Alternative investments have traditionally been off-limits to a wide variety of investors who fell outside of the Securities and Exchange Commission’s (SEC) definition of an “accredited” investor. However, as the traditional stock and bond markets performed poorly for many in 2022, allocations to alternative investments are expected to grow in 2023 as advisors and investors seek increased diversification and risk protection. Our latest Cogent Syndicated report, Trends in Alternative Investments™, digs into advisor and investor interest in alternatives, types used, barriers and accelerants to entry, and where advisors are accessing these products.

Interest

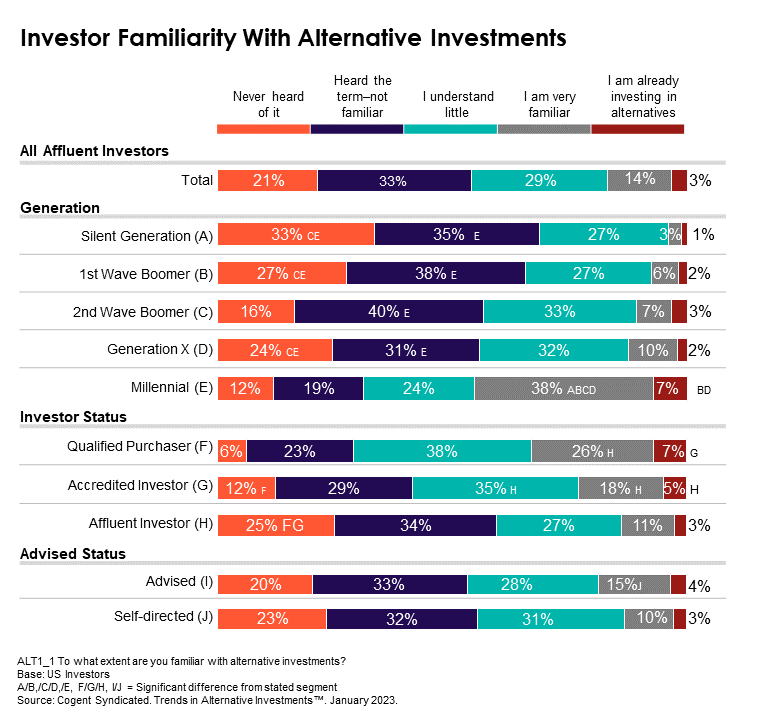

Advisors are planning to increase their allocations to alternative investments in the next couple of years, with some of the highest anticipated use and growth coming from RIAs. While ownership of alternative investments remains low among investors, interest in this asset class is growing in part driven by age, asset levels and use of financial advice. As there is a movement within the industry to “democratize finance” and change the SEC definition of accredited investors, we see that Millennials provide the movement behind a lot of investor interest in and desire for greater access to alternative investments.

Types

When it comes to the types of alternatives that are attracting interest, the report finds that REITs continue to be the most popular alternative asset class, with almost eight in ten advisors recommending REITs to their clients. This is followed by MLPs/commodities and real assets. Despite doomsday predictions for private equities (as higher interest rates coupled with a slow economy makes corporate purchases slow down), interest among advisors and investors remains relatively strong, with about one-third of investors interested in learning more about this asset class along with liquid alternatives.

Barriers and Accelerants to Entry

Even though there is growing interest in the alternatives market, it’s not yet translating to use. Advisors continue to cite limited interest from clients and a lack of transparency as the top barriers to entry. Interestingly, lack of liquidity is a double-edge sword and a matter of perspective, as it’s named a top barrier as well as one of the top accelerants to entry among advisors. Other accelerants mentioned are client goal alignment and increased diversification.

Advisor Access

Advisors continue to access alternative investments most often through their home office and internal due diligence teams. While all advisors lean on asset managers for approaching alternative investments second to the home office, RIAs are more likely to rely on individual relationships and custodians. A small uptick in accessing through third-party platforms and TAMPs (turnkey asset management providers) can be seen, with a particularly heightened use by RIAs of specialist platforms while Independent advisors are more likely to use TAMPs.

As the market and the economic environment continue to change, alternative investments may offer part of the solution for increased diversification, income and continued growth potential. Cogent Syndicated’s Trends in Alternative Investments report, published in January 2023, measures use of and interest in alternative investments among advisors and affluent investors. This report trends advisor data back to a previous report published in 2021 by Javelin Strategy and Research and provides new data geared specifically at understanding those who qualify to invest in alternatives per the SEC definition. It also tracks attitudes and use across advisor channels and AUM breakouts along with barriers and accelerants, platform and vehicle access as well as unaided consideration of providers within this space.

To learn more about the full report and how your firm can leverage our data to build your business and your brand, click below.