With financial incentives as motivation, DC plan advisors are more effectively aligning their plan design recommendations to address market demand. But data from our Retirement Plan Advisor Trends™ report recently published by Cogent Syndicated find that disconnects between the needs of plan sponsors and plan participants still exist. These divergences can be turned into new opportunities for plan providers that are willing to bridge these gaps, particularly in the areas of financial wellness programs and health savings accounts (HSAs).

The Financial Wellness Opportunity

Despite strong demand from plan participants and evidence of financial wellness programs’ effectiveness, the overall availability of these programs is down from 38% in 2021 to 31% in 2022. This decline largely stems from fewer Emerging DC advisors (those managing less than $10M in DC AUM) offering financial wellness programs (22%, down from 36% last year). But adoption remains strong in other cohorts. More than half (51%) of DC specialists (managing $50 million or more in DC AUM) are currently offering these programs.

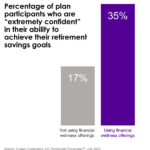

This is a huge pitfall that must be addressed, especially as our latest DC plan participant findings prove financial wellness programs are instrumental in creating more confidence and retirement readiness. In fact, one-third of users (35%) are “extremely confident” in their ability to achieve their respective retirement savings goals—double the rate among non-users (17%). Confidence levels are most pronounced among Millennials (42% of users vs. 15% of non-users) and Gen Xers (30% of users vs. 15% of non-users).

This is a huge pitfall that must be addressed, especially as our latest DC plan participant findings prove financial wellness programs are instrumental in creating more confidence and retirement readiness. In fact, one-third of users (35%) are “extremely confident” in their ability to achieve their respective retirement savings goals—double the rate among non-users (17%). Confidence levels are most pronounced among Millennials (42% of users vs. 15% of non-users) and Gen Xers (30% of users vs. 15% of non-users).

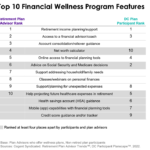

Not only that, but DC advisors have ample opportunity to align their individual financial wellness program offerings to address specific participant demands. The second- and fifth-most desired financial wellness offerings among participants—respectively, advice on Social Security and Medicare decisions, and help projecting future healthcare expenses in retirement—only rank a respective sixth and tenth among current DC advisor offerings. This reveals a sustained unmet need. HSA guidance, mobile (app) capabilities with financial planning tools, and credit score guidance—features that also rank among the top 10 most desired offerings among participants—don’t even crack the top 10 current DC advisor offerings.

Providers can play a leading role in educating plan advisors on what’s most vital to include in order to create more confident retirees in the future.

The Health Savings Account Opportunity

HSAs are another big disconnect we are tracking. The proportion of plan advisors recommending HSAs continues to trail overall plan sponsor adoption. However, this trend is most likely due to most DC advisors serving smaller plans. While fewer than one in ten DC advisors recommends HSAs to their plan sponsor clients (9%, up from 4% in 2020 and 2021), nearly half of plan sponsors offer HSAs (48%). That number jumps to more than two-thirds among Small-Mid and Large-Mega plans offering HSAs, according to Cogent’s latest plan sponsor findings.

What’s Going Right?

What elements of DC plan design are plan advisors getting right? This year there is greater industry alignment with student loan 401(k) matching and emergency savings accounts (ESAs).

In the wake of President Biden’s student loan forgiveness plan, student loan 401(k) match recommendations among plan advisors are holding steady year-over-year. One-third of DC advisors are likely to advocate student loan 401(k) matching (32%), with enthusiasm peaking among $25M+ producers and Independent advisors. Meanwhile, plan sponsors are less likely to embrace this benefit given greater adoption of tuition reimbursement programs, with fewer than three in ten plan sponsors being likely to offer a student loan 401(k) match.

Pivoting to ESAs, with the COVID-19 pandemic largely in the rear view, just a fraction of DC advisors are endorsing emergency savings accounts. ESA recommendations are highest among DC specialists (at just 5%), while future intent is relatively weak at 20% overall. This largely mirrors our latest insights from plan sponsors, in which just 15% of employers are offering ESAs, down from 21% in 2021. While there is congruity among plan advisors and plan sponsors, this sentiment could be shortsighted, as participants are still voicing concerns over having limited money and worry about dipping into their retirement savings for emergencies.

Whether it’s a disconnect between financial wellness offerings, HSAs or continuing to meet needs for student loan 401(k) matching and ESAs, it’s clear there remains opportunity for providers to better advocate for participant best interests and ensure assets remain in-plan. Cogent Syndicated’s Retirement Plan Advisor Trends report gives firms an in-depth understanding of the attitudes and preferences of the most critical players in the distribution of DC plans to help providers find these and more opportunities to grow market share and strengthen plan advisor loyalty. Click below to learn more.