When asked why they work in the retirement industry, women rank compensation at the top of the list. While there are plenty of women who feel content with their salary, over four in ten (44%) believe theirs has not kept pace with their experience and responsibilities and believe there are notable differences compared with their male peers.

“I feel like my pay is under what a male would be paid in my position based on my past 18 years in the financial industry. I actually had to ask for an increase in pay when I was hired and I was promised a bonus package but that has yet to pan out.”

– Gen X Woman

Last fall, WIPN and Escalent embarked on a first-of-its-kind assessment of the attitudes, experiences, behaviors and compensation of women in the retirement industry. Unsurprisingly, we uncovered clear signs that more salary research is needed among women employees to determine their worth. We also found a need for improvement on the employer side when it comes to staying in tune with the career growth of women employees and giving them proper recognition when deserved.

Starting vs. Current Salaries

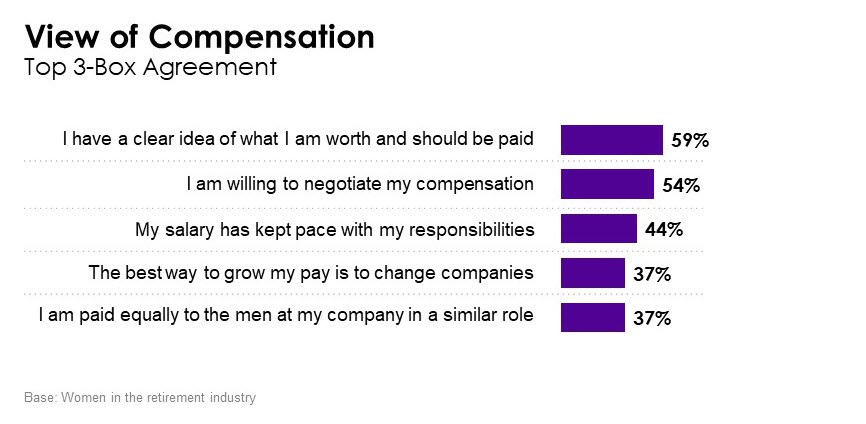

While over half of women (62%) employed in the retirement industry believe their starting salary was just right given their experience and competency, only 44% believe their current salary has kept pace with their responsibilities. Additionally, only about four in ten women (37%) believe they are paid equally to men in a similar role at their company, indicating a strong perception that gender pay gaps still exist in the industry.

“I work in a very small organization. I believe my pay is fair in comparison to the other members of our team. But, I have no idea.”

– Boomer Woman

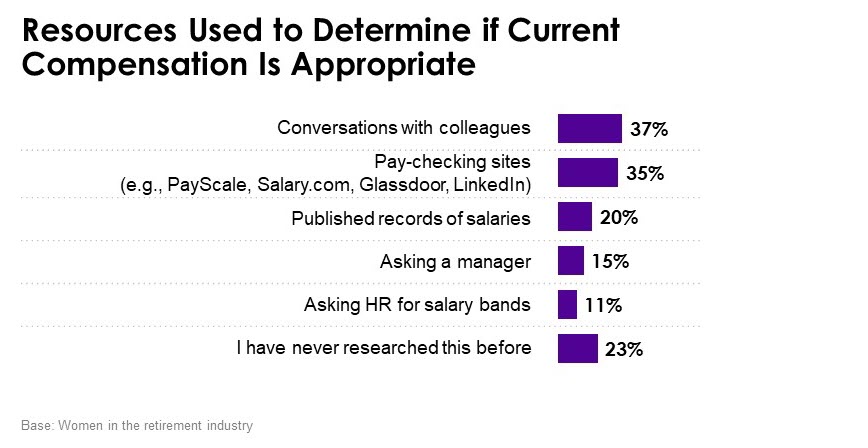

Grounding compensation reactions in perception rather than data stems from the over one in five women who has never researched compensation, as well as the approaches that may not paint a complete picture, such as talking to colleagues. Perhaps most striking is the prevalence of inward-facing approaches—asking a manager, asking HR for salary bands—that keep the frame of reference solely within the organization instead of at the market level.

Importance of Compensation

Besides the more obvious reasons compensation is important to women employees and employees in general, earning a higher pay and receiving a promotion are top factors that make women employed in the retirement industry feel successful. However, only about half (54%) are willing to negotiate their compensation. Those who do seek out a raise are at a critical inflection point: the negative feelings from asking for a raise and not getting it are stronger than the positive feelings that come from asking for a raise and getting it. Recognizing and rewarding women employees for hard work in a timely manner encourages satisfaction and loyalty to the company, as about four in ten women working in the retirement industry feel the best way to grow their pay is to change companies.

“I am definitely paid less than my peers. Compared to others in my role at other companies, but also compared to others in my role at my current company. I have not jumped around companies often, which I believe to be a major factor …. I also believe having been out on three maternity leaves in the last five years has been a very clear detractor to my promotion schedule; in fact, I missed a promotion last year with the comment, ‘you will not be able to get enough face time before the end of the year’ [baby was due in early September].”

– Millennial Woman

The softer side (e.g., culture, having work-life balance) impacts how women employed in the retirement industry feel about the harder side (money). So, while salary is an extremely important factor in feeling successful, happy and loyal, it’s not just the compensation itself that employers should keep in mind, but the whole package.

A Bright Spot

Despite ongoing challenges with salary perceptions, there are certainly bright spots to celebrate for women in the retirement industry. Among the women surveyed in the WIPN research, the average salary is healthy and many women cite that their jobs have allowed them to live comfortable lifestyles.

“The pay at our company is incredible. It allowed me to replace my income in my old career to transition into financial services.”

– Gen X Woman

As a woman working in the market research industry on the financial services team, this research hit close to home and I am proud to be part of it. My hope is that these data will arm women with the knowledge they need to research their worth, advocate for themselves, and work toward closing gender pay gap perceptions. Not only that, but my hope is that these data will serve as an eye-opener to employers to revisit pay bands across titles and gender, look for ways to improve overall compensation, and reward hard work when it is earned so women don’t feel they have to switch jobs to improve their compensation. On a more positive note, I hope more young women enter the financial services industry, as many women do have positive perceptions of their compensation and live comfortable lifestyles as a result.

For a deeper look at the attitudes and behaviors of women in the retirement industry, download our joint white paper with WIPN, What’s Working at Work.