This year Uber and Lyft formally entered the healthcare market to offer rideshare services to non-emergency patients for transportation to scheduled doctor appointments. Patient no-shows are a prevalent problem in the US, with an estimated 3.6 million Americans reportedly missing their scheduled doctor appointments due to transportation issues each year. Rideshare services may particularly benefit older Americans, Medicaid patients and those with chronic diseases to help keep appointments and get care. Uber and Lyft have identified a wide-open opportunity that could significantly improve their business and simultaneously reduce healthcare costs and improve quality care.

How Uber and Lyft Are Expanding

Uber Health entered the healthcare market in March 2018 by partnering with healthcare organizations to provide transportation services for patients. Providers access the Uber Health dashboard to order and schedule rideshare services, and patients can use the services even if they don’t have access to a smartphone or Uber app because healthcare providers can manage the ride scheduling and billing through Uber’s dashboard.

Lyft followed suit shortly after the launch of Uber Health by offering a healthcare rideshare platform called Lyft Concierge. Lyft partnered with Allscripts, the largest electronic health systems provider, to request Lyft rides for patients directly through an integrated platform. Lyft recently expanded its reach by partnering with Formativ Health to provide nonemergency rides for patients. This partnership puts Lyft Concierge into Formativ’s patient engagement platform, enabling Formativ’s roughly 250 patient engagement specialists to book rides for patients in more than 40 states.

Both companies are going to lengths to strongly position and promote their healthcare rideshare services by minimizing the effort needed to use them. In Lyft’s case, it has opted to fully integrate its services into the fabric of the healthcare systems. It will be interesting to see which company succeeds and the overall impact of the healthcare rideshare services on both brands.

Will Rideshare Services for Patients Work?

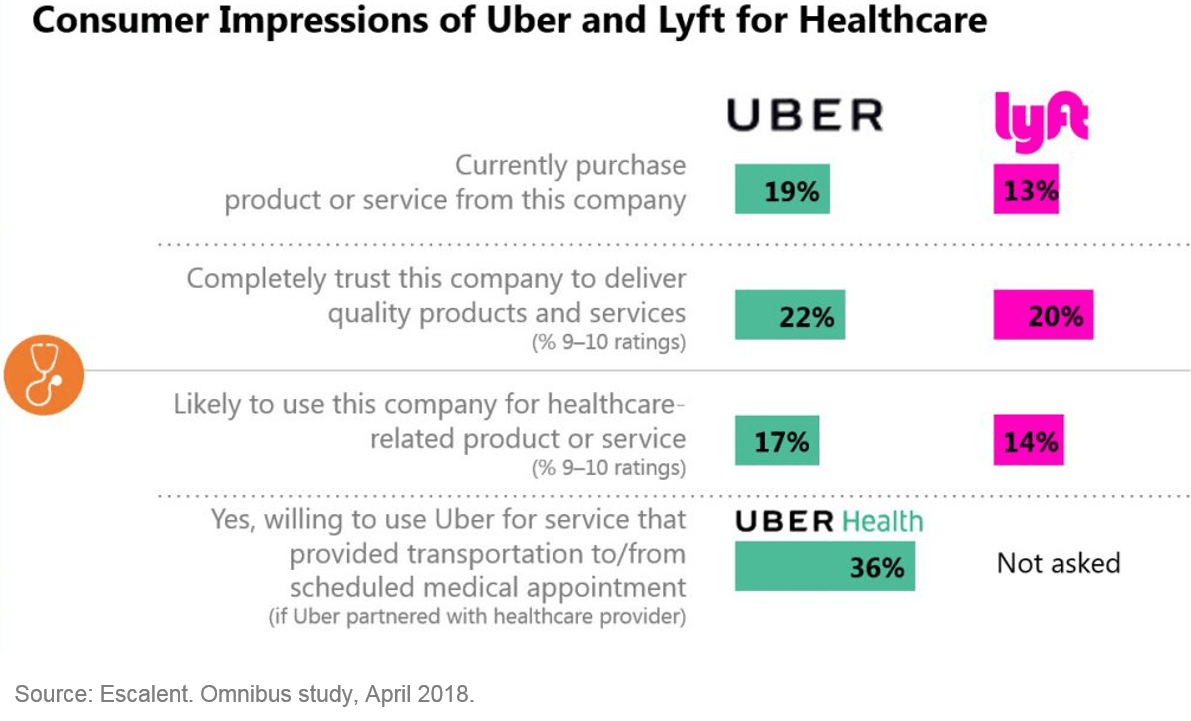

While there is debate on whether rideshare services effectively reduce the number of patient no-shows, our quantitative research team recently completed a study conducted among 1,003 consumers nationwide suggesting patient rideshare services are a significant opportunity that is likely to grow in popularity. The study reports that nearly two in ten consumers are very likely to use a healthcare transportation service from Uber or Lyft if offered.

Further, nearly four in ten consumers say they are willing to use Uber for medical appointment transportation, demonstrating a large potential market for this type of service. Currently, the greatest barrier to using Uber is a lack of trust in the Uber drivers—something Uber is actively working to address. If the customer-centric efforts being taken by both Uber and Lyft are successful, our results suggest that consumers have the appetite and need to try nontraditional transportation approaches for their healthcare visits. Given these findings we expect Uber and Lyft to impact a reduction of no-shows via their expanded medical rideshare services.

The Impact of a Successful Rideshare Services on Healthcare

At this point, our study shows Uber only slightly leading over Lyft, with no clear competitive advantage of one over the other. This healthy competition between Uber and Lyft can improve access to care, reduce healthcare costs and achieve better health quality outcomes. The success of rideshare services translates to more patients keeping their appointments and fewer patients relying on more expensive transportation services and care such as ambulances and ER visits. Ultimately, improving transportation for healthcare will yield better care for patients and improve administrative operations and bottom lines for hospitals, providers and insurers. Tackling the large transportation barrier with Uber and Lyft services could be the perfect opportunity to move healthcare in a positive direction.

We are continuing to watch trends as healthcare continues to converge with digital technology. Our Health Market Research and Technology Market Research teams have noticed these two markets converging at an increasing pace over the last decade. Sign up for our newsletter to stay informed. We will be tracking health tech and digital trends in healthcare as part of our future self-funded research studies. We offer a holistic understanding of how healthcare and technology will continue to integrate, with deep expertise across both health and technology sectors. Connect with us for more information on how we can help with your business needs.

About the Study

Escalent interviewed a national sample of 1,003 consumers aged 18 and older from April 4 to 6, 2018. Respondents were recruited from the Full Circle opt-in online panel of US adults and interviewed online. The data were weighted by age and gender to match the demographics of the US population. Due to its opt-in nature, this online panel (like most others) does not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Escalent will supply the exact wording of any survey question upon request.