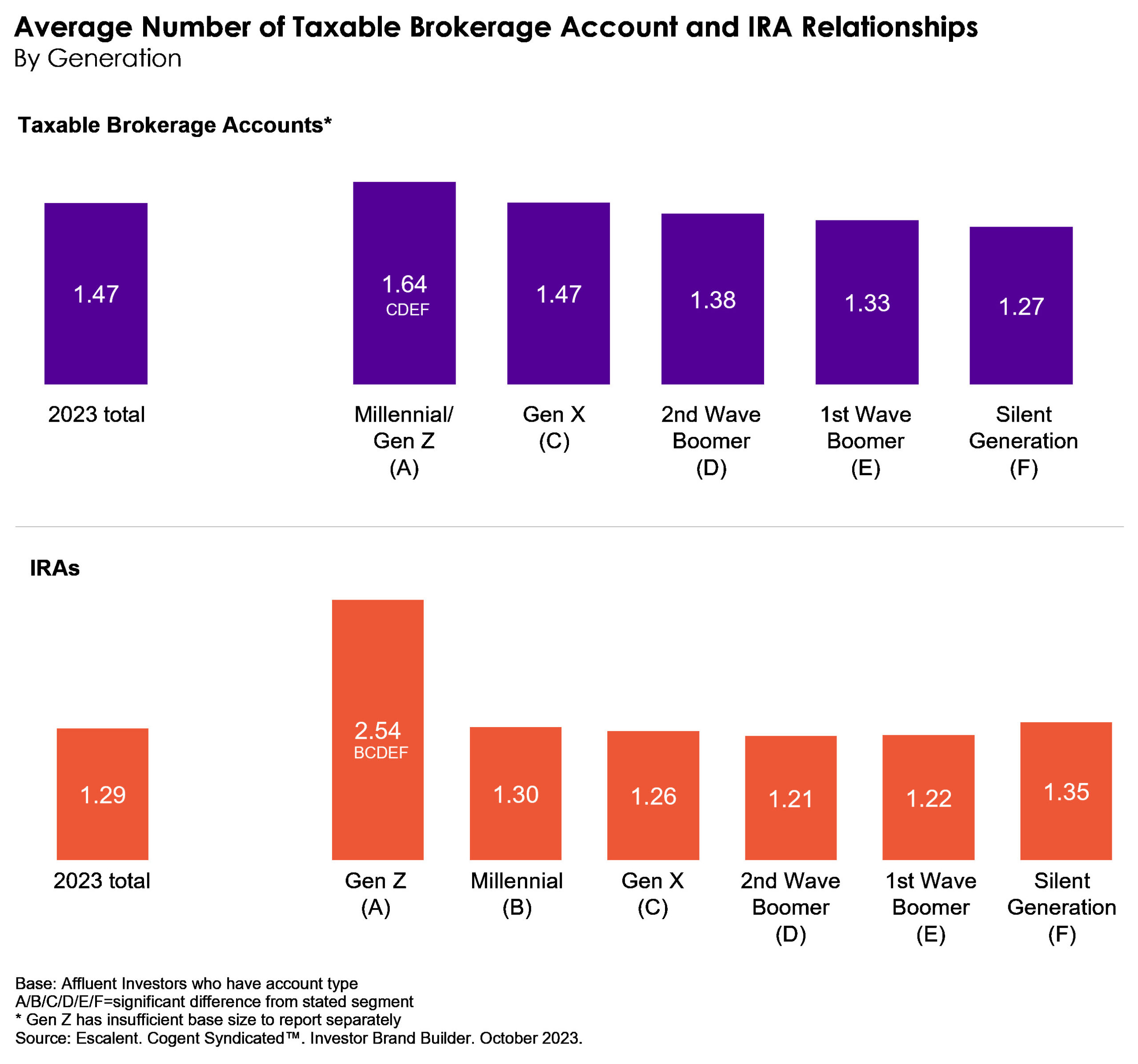

Yet Affluent Investors Hold Multiple Investment Accounts

Owners of taxable brokerage accounts and/or IRAs have more than one account relationship of these account types on average. Millennial/Gen Z affluent investors who own taxable brokerage accounts own a significantly higher number of this account type on average (1.64) compared with older affluent investors. Similarly, Gen Z affluent investors who own IRAs own a significantly higher number of this type of account (2.54) compared with older cohorts.

What Does It Mean?

The most affluent investors, although representing a smaller proportion of the affluent investor population, control the greatest amount of assets. Investors across all ages and wealth cohorts are consolidating their mutual fund and ETF relationships. And affluent investors across all age groups have similar accounts with multiple providers, with younger affluent investors using more providers than their older counterparts. When your clients have relationships for the same account type with your competitors, your firm is at risk of losing assets to those competitors. But it also means your firm has an opportunity to convert assets away from competitors. How do you do that? Capitalize on your firm’s strengths and focus on you firm’s High-Value Best Prospects.

This approach enables wealth management firms to harness conversion strategies, protect assets and leverage the full potential of their existing client base. By focusing on High-Value Best Prospects, firms can drive growth and capitalize on opportunities in the evolving wealth management landscape. We’ll dive deeper into how you can identify your firm’s High-Value Best Prospects in an upcoming white paper, but until then, click below to learn more about our Investor Brand Builder report, which can serve as a base for future-proofing strategies.