There’s no doubt we are in a recession that will impact every aspect of our lives and the economy. In past recessions, the fixed price of personal auto insurance was viewed as a great value by many. But in the decade since the Great Recession, many insurance carriers began to offer variable-priced solutions, opening the door for consumers to more readily seek savings as their wallets are squeezed from all sides.

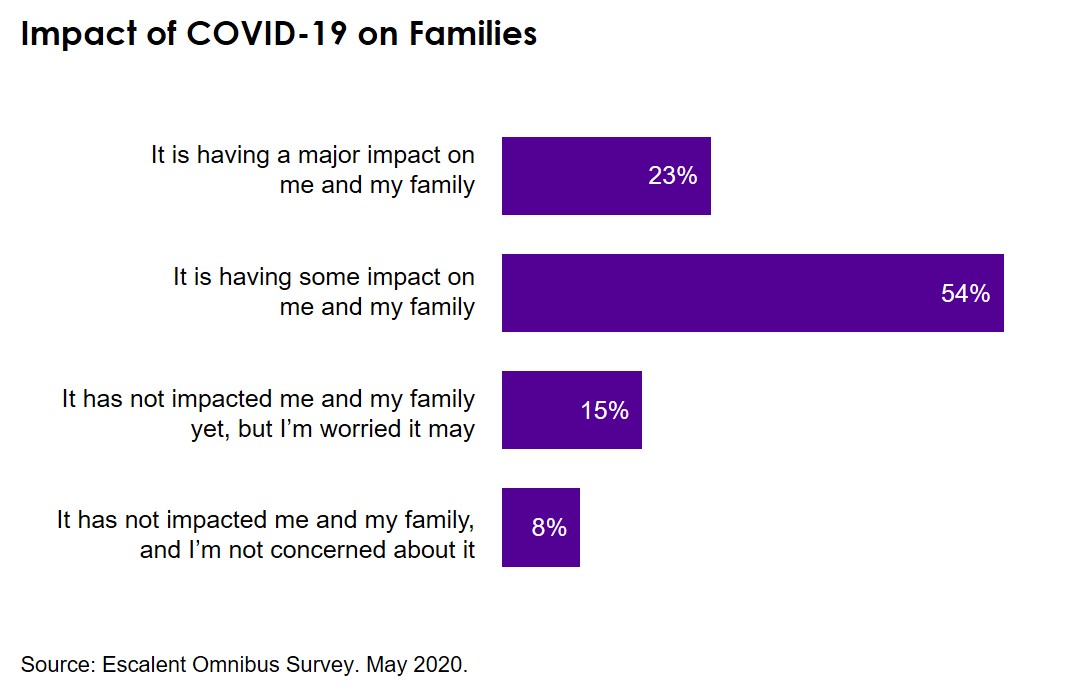

A recent omnibus study from Escalent found that more than three-quarters of American households report at least some impact of the pandemic on their families, and just under one in four indicates the impact has been major. Another 15% report not feeling the impact yet but are worried that they may with time. It’s clear the economic impacts are great, and savings are both sought after and appreciated. How will the auto insurance market be affected?

The Market Will Contract—Focus on Loyalty

During the initial pandemic shutdown, Americans drove 50%–60% less, according to data released in April by Waze, the mobile navigation app used by over 115 million drivers worldwide. While traffic volumes have increased as states relaxed shelter-in-place orders, US traffic levels remain at only 80% of normal levels. This could profoundly impact the personal auto insurance marketplace, as diminished use translates to lower industry claim severity, and thereby lower total premiums. For carriers that already offer usage-based insurance (UBI) options, many more consumers could potentially save significantly by switching to one of these low-mileage or safe-driver rate models. For carriers who haven’t yet implemented a UBI program, this could be a strong incentive to get on the bandwagon.

The pandemic and lower auto use have prompted dozens of auto insurance companies to offer their customers credits or discounts of 15% to 20%. However, the messaging by some has been ineffective and many insureds are unclear if they are going to receive back anything. Making that message clear could help build loyalty and keep your customers from shopping around.

Increased Consumer Churn and Adoption of New Coverage Options

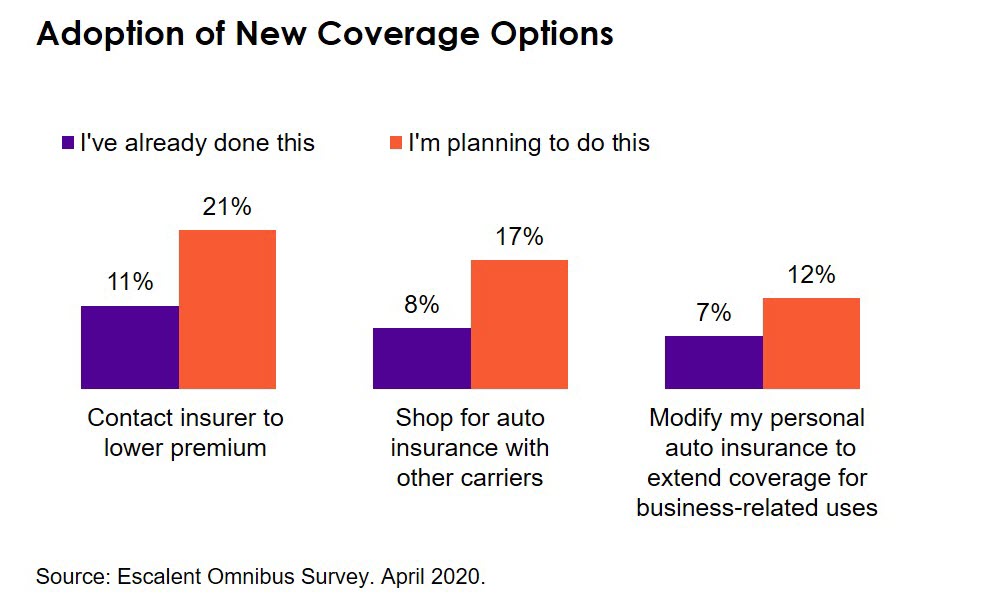

As a consequence of the pandemic and associated recession, a significant proportion of consumers are taking steps to lower their insurance bill. In our survey among drivers, one-third of insureds have contacted or are planning to contact their insurer to discuss lowering their premiums, and one in four is shopping competitors’ rates with the same goal in mind.

An interesting byproduct of the many shelter-in-place orders has been the increasing number of businesses offering to deliver merchandise and increasing use of services such as DoorDash and Uber Eats. Our survey found 7% of personal vehicle owners have contacted their insurer to modify their current policy, extending it for these commercial uses. Among those considering commercial coverage for their vehicle, almost half have suffered financial harm as a result of the pandemic.

The Great Recession accelerated the growth of direct writers like GEICO, Progressive and USAA, as consumers sought cost savings during economic adversity. Compounding the pressure to soften rates again during this recession, new underwriting models will no doubt see heightened adoption rates, especially among the many drivers who are no longer commuting daily to work or school. In the weeks and months ahead, it is vital for insurers to communicate with existing and prospective customers alike about the various offerings available and how they can help tailor insurance solutions to meet new household needs. By being proactive, insurers can build brand loyalty at a time when many brands are struggling to preserve consumers’ trust.

For more of our coverage on the impacts of the pandemic on the financial services industry, read our Financial Services COVID-19 Market Research Perspectives.